Saudi Arabia Aggregates $860M Of Venture Capital Deployment In H1 2025

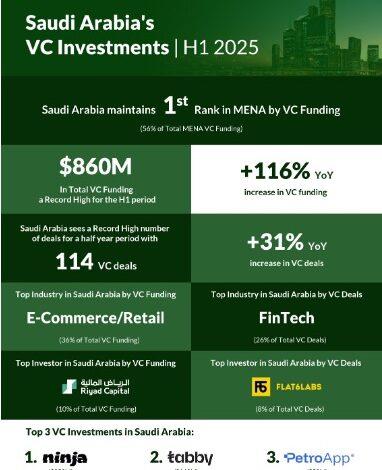

The“H1 2025 Saudi Arabia Venture Capital Report” revealed that Saudi Arabia achieved a record total Venture Capital (VC) deployment of $860 million (SAR 3.2Bn) in H1 2025, up by 116% compared to H1 2024, surpassing the total VC funding for all of 2024.

The Kingdom also maintained its first rank across the MENA region in VC funding, accounting for 56% of the total capital deployed in the region. This confirms the attractiveness of the Saudi market, its competitive environment, and its position as the largest economy in the MENA region.

The report released today by the venture data platform MAGNiTT, sponsored by SVC, also shows that Saudi Arabia achieved a record 114 VC deals in H1 2025, a 31% increase compared to H1 2024. This accounts for 37% of the total deals in the MENA region, marking the highest share ever for the Kingdom.

According to the report, e-commerce ranked first among sectors in Saudi Arabia, accounting for 36% of the country's capital deployed in H1 2025, with a value of $306 million (SAR 1.1 billion). Fintech led in the number of deals, with 30 deals, representing 26% of all VC deals in the Kingdom.

SVC is an investment company established in 2018 and is a subsidiary of the SME Bank, one of the development banks affiliated with the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO through investment in private capital funds (venture capital, private equity, venture debt and private credit) as well as direct investment in startups and SMEs.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment