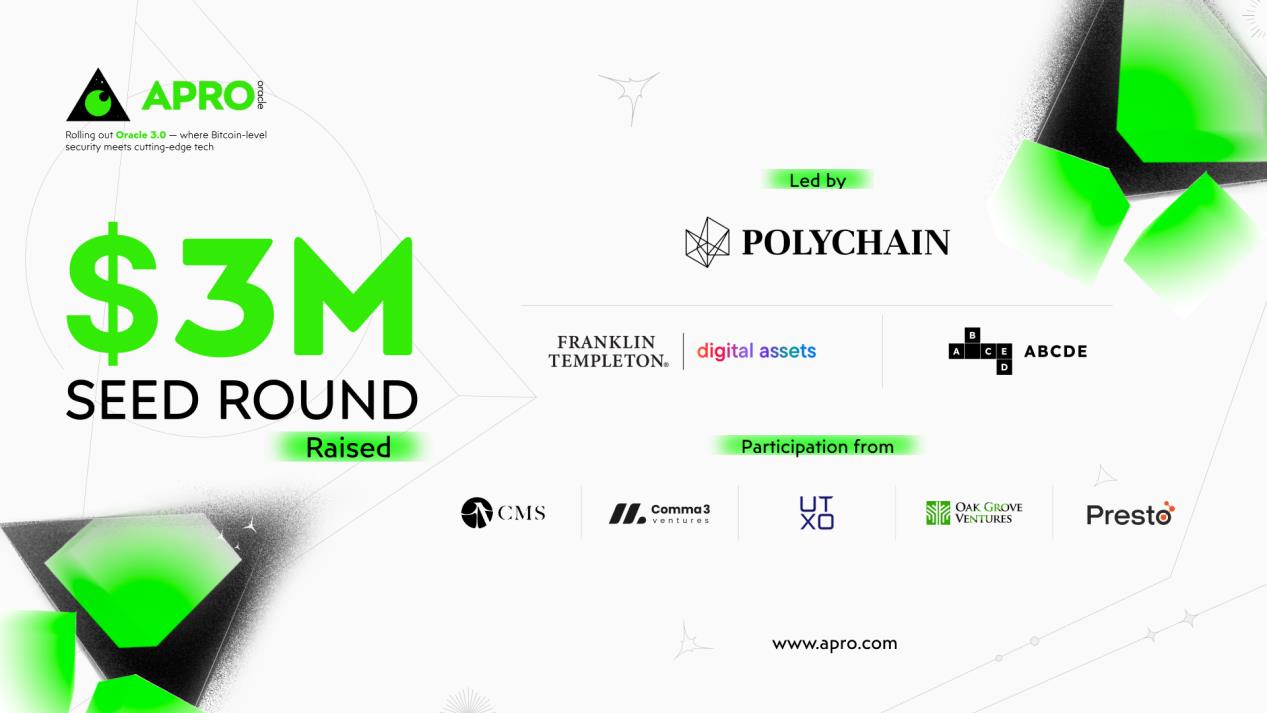

APRO Oracle Secures $3M In Seed Round Led By Polychain Capital, Franklin Templeton, ABCDE Capital

ROAD TOWN, British Virgin Islands, Oct. 08, 2024 (GLOBE NEWSWIRE) -- APRO Oracle, a leading provider of decentralized oracle services for the Bitcoin ecosystem, has raised $3 million in a seed funding round led by Polychain Capital, Franklin Templeton, and ABCDE Capital. The round also saw participation from CMS Holdings, Comma3 Ventures, UTXO Ventures, Oak Grove Ventures, Presto Labs, and others.

The funding will support APRO Oracle's continued product innovation and market expansion. The company's Oracle 3.0 technology, which combines Bitcoin-grade security with fast response times, is positioned to meet the growing demand for decentralized applications (dApps) across multiple blockchains. APRO Oracle currently operates on over 15 blockchains and provides price feeds for more than 140 assets.

"APRO Oracle has addressed a significant gap in the Bitcoin ecosystem, providing a secure, responsive oracle service designed for decentralized finance (DeFi), gaming, and other applications,” Polychain Capital said in a statement.“Its Oracle 3.0 product offers lower latency and reduced costs compared to traditional oracle services, giving it a competitive edge.”

BMAN from ABCDE Capital echoed similar sentiments, calling APRO Oracle's rapid rise as the top oracle provider in the Bitcoin ecosystem“pivotal.” He added,“In just three months, APRO Oracle has emerged as the leading oracle service for Bitcoin-based DeFi. We are excited to support their continued growth.”

APRO Oracle's funding marks a notable milestone for the company, as it becomes the first Bitcoin-focused oracle to receive backing from Franklin Templeton, a licensed ETF institution. The inclusion of prominent investors such as Polychain Capital underscores APRO Oracle's potential to drive significant innovation in the decentralized finance space.

APRO Oracle's product offerings support a wide array of protocols, including Bitcoin L1, Bitcoin L2s, Ordinals, Runes Protocol, Lightning Network, and EVM-compatible chains. These solutions are designed to enhance project development and unlock liquidity for emerging ecosystems.

The company plans to expand its team and product offerings in the coming months, with a focus on fueling large-scale growth in Bitcoin liquidity and decentralized finance.

About APRO Oracle APRO Oracle is the top decentralized oracle in the Bitcoin ecosystem and the fastest-growing one. With partnerships across 100+ leading projects and top-tier collaborators, APRO Oracle continues to push the boundaries of decentralized data solutions.Its Oracle 3.0 technology combines Bitcoin-grade security with high-speed performance to serve decentralized applications across multiple blockchains.

Learn more at APRO Oracle . Follow APRO Oracle on Twitter and Telegram .

Contact:

John Lee

Marketing Manage

...

Disclaimer: This content is provided by APRO Oracle. The statements, views and opinions expressed in this column are solely those of the content provider. The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Please conduct your own research and invest at your own risk.

Photos accompanying this announcement are available at:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Mutuum Finance (MUTM) New Crypto Coin Eyes Next Price Increase As Phase 6 Reaches 50% Sold

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- Bydfi Joins Korea Blockchain Week 2025 (KBW2025): Deepening Web3 Engagement

- Over US$13 Billion Have Trusted Pendle, Becoming One Of The Largest Defi Protocols On Crypto

- Cregis Joins TOKEN2049 Singapore 2025

- Daytrading Publishes New Study Showing 70% Of Viral Finance Tiktoks Are Misleading

Comments

No comment