Hands Off My 401(K): American Retirement Savers Appreciate Their Plans Just The Way They Are

As Congress considers the expiring provisions of the 2017 Tax Cuts and Jobs Act, policymakers must protect Americans' ability to save for their futures by ensuring the tax treatment Americans rely on for retirement savings isn't used as a "pay-for" to finance other government spending or tax changes.

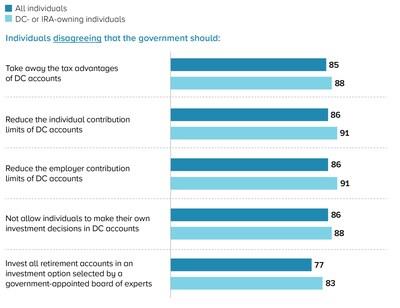

(Refer to Figure) Americans Broadly Reject Changes to the Key Features of DC Plans

Percentage of U.S. individuals disagreeing with each statement, fall 2024

Note: The figure plots the percentage of adults who "strongly disagreed" or "somewhat disagreed" with the statement. See Figure 3 in the report for additional details.

Source: ICI tabulation of NORC AmeriSpeak® survey data (fall 2024)

A strong majority of Americans disagreed with proposals to remove or reduce tax incentives for retirement savings. In fall 2024, 85 percent disagreed that the government should take away the tax advantages of DC accounts, and 86 percent disagreed with reducing the amount that individuals can contribute to DC accounts. Disagreement was higher among those with retirement accounts.

To advocate for American retirement savers, ICI launched the "Help U.S. Retire " campaign. "Help U.S. Retire" is an advocacy campaign to protect the retirement funds that middle-class Americans rely on to build their long-term financial security. The campaign will mobilize the 120 million American investors that use mutual funds and ETFs as long-term savings vehicles, building a grassroots network to amplify their voices to Congress.

Other findings from the study:

-

ICI's research also found that an overwhelming majority of DC plan participants agreed that their DC plan helps them think about the long-term and makes it easier to save. Almost half also indicated that they would probably not be saving for retirement if not for their DC plans at work.

Most (92 percent) DC-owning individuals agreed that it was important to have choice in and control of the investments in their DC plans. More than eight out of 10 DC-owning individuals (83 percent) indicated that their DC plan offered a good lineup of investment options. DC plans not only facilitate saving but also investing.

Across the adult U.S. population more generally, nearly nine out of 10 (86 percent) individuals surveyed disagreed with the idea of not allowing individuals to make investment decisions in their DC accounts, and nearly eight out of 10 (77 percent) disagreed with investing all retirement accounts in an investment option selected by a government-appointed board of experts.

The bottom line is retirement plan accounts can help individuals meet retirement goals and are a powerful tool for household savings.

About the ICI Survey

With millions of U.S. households personally directing their retirement savings, the Investment Company Institute (ICI) has sought to track retirement savers' actions and sentiment. This report, the 17th in this series, summarizes results from a nationally representative survey of Americans aged 18 or older. The survey was designed by ICI research staff and administered by NORC at the University of Chicago using the AmeriSpeak® probability-based panel. This report presents survey results that reflect individuals' responses collected during November and December 2024. All prior reports are available at .

Contact us: [email protected]

SOURCE Investment Company Institute

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment