CBE Launches Payment Card Tokenization On Mobile Apps, Apple Pay To Boost Digital Transactions

The tokenization service was introduced in partnership with global digital payment giants, including VISA, Mastercard, and the National Payment Scheme“Meeza,” as well as Apple Inc. The collaboration also involved multiple banks, mobile payment app providers, and FinTech companies, ensuring seamless integration between local and international systems. This expansion of digital payment services aims to enhance accessibility, boost consumer trust, and promote widespread adoption of electronic payments across Egypt.

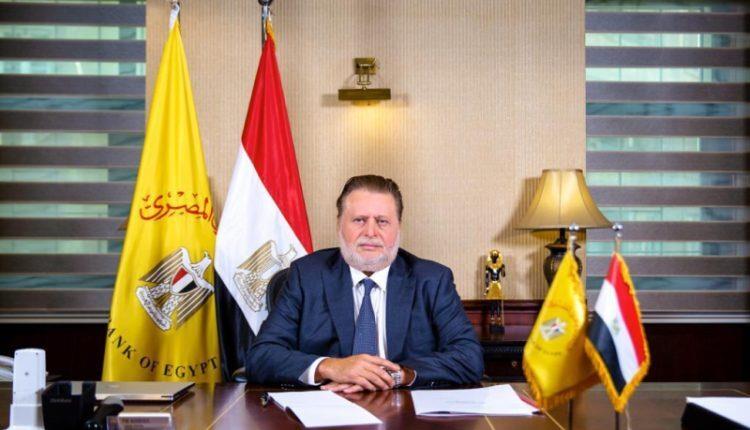

Hassan Abdalla, Governor of the Central Bank of Egypt, emphasized:“The launch of the payment card tokenization service is a testament to the CBE's commitment to keeping pace with technological advancements, and it continues our progress in digital banking services. Today, Egyptian citizens can enjoy the convenience of conducting financial transactions easily, securely, and at competitive costs, anytime and anywhere.”

Rami Aboulnaga, Deputy Governor of the CBE, said:“This new service underscores the CBE's dedication to strengthening Egypt's digital financial infrastructure. By providing secure and innovative electronic payment solutions, we are meeting the evolving needs of our customers while aligning with global standards.”

The National Cards Tokenization Platform enables a digital version of payment cards within mobile apps, allowing users to make contactless purchases at Point of Sale (POS) terminals and online retailers. Transactions are authenticated using biometric features such as facial recognition or fingerprints, eliminating the need for PINs and further enhancing security and convenience. This service promises to offer fast, secure, and efficient transactions, streamlining the digital payment experience for consumers.

The rollout of this card tokenization service is expected to significantly boost transaction volumes, particularly in POS terminals and e-commerce platforms, both of which have shown remarkable growth in recent years. By the end of 2024, the value of POS transactions is projected to reach EGP 640bn, reflecting a 280% increase from EGP 169bn in 2021. Likewise, e-commerce transactions are expected to exceed EGP 180bn, marking an impressive growth of over 500% from EGP 29bn in 2021.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment