403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Attack on Trump may prompt safe-haven flows in Asian markets

(MENAFN- Matrix PR) Report by APAC Research Team, Saxo Bank

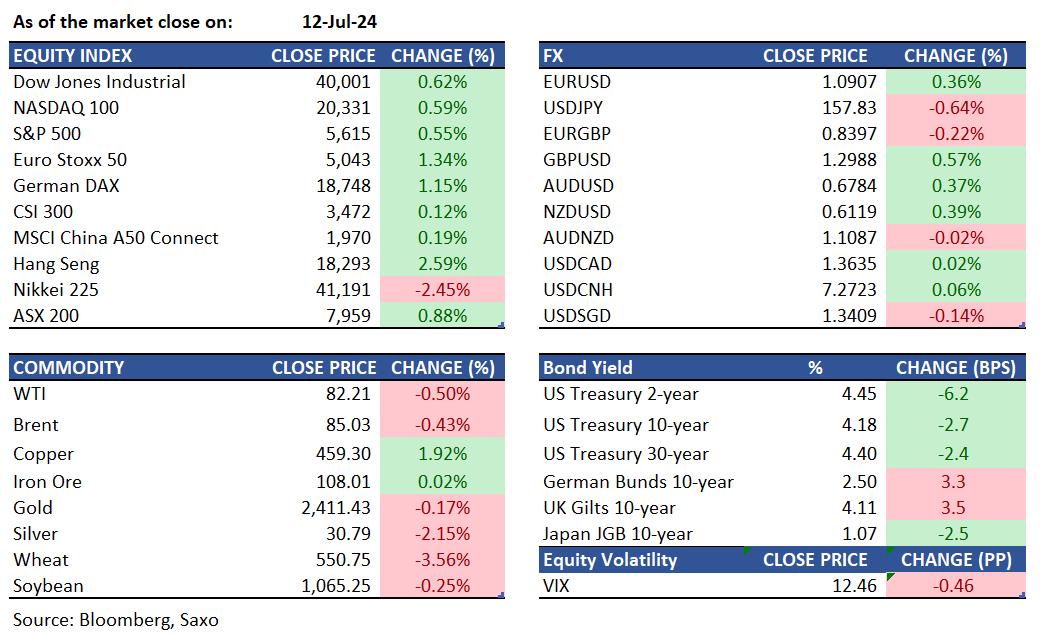

Commodities: WTI crude oil futures declined by 0.5% to close at $82.21 per barrel, ending a two-day winning streak and marking a 1.14% decrease for the week. Brent Crude futures also fell, settling at $85.03 per barrel, down 0.43%. Natural gas saw a late-week rebound, finishing up 0.43% for the week at $2.329. Gold prices slipped by 0.17% to $2,420.70, and silver prices declined 2.15% to $30.79, achieving their third consecutive weekly gain as investor confidence grew regarding the U.S. Federal Reserve's potential interest rate cuts. Rice fell to a 12-month low of $14.57 per cwt. Over the past 4 weeks, it has declined by 21.32%.

Equities: Equity markets demonstrated strong resilience on Friday, erasing most of Thursday's losses and closing the week higher. The Russell 2000 Smallcap Index, benefiting significantly from Thursday's tech selloff with a 3.5% rise, continued its upward trajectory, ending the week with a 5% gain. The S&P 500 and Nasdaq also showed sustained strength as investors capitalised on the brief decline in large-cap tech stocks. Geopolitical developments, particularly the attack on President Trump, may prompt safe-haven flows in Asian markets. Early indications show the USD slightly higher, while S&P 500 futures remain flat.

Fixed income: Treasuries advanced in the US afternoon session, reversing initial declines following the June PPI data. US 10-year note futures closed near the day's highs while the yield curve steepened due to front-end gains, reinforcing expectations for at least two rate cuts this year. Increased activity in October fed funds futures indicated a potential half-point rate cut in September. Additionally, Treasury futures volumes surged 13% above the 20-day average, with 2-year notes trading 45% above typical levels.

FX: The US dollar opened higher following the assassination attempt on former President Donald Trump over the weekend as markets have increased the probability of a second Trump presidency. FX market liquidity was thin with Japan on holiday, but the Mexican peso opened lower while the euro and Aussie slipped along with the Chinese yuan amid risks of higher tariffs. China’s third plenum kicks off today, and the focus will be on any reform announcements. The Swedish krona remained an underperformer in G10 as softer Sweden inflation supported the case for three rate cuts that the Riksbank has guided for. The British pound remained strong after hawkish BOE comments last week, and UK CPI will be on the radar this week.

Commodities: WTI crude oil futures declined by 0.5% to close at $82.21 per barrel, ending a two-day winning streak and marking a 1.14% decrease for the week. Brent Crude futures also fell, settling at $85.03 per barrel, down 0.43%. Natural gas saw a late-week rebound, finishing up 0.43% for the week at $2.329. Gold prices slipped by 0.17% to $2,420.70, and silver prices declined 2.15% to $30.79, achieving their third consecutive weekly gain as investor confidence grew regarding the U.S. Federal Reserve's potential interest rate cuts. Rice fell to a 12-month low of $14.57 per cwt. Over the past 4 weeks, it has declined by 21.32%.

Equities: Equity markets demonstrated strong resilience on Friday, erasing most of Thursday's losses and closing the week higher. The Russell 2000 Smallcap Index, benefiting significantly from Thursday's tech selloff with a 3.5% rise, continued its upward trajectory, ending the week with a 5% gain. The S&P 500 and Nasdaq also showed sustained strength as investors capitalised on the brief decline in large-cap tech stocks. Geopolitical developments, particularly the attack on President Trump, may prompt safe-haven flows in Asian markets. Early indications show the USD slightly higher, while S&P 500 futures remain flat.

Fixed income: Treasuries advanced in the US afternoon session, reversing initial declines following the June PPI data. US 10-year note futures closed near the day's highs while the yield curve steepened due to front-end gains, reinforcing expectations for at least two rate cuts this year. Increased activity in October fed funds futures indicated a potential half-point rate cut in September. Additionally, Treasury futures volumes surged 13% above the 20-day average, with 2-year notes trading 45% above typical levels.

FX: The US dollar opened higher following the assassination attempt on former President Donald Trump over the weekend as markets have increased the probability of a second Trump presidency. FX market liquidity was thin with Japan on holiday, but the Mexican peso opened lower while the euro and Aussie slipped along with the Chinese yuan amid risks of higher tariffs. China’s third plenum kicks off today, and the focus will be on any reform announcements. The Swedish krona remained an underperformer in G10 as softer Sweden inflation supported the case for three rate cuts that the Riksbank has guided for. The British pound remained strong after hawkish BOE comments last week, and UK CPI will be on the radar this week.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment