Gold Glitters At End Of The World As We Know It

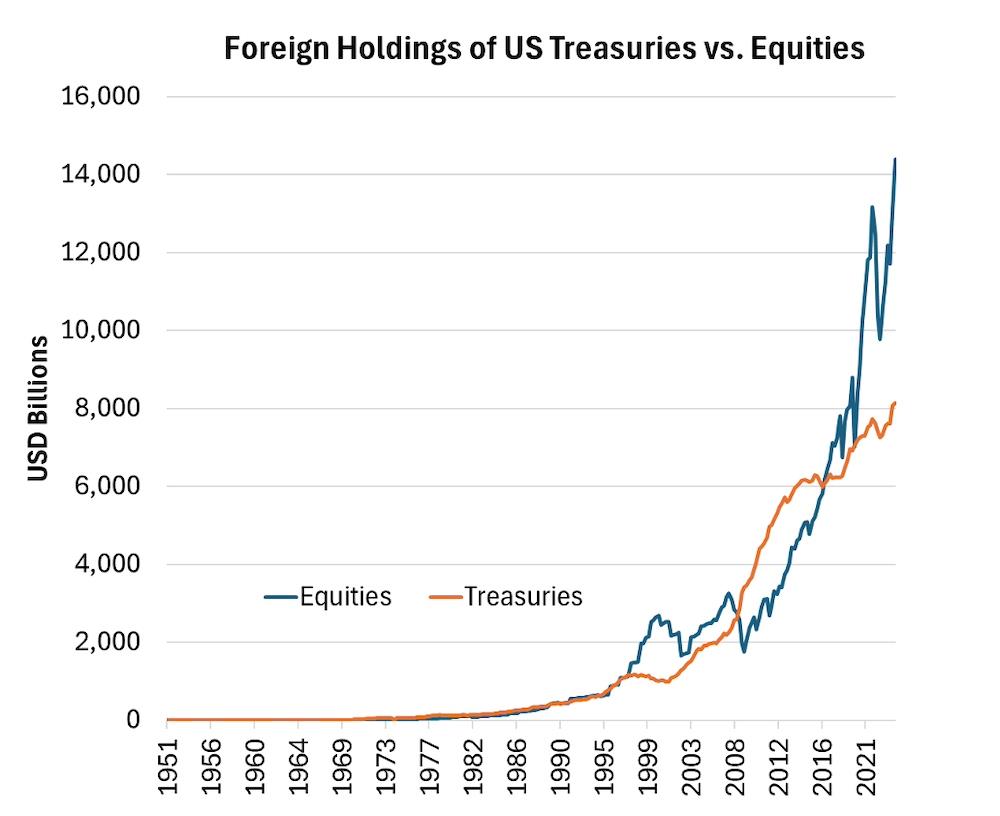

Why hedge against extreme distress amid ebullient tech-driven optimism? The answer is a lot could go wrong-catastrophically wrong, in fact. Tech stocks are now the core asset of the dollar-based world monetary system. The United States has sold US$24 trillion more of its assets to foreigners than foreigners have sold to Americans.

Graphic: Asia Times

That“net international investment position” of $24 trillion, up from $18 trillion at the end of Donald Trump's first term in office, paid for America's cumulative trade deficit over the past 30 years. For the past 10 years, foreigners have been buying stocks rather than US Treasury bonds, as in the past.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment