US Manufacturing Continues To Struggle With Tariff Uncertainty

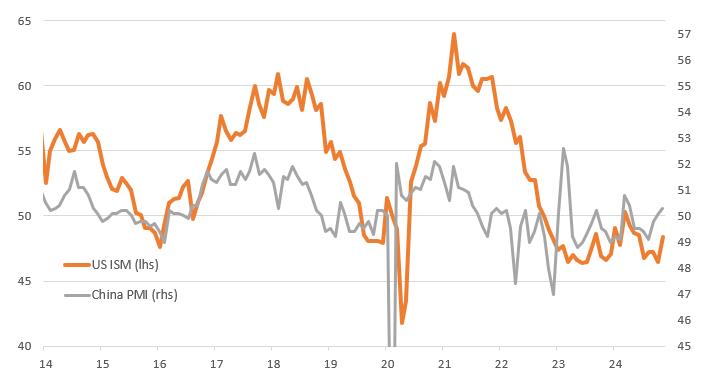

The US manufacturing ISM index rose to 48.4 in November from October's 46.5 print. This was above the 47.5 consensus forecast, but it remains below the 50 breakeven level. In fact, it has been in expansion territory (above 50) only once in the past 26 months. New orders broke above 50 for the first time since March, which could be on post-election clarity resulting in some companies pushing through delayed orders, but production remained very soft at 46.8 and employment, while improving, remains very weak at 48.1. There was good news on the inflation front with prices paid dropping to 50.3 from 54.8 with the ongoing softness in energy costs clearly very helpful.

US and Chinese manufacturing purchasing managers' indices

Source: Macrobond, ING Tariff uncertainty makes planning challenging

In terms of the outlook for the sector, there is a lot of uncertainty and much of that is tied to tariffs. While Donald Trump initially suggested tariffs were going to be used to raise tax revenue and incentivise re-shoring, they appear to be increasingly tied to achieving broader aims, including immigration restriction, drug trafficking control and military spending from trade partners. This means that US manufacturers have little visibility on the timing and scale of potential action at this point, although they do at least know Donald Trump is looking to cut taxes on profits. While US manufacturers should receive a competitive advantage from tariffs via the higher prices charged for foreign made products, there are consequences for their own supply changes and the potential for foreign reprisals that could hurt exporters. As a result, US manufacturing activity looks set to remain subdued at least until there is some clarity on the trading environment they face.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment