$1.5 Billion Stolen In Unprecedented Bybit Crypto Exchange Hack

In a staggering blow to the cryptocurrency industry, Dubai-based exchange Bybit has fallen victim to a cyberattack resulting in the theft of approximately $1.5 billion in Ethereum tokens. This incident, occurring during a routine transfer between digital wallets, is now considered the largest digital heist in history.

The breach transpired as Bybit conducted a standard operation, moving assets from a cold wallet-offline storage designed to safeguard funds-to a warm wallet used for daily transactions. During this process, malicious actors manipulated the transfer, seizing control of the cold wallet and diverting 401,000 Ethereum tokens to an unidentified address. Blockchain analytics firms, including Arkham Intelligence, have traced the stolen funds, revealing that $1.36 billion in Ethereum was swiftly liquidated from associated accounts.

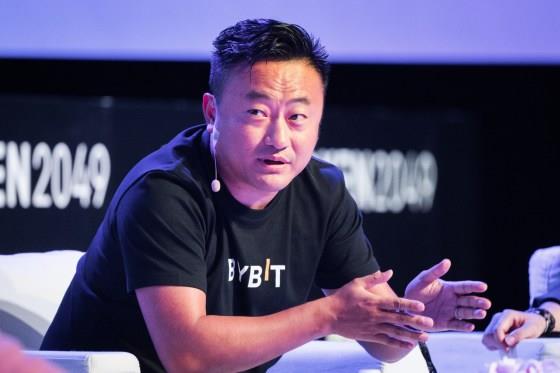

Bybit's CEO, Ben Zhou, addressed the crisis, assuring clients that the exchange remains solvent and that all customer assets are backed on a one-to-one basis. He emphasized that unaffected wallets and withdrawal processes continue to operate normally. To mitigate the impact on users, Bybit has implemented bridge loans to cover any unrecovered funds and has launched a recovery bounty program, offering up to 10% of the reclaimed amount to ethical hackers assisting in the retrieval efforts.

The magnitude of this theft has prompted a surge in withdrawal requests, with over 350,000 submissions flooding the platform. While this influx has the potential to cause processing delays, Zhou noted that the rate of withdrawals has begun to decelerate. In response to the breach, Bybit is collaborating with law enforcement agencies and cybersecurity experts to trace the perpetrators and enhance its security infrastructure to prevent future incidents.

See also PEPE Investors Pivot to FloppyPepe Amidst Market ShiftsSpeculation regarding the identity of the attackers has intensified, with some experts pointing towards North Korea's notorious Lazarus Group. This collective has been implicated in previous high-profile cryptocurrency thefts, including the pilfering of $1.7 billion in 2022 and $800 million in 2024. While these allegations remain unconfirmed, the pattern of large-scale crypto heists attributed to state-sponsored actors raises significant concerns about the security of digital assets on global trading platforms.

In a related development, cybersecurity firm CertiK has identified another suspicious transfer involving approximately $49.5 million from an unverified Ethereum contract. The recipient address has been observed converting these funds into the stablecoin DAI. The community speculates that this incident may be connected to the Infini platform, a stablecoin digital bank, though official confirmation is pending.

These consecutive breaches underscore the vulnerabilities inherent in the rapidly evolving cryptocurrency landscape. As digital assets become increasingly mainstream, the imperative for robust security measures and regulatory oversight grows more pressing. The Bybit hack serves as a stark reminder of the potential risks investors face and the necessity for exchanges to implement stringent protective protocols to safeguard user funds.

In the wake of these events, the cryptocurrency market has experienced notable fluctuations. Ethereum's value witnessed a temporary decline of approximately 4%, reflecting investor apprehension following the breach. Market analysts advise stakeholders to exercise caution and remain informed about security practices employed by exchanges to mitigate exposure to such risks.

Bybit's commitment to reimbursing affected users and bolstering its security framework aims to restore confidence among its clientele. However, the broader implications of this unprecedented theft continue to reverberate throughout the digital currency ecosystem, prompting a reevaluation of security standards and the adoption of more resilient measures to combat the escalating threat of cyberattacks targeting cryptocurrency platforms.

See also Finanx AI's FNXAI Token Gains Momentum Amid AI-Driven Investment StrategiesAs investigations proceed, the collaboration between cryptocurrency exchanges, cybersecurity firms, and regulatory bodies will be crucial in addressing the challenges posed by increasingly sophisticated cyber threats. The lessons gleaned from the Bybit incident are poised to inform future strategies aimed at fortifying the security of digital assets and ensuring the integrity of the burgeoning cryptocurrency market.

Arabian Post – Crypto News Network

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment