How Elon Musk's Spacex Secretly Allows Investment From China

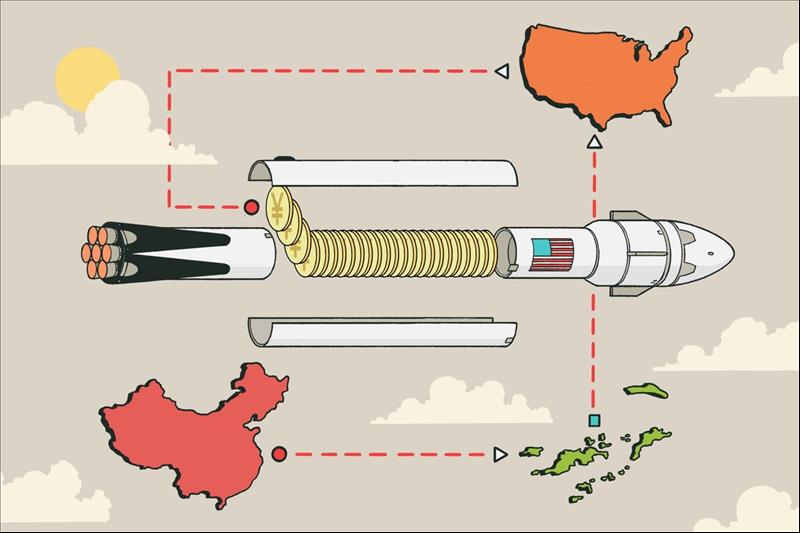

Elon Musk's aerospace giant SpaceX allows investors from China to buy stakes in the company as long as the funds are routed through the Cayman Islands or other offshore secrecy hubs, according to previously unreported court records.

The rare picture of SpaceX's approach recently emerged in an under-the-radar corporate dispute in Delaware. Both SpaceX's chief financial officer and Iqbaljit Kahlon, a major investor, were forced to testify in the case.

In December, Kahlon testified that SpaceX prefers to avoid investors from China because it is a defense contractor. There is a major exception, though, he said: SpaceX finds it“acceptable” for Chinese investors to buy into the company through offshore vehicles.

“The primary mechanism is that those investors would come through intermediate entities that they would create or others would create,” Kahlon said.“Typically they would set up BVI structures or Cayman structures or Hong Kong structures and various other ones,” he added, using the initials of the British Virgin Islands.

Offshore vehicles are often used to keep investors anonymous. Experts called SpaceX's approach unusual, saying they were troubled by the possibility that a defense contractor would take active steps to conceal foreign ownership interests.

Kahlon, who has long been close to the company's leadership, has said he owns billions of dollars of SpaceX stock. His investment firm also acts as a middleman, raising money from investors to buy highly sought SpaceX shares. He has routed money from China through the Caribbean to buy stakes in SpaceX multiple times, according to the court filings.

The legal dispute centers on an aborted 2021 deal, when SpaceX executives grew angry after news broke that a Chinese firm was going to buy $50 million of the company's stock. SpaceX then had the purchase canceled.

In separate testimony, the rocket company's CFO explained that the media coverage was“not helpful for our company as a government contractor.” SpaceX's business is built on those contracts, with the US government paying the company billions to handle sensitive work like building a classified spy satellite network.

Company executives were concerned that coverage of the deal could lead to problems with national security regulators in the US, according to Kahlon's testimony and a filing from his attorneys.

SpaceX, which also launches rockets for NASA and sells satellite internet service, is perhaps the most important pillar of Musk's fortune. His estimated 42% stake in the company is valued at around $150 billion. If he owned nothing else, he'd still be richer than Bill Gates.

Federal law gives regulators broad power to oversee foreign investments in tech companies and defense contractors. Companies only have to proactively report Chinese investments in limited circumstances, and there aren't hard and fast rules for how much is too much.

However, the government can initiate investigations and then block or reverse transactions deemed national security threats. That authority typically does not apply to purely passive investments in which a foreign investor is buying only a small slice of a company. But experts said that federal officials regularly ask companies to add up Chinese investments into an aggregate total.

The US government charges that China has a systematic strategy of using even minority investments to secure leverage over companies in sensitive industries, as well as to gain privileged access to information about cutting-edge technology. US regulators view even private investors in China as potential agents of the country's government, experts said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment