Solidus Resources, LLC Announces Positive Feasibility Study Results For Its Spring Valley Gold Project In Nevada

| Area | Item | Unit | Total |

| Mine | Ore tons Mined | Mton | 243 |

| Gold Grade | oz/ton Au | 0.016 | |

| Gold Contained | Moz Au | 3.8 | |

| Strip Ratio | Ore : Waste | 2.9 | |

| Average gold recovery | % | 80.5 | |

| Average gold production in first 5 years | koz pa | 348 | |

| Average gold production LOM# | koz pa | 303 | |

| Capital Cost | Initial Capital | $M | 823 |

| Peak Investment | $M | 820 | |

| Total Investment | $M | 1,282 | |

| Costs | NSR | $/ton ore | 28.00 |

| Site Costs | $/ton ore | 9.79 | |

| Royalties | % of NSR | 4.3 | |

| All In-Sustaining Costs | $/oz Au | 1,103 | |

| Financials | EBITDA | $/ton ore | 17.00 |

| EBITDA Margin | EBITDA / NSR, % | 61 | |

| Annual FCF | $M | 297 | |

| Total EBITDA | $M | 4,131 | |

| LOM NCF | $M | 2,381 | |

| Post-Tax NPV5% | $M | 1,520 | |

| Cash Flow Index | NPV : Peak Investment | 1.85x | |

| IRR | % | 36.1 | |

| Simple Payback | year | 1.8 |

Notes:

- Excludes residual leach year.

- Economics are based on consensus gold price of $2,400/oz in 2028E and $2,200/oz LT from 2029E onwards. Includes closure expenses and salvage value. EBITDA = earnings before interest, taxes (excludes state net proceeds tax), depreciation and amortization; NSR = net smelter return; NPV = net present value; IRR = internal rate of return. Post-tax NPV5% / Peak Investment.

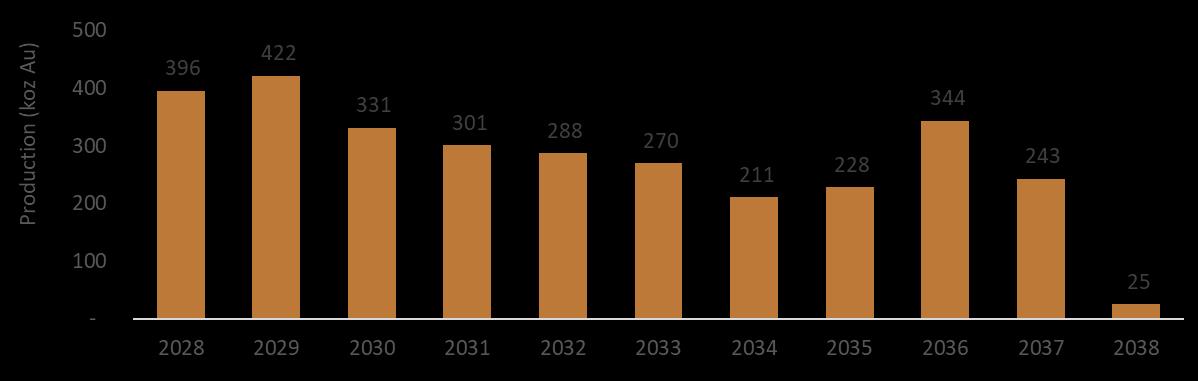

Mine Plan

The mine plan will entail excavation of 957 million tons of material mined during ten years while process operations are active. Following the completion of pit operations, process operations will continue for a further 9 months of residual leaching.

Spring Valley is expected to be mined from a single open pit utilizing 320-ton autonomous haul trucks and hydraulic face shovel excavators. Blasthole drills will also use autonomous drill system technology.

The Project contains 3.8 Moz Au of proven and probable mineral reserves at an average gold grade of 0.016 oz/ton.

Spring Valley Annual Gold Production

Spring Valley Mineral Reserve Estimate (Effective Date: September 3, 2024)

| Classification | Tonnage | Gold Grade | Contained Metal |

| ('000 tons) | (oz/ton) | (koz Au) | |

| Proven | -- | -- | -- |

| Probable | 242,977 | 0.016 | 3,799 |

| Total | 242,977 | 0.016 | 3,799 |

Notes:

- The Mineral Reserve estimate was prepared in accordance with the 2014 CIM Definition Standards by Dave Penswick, P.Eng. an independent mining consultant. The Mineral Reserve estimate is contained within pit designs using Indicated Mineral Resources only and a gold price of $1800/oz. The Mineral Reserve estimate is based on an ore cut-off grade of 0.004 oz/ton gold. Excludes contained gold in overliner material. ROM design ore recovery: 79% of oxide contained; 70% of transition contained; 56% of sulfide contained. Crushed design ore recovery: 88% of oxide contained; 80% of transition contained; 74% of sulfide contained. Mining costs: Average base mining cost: $1.53/ton Ore; $1.36/ton Waste Rock; $0.98/ton Alluvium; mining cost adjustment factor: $0.048/ton per 25 ft bench. Process costs: $2.65/ton ROM ore; $3.23/ton crushed ore; refining costs: $0.75/oz; general and administrative (G&A) costs: $0.80/ton total ore; transport costs $0.63/oz gold. The Mineral Reserve estimate is reported within a pit design that uses geotechnical parameters developed by WSP, where the recommended pit slope angles range from 34 to 47 degrees. Unplanned dilution averaging 14.3% was estimated and included in the reserves. There are no known legal political, or environmental risks that could materially affect the potential development of the Mineral Reserve estimate. Royalties were applied to the Spring Valley Mineral Reserves with an average royalty burden of 4.3% of net smelter return (NSR). The individual effective royalties are between 1% and 6% as described in the Feasibility Study.

Processing

Gold recovery values are based on extensive metallurgical test work, trade-off studies and optimization.

Ore is expected to be treated through one of two process streams that include (1) higher-grade ore crushed in three stages and stacked on the crushed ore pad with conveyors, and (2) lower-grade material will be delivered by open pit haul trucks to the ROM ore pad.

Key Process Design Criteria

| Description | Unit | Crushed Ore | ROM Ore |

| LOM Ore Reserve | Mton | 123.4 | 119.6 |

| Ore Throughput | Mton per annum | 12.8 | 4.5 - 20.0 |

| Stacking Method | - | Crushing & Stacking | ROM Truck Dump |

| Gold Head Grade, LOM avg | oz/ton | 0.025 | 0.006 |

| Average Gold Recovery | % | 82.0 | 74.2 |

Capital Expenditure

The Project's initial capital cost is $823 million expressed in Q3 2024 dollars. This estimate falls under AACE Class 3 Classification Guidelines, with an expected accuracy of ±15% of the final Project cost including contingency.

Sustaining capital is estimated to be $388 million. Reclamation capital and bond interest total $87 million ($84 million after discounting), and salvage value applied at the end of the LOM is $13 million. This results in a total LOM investment of $1,282 million.

Capital Cost Summary

| Description | Initial Capex ($M) | Sustaining Capex ($M) | Total Capex ($M) |

| Mine Development | 275.1 | 287.6 | 562.7 |

| Site Preparation | 143.4 | 6.8 | 150.2 |

| Process Facilities | 155.9 | 7.8 | 163.7 |

| Heap Leach | 81.8 | 73.5 | 155.3 |

| Sub-Total Direct Costs | 656.2 | 375.7 | 1,031.9 |

| Indirect | 86.9 | 5.3 | 92.2 |

| Provisions (Contingency) | 79.6 | 7.3 | 86.8 |

| Sub-Total Indirect Costs | 166.5 | 12.6 | 179.0 |

| Project Total | 822.7 | 388.3 | 1,211.0 |

Note: exclusive of reclamation, salvage and reclamation bond interest.

Operating Costs

Operating costs over the LOM were estimated at $2.4 billion, equivalent to $9.79/ton processed, and include mining, processing and G&A costs. The operating cost estimates are reflective of Q4 2024 pricing and don't include allowances for inflation. The cost estimates align with the principles of a Class 3 Feasibility study level estimate with a ± 15% accuracy according to the AACE guidelines.

LOM Operating Cost Summary

| Cost Area | $/ton Processed | Total ($M) | Percent of Total (%) |

| Mining | 6.10 | 1,482 | 62.3 |

| Process | 2.88 | 701 | 29.5 |

| G&A | 0.80 | 195 | 8.2 |

| Total | 9.79 | 2,378 | 100.0 |

Notes:

Ore Processed includes 123.4 Mtons Crush Leach and 119.6 Mtons ROM Leach. Ore Processed excludes 5.8 Mtons sub-grade material used as liner that contribute 4koz payable Au. Excludes TCRC costs which are equivalent to an additional $0.02/ton ore.Mineral Resource Estimate and Exploration

The Mineral Resources at the Project total 4.4 Moz gold of Indicated resources and 0.6 Moz gold of Inferred resources constrained within a $1,700/oz gold pit shell and cut-off gold grade of 0.004 oz/ton. During operations, RC grade control in advance of blasthole drilling will be carried out to assist with medium-term planning.

Spring Valley Mineral Resource Estimate (Effective Date: August 24, 2023)

| Classification | Tonnage | Gold Grade | Contained Metal |

| ('000 tons) | (oz/ton) | (koz Au) | |

| Measured | -- | -- | -- |

| Indicated | 259,802 | 0.017 | 4,362 |

| Total M&I | 259,802 | 0.017 | 4,362 |

| Inferred | 44,354 | 0.014 | 618 |

Notes:

- ton=short tons, oz/ton=ounces per short ton, koz= kilo troy ounce. The Mineral Resource estimate was completed by Mr. Simeon Robinson, P.Geo., Principal Geologist of AMC. There is no known depletion by mining within the model area. Near surface Mineral Resources are constrained by a nominal optimized pit shell.

- Metal prices of $1,700/oz Au. Pit angles vary from 32° in alluvium to 43°. Crusher process recoveries of 88.7%, 87.4%, and 74.9% for oxide, transitional, and sulfide respectively, and ROM process recoveries of 80.1%, 71.10%, and 62.5% for oxide, transitional, and sulfide respectively. Mining costs $1.43/ton autonomous, processing costs $2.90/ton (ROM), $4.40/ton (crusher), G&A costs of $0.79/ton, selling costs of $1.42/oz.

There is strong potential for defining additional Mineral Resources outside the current resource pit, including extensions to the Spring Valley Deposit, multiple exploration targets nearby, and targets along a 7-mile strike length across the Black Ridge fault zone. The Project is located in the Humboldt Range that has a gold endowment of ~60 Moz within a ~50-mile radius.

Spring Valley Property and Nearby Au-Rich Deposits

About Solidus Resources, LLC

Solidus Resources, LLC is a gold developer focused on advancing the Spring Valley Gold Project in Pershing County, Nevada, through permitting, construction and into operations. Solidus is a wholly-owned subsidiary of Waterton Mining, a private equity backed mining company.

For further information, please visit the Solidus Resources website at

Alternatively, please contact:

Jack McMahon, President

...

Feasibility Study Report and Contributing Authors

The Feasibility Study for the Spring Valley Project was led by Ausenco Engineering Canada ULC with additional contributors to the report including Lincoln Metallurgical Inc, AMC Mining Consultants (Canada) Ltd, NewFields Mining Design & Technical Services LLC, Ray Walton Consulting Inc, Sunstone Environmental Solutions LLC, Gibsonian Inc, WSP USA Inc, and FloSolutions USA Ltd.

As Solidus is a private entity not soliciting capital and not a Reporting Issuer under either Canadian or US securities law, the disclosure requirements of NI 43-101 and SK-1300 do not apply.

The Feasibility Study supporting the results disclosed herein will be published on Solidus' website within 45 days. The effective date of the Feasibility Study report is January 31, 2025. For readers to fully understand the information in this release they should read the report in its entirety when it is available on Solidus' website, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not be read or relied upon out of context.

Forward Looking Statements

Certain information contained or incorporated by reference in this release constitute forward-looking statements, including, without limitation, any information relating to strategies, plans, future financial or operating performance (including costs or recoveries) and other similar guidance. Forward-looking statements generally can be identified by the use of forward-looking terminology such as“may,”“should,”“could,”“would,”“predicts,”“potential,”“continue,”“expects,”“anticipates,”“future,”“intends,”“plans,”“believes,”“estimates” or similar expressions or their negatives, as well as statements in future tense. Although Solidus believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, beliefs and expectations, such forward-looking statements are not predictions of future events or guarantees of future performance, and actual results could differ materially from those set forth in the forward-looking statements. Some factors that might cause such a difference include the following: fluctuations in the spot and forward price of gold; the speculative nature of the business of mining; changes in mineral production performance; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; timing or receipt of necessary permits and approvals; increased cost and physical risks, including extreme weather events and resources shortages; and increased costs associated with mining inputs and labor. Any forward-looking information presented herein is made only as of the date of this release, and Solidus does not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

Photos accompanying this announcement are available at:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment