Tariffs Have A Laffer Curve, Too

At a tax rate of zero, the government has no tax revenues, but it also has no revenues at a tax rate of 100%, because the economy would shut down. Somewhere in between, there's a tax rate that generates the maximum revenue.

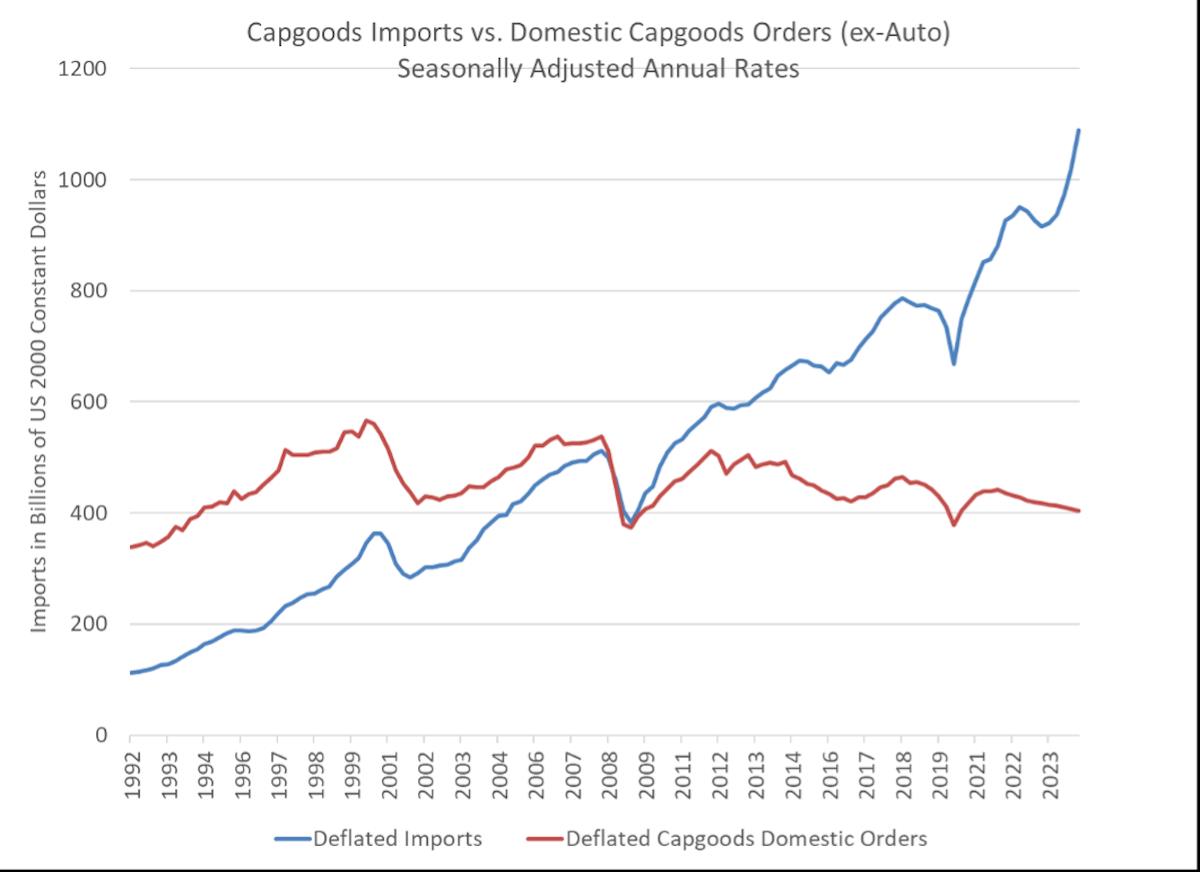

The US can't continue to run trillion-dollar trade deficits without dire consequences. The US net international investment position has sunk to negative $25 trillion, about equal to the sum of US deficits over the past 30 years. During the past decade, foreigners poured into US tech stocks. If the tech boom fades, for example, the US will have to persuade foreigners to buy bonds, and that implies higher interest rates to attract funds.

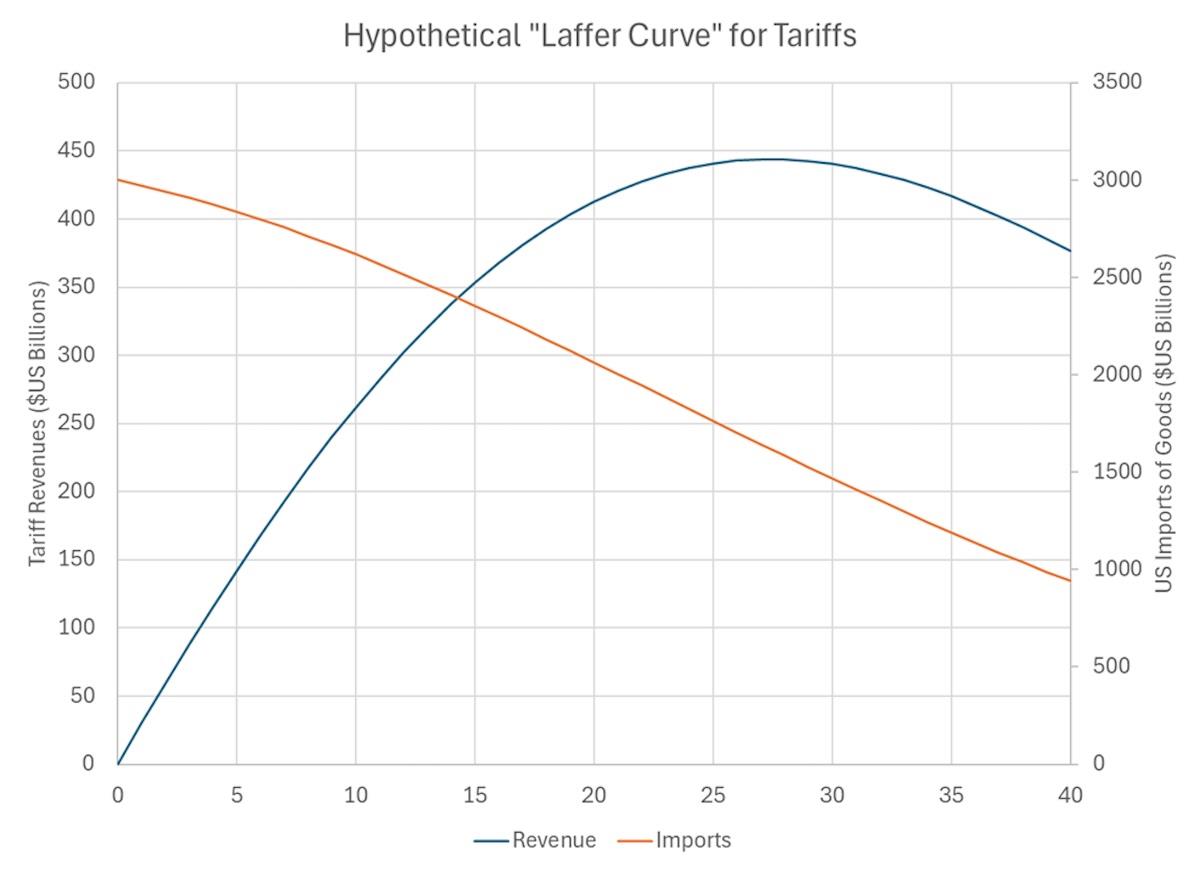

Tariffs are a tax, and Laffer's simple illustration applies to the impact of tariffs as well, although more variables are in play. A reasonable guess is that tariffs in the 10% to 15% range would yield a meaningful amount of revenue without undue disruption of economic activity.

Tariffs have multiple effects: Domestic production will replace some imports, but some consumers and businesses will have to absorb higher import prices. Some exporters will build plants in the US to avoid tariffs, as US President Trump proposes.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment