Can Policy Stimulus Reignite Chinese Economic Growth?

DOHA: In recent decades, China has been a dominant engine of economic growth for the global economy. During the period 2008-2019, which includes the years between the Great Financial Crisis and the Covid-pandemic, the Chinese economy expanded at an average rate of 8%, accounting for approximately 1/3 of global growth. Since then, a combination of domestic factors has led to a marked deceleration in the pace of economic expansion, QNB said in its economic commentary.

Over the last years, pessimism regarding China's growth performance has become widespread as economic indicators failed to meet expectations. This was substantiated by the China Economic Surprise Index, which provides a formal measure of how data releases stand relative to forecasts. Since June last year, the index plunged into the negative territory and displayed how negative news prevailed for the next 4 months before recovering since mid-Q4.

Furthermore, fears began to rise as attention shifted to the correction in property markets that seemed unable to find its trough, as well as the growing threat implied by mounting debts of local governments. In this context, there was growing impatience with the cautious and incremental approach by the government to implement policy stimulus to the economy. The Bloomberg consensus forecasts pointed to 4.7% growth of GDP for 2024. Although this number is remarkable by international standards, it was 3.3 percentage points (p.p.) below the 8% average for China between 2008 to 2019.

It is unlikely that growth rates could return to the rocketing pre-pandemic average, given the structural developments that conduct the economy to a natural long-term trend of growth moderation. However, several tailwinds allow for an improvement in its growth performance this year. In this article, we discuss three factors that will support growth in China in 2025.

First, economic indicators are delivering positive surprises, with signals that the constructive momentum will persist. The Economic Surprise Index comfortably entered the positive range in Q4-2024, amid better-than-expected gauges across key production sectors. Property markets displayed signs of stabilization as the declines in prices and sales moderated, with some statistics even exhibiting positive growth. This comes after the government ramped up incentives in the sector by relaxing conditions on mortgages and announced funds for targeted projects and housing for lower-income families.

Additionally, robust growth in sales of electric vehicles and household appliances points to stronger appetite for consumption by households. More generally, the Manufacturing Purchasing Managers Index (PMI) also entered the expansionary range in the last quarter of last year, after 5 consecutive months in the negative region. The improved evolution of indicators across various sectors imply that current projections should be revised upwards.

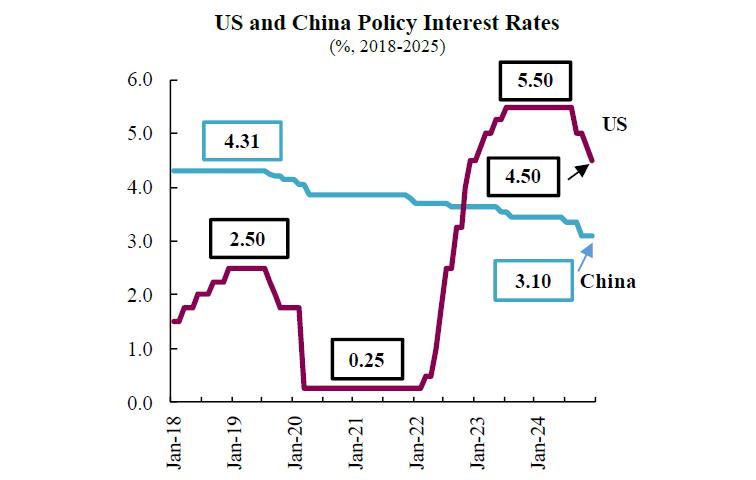

Second, the Chinese government is launching an aggressive battery of coordinated monetary and fiscal policy measures to provide stimulus to the economy. The Politburo led by President Xi Jinping announced it will conduct a“moderately loose” monetary policy strategy this year, anticipating a stance that had not been adopted since the Global Financial Crisis. Specifically, this has translated into expectations of interest rate cuts by 40-60 basis points (b.p.) by the PBoC, but will undoubtedly be accompanied by other measures of monetary easing. In the fiscal front, policymakers are expected to set a budget deficit target of 4% of GDP, the widest since 1994, and larger than the typical levels below 3%.

The recent announcements add to previous rounds of initiatives that included the re-capitalization of state banks, cuts in interest rates and reserve requirement ratios, public spending, support measures for the real estate and capital markets, and a USD 1.4 Tn package to alleviate local government debt pressures, among many others.

Third, the continuation of the easing cycles of central banks in major advanced economies contribute to improve external conditions for China. Last year, as inflation was brought under control, the European Central Bank and the US Federal Reserve cut rates by 100 and 100 b.p., respectively. This year, expectations point to additional cuts of 100 and 75 b.p. As a result, global financial conditions will continue to improve significantly. As central banks in major advanced economies cut rates, liquidity and credit expand. In addition, the PBoC will have more room to ease, as lower interest rate differentials means lessened concerns of capital flows leaving China to seek higher returns abroad.

In our view, absent a major trade conflict with the US, Chinese economic growth will be supported by positive momentum, more aggressive policy stimulus, and improving global financial conditions, favouring an above-consensus expansion rate of close to 4.8%.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment