How Will Australia Self Storage Market Size, Share & Demand Evolve By 2033?

Report Attributes and Key Statistics

-

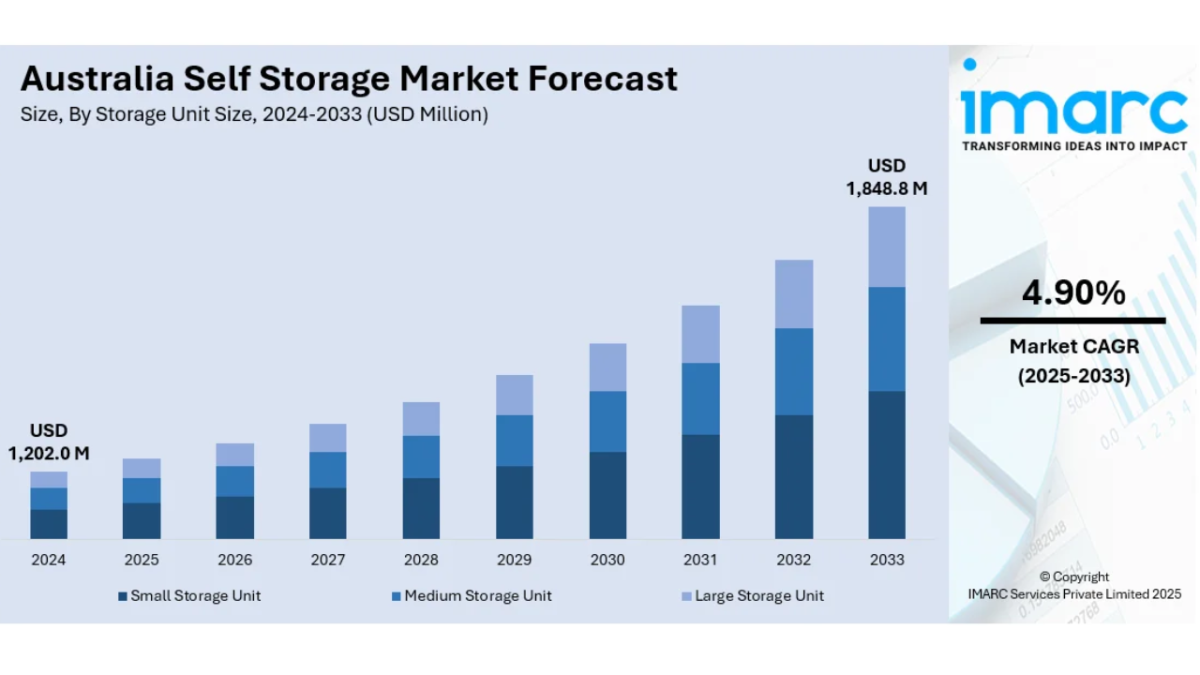

Base Year: 2024

Historical Years: 2019–2024

Forecast Years: 2025–2033

Market Size in 2024: USD 1,202.0 Million

Market Forecast for 2033: USD 1,848.8 Million

Market Growth Rate 2025–2033: 4.90%

The Australia self storage market is expanding as the urban population increases in cities such as Sydney, Melbourne, and Brisbane, leading to reduced average dwelling sizes. As more Australians reside in high-rise and compact homes, self-storage facilities provide a practical solution for storing seasonal and infrequently used items. Fluctuations in the housing market, transitional living, and frequent relocations have also boosted demand for temporary storage. The e-commerce boom continues to fuel requirements from online retailers and small businesses needing scalable storage for inventory and equipment. Additionally, Australia's ageing population is opting for smaller dwellings, raising demand for secure off-site spaces for furniture and valuables. Consumer awareness campaigns and tech-enabled booking systems further normalize self-storage as a mainstream, accessible service.

Request For Sample Report:

https://www.imarcgroup.com/australia-self-storage-market/requestsample

Australia Self Storage Market Trends

-

Growth in urban density and residential downsizing.

Increasing transitions between homes and rising temporary renters boosting the need for storage during relocation.

The surge in e-commerce and small businesses increasing requirements for flexible inventory and workspace solutions.

Rising demand among older adults seeking convenient long-term storage for valuables as they downsize.

Adoption of smart technology (digital locks, automated kiosks, remote monitoring) and 24/7 access.

Facility expansion into regional hubs and non-traditional sectors such as freelancers and tradespeople.

Increased investment in sustainability through eco-friendly facility design and energy efficiency.

-

Population growth in urban centers.

Rising home transitions, rental rates, and property prices necessitating interim storage.

Lifestyle trends toward minimalism and decluttering.

E-commerce expansion creating demand for storage of inventory and goods.

Increased business use from small-scale entrepreneurs seeking scalable space.

-

High land and construction costs, especially in urban areas.

Market saturation and intense competition in major cities.

Balancing robust security and easy access for customers.

Regulatory approvals and capital expenses for new facility development.

-

Expansion into regional areas and diversification of facility use cases.

Integration of advanced technologies for automation and digital management.

Customization for non-traditional users (e.g., SMEs, freelancers, e-commerce sellers).

Adoption of eco-friendly infrastructure and energy-efficient operations.

-

Small Storage Unit

Medium Storage Unit

Large Storage Unit

-

Personal

Business

-

Australia Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

-

March 2025: The Self-Storage Association of Australia (SSAA) reported strong east coast demand, with 62 new facilities expected to open by the end of 2025 and 164 more in approval stages, projected to add over 1.3 million square metres of storage space in NSW alone.

July 2025: Global asset-management firm Barings entered the Australian market with a $130 million majority acquisition of Swift Storage, highlighting growing institutional investor interest and international participation in the sector.

Key Highlights of the Report

-

In-depth segmentation and regional market forecasts for 2025–2033

Analysis of urban density, minimalism, and population shifts influencing demand

E-commerce impact on business storage requirements

Facility investment trends and digital transformation

Competitive landscape analysis including operator profiles and strategies

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel. No.: (D) +91 120 433 0800

Americas: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment