China Silent On Bangladesh's Financial Request

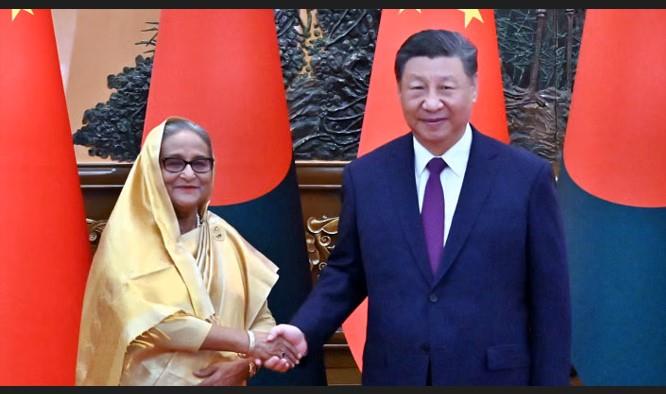

Colombo, July 11: Before Bangladesh Prime Minister Sheikh Hasina left for China on a State Visit, Foreign Minister Dr. Hassan Mahmud said that the Prime Minister would seek a US$ 5 billion soft loan from China to meet the debilitating financial crisis in the country.

But at the end of the State Visit on Wednesday, the official Chinese news agency Xinhua only said that President Xi Jinping and Sheikh Hasina“agreed to elevate bilateral relations to a comprehensive strategic cooperative partnership”.

ADVERTISEMENTThere was no information on what transpired between the two leaders.

Earlier, after a meeting between Sheikh Hasina and the Chinese Prime Minister Li Qiang, Dr. Mahmud said that Li promised US$ 1 billion in economic assistance. This will be given in four ways, as grants, interest-free loans, concessional loans and commercial loans, he added.

Mahmud further said that technical committees from both the countries would sit together to decide how these four types of financial assistance would be given to Bangladesh.

But there was no word from the Chinese Premier's office confirming or denying Mahmud's statements.

However, after the Hasina-Xi meeting on Wednesday, Bangladesh and China signed 21 instruments. These were on cooperation in the economic and banking sector, trade and investment, digital economy, infrastructure development, assistance in disaster management, construction of the sixth and ninth Bangladesh-China friendship bridges and export of agricultural products from Bangladesh.

Controversial Teesta Development Project

There was no hint about Hasina having discussed the controversial Teesta River basin development project in which there is a stiff competition between China and India.

With the Teesta water-sharing deal with India falling through, a frustrated Bangladesh in 2019 turned to China for help to manage the limited amount of water that Bangladesh was getting.

In 2020, Beijing presented a US$ 1 billion Teesta River Comprehensive Management and Restoration project proposal. But this rang alarm bells in New Delhi because of the proximity of the project to the Indian border. During Hasina's visit to New Delhi in June this year, India proposed to execute the project.

It was expected that when Hasina goes to Beijing she would be able to convince Xi Jinping to withdraw from the project. But there is no knowing if the issue was discussed with Xi at all and if it was what he said in reply.

“Bangladesh will try to compensate in some other ways if China is unhappy about our position on the Teesta,” Foreign Minister Mahmud had said.

Perhaps as compensation, Bangladesh opened the door wide for Chinese companies to invest in the country massively.

MOU on Massive Investments

On June 9, Bangladeshi and Chinese companies signed 16 agreements at a Sino-Bangladesh summit on trade, business, and investment opportunities.

As per the agreements, Chinese companies will invest in Bangladesh's textile, electric vehicle, solar power, fintech and technology sectors.

The MoU are: Agreement between Nagad and Huawei Technologies (Bangladesh) Ltd., with an investment of U$ 50 million. US$ 20 million investment for the 'Bangladesh Capital Market Digital Transformation Project' signed between Dex Bangladesh Tech Ltd and Huawei Technologies (Bangladesh).

US$ 400 million in investment will come from China under an MoU signed between Deshbondhu Group, Chemtex and China Chemical CNCC. Both parties will establish the largest PSF, PET bottle, and Textile grade factory in the Mongla Economic Zone.

The China Road and Bridge Corporation (CRBC) and Ningbo Cixing Company Limited signed an MoU on the investment framework agreement in Bangladesh's Chinese Economic and Industrial Zone.

The Billion10 Communications Ltd and CHTC (HengYang) Intelligent EV Company Ltd signed an MoU on manufacturing electric vehicles. The Billion10 Communications Ltd and Ningbo Sun East Solar Co Ltd signed an MoU to set up a Solar Park in Sylhet.

Billion10 Communications Ltd and HeSheng (Hoshine) Silicon Industry Co Ltd signed an MoU to invest in the renewable energy industry. Billion10 Communications Ltd and Zhongke Guorui (Zhuhai) New Material Technology Co Ltd signed an MoU to invest in Bangladesh's waste lubricant oil recovery and refining industry.

EB Solution Ltd and Hongji Intelligent Transport Co Ltd signed an MoU to invest in the Dhaka City Mobile Project. EB Solution Ltd and Ningbo Shering New Energy Technology Ltd signed an MoU to invest in Bangladesh's Smart Cold Chain Logistic Solutions sector.

US $20 million investment will come to Bangladesh for the CNG transportation by river and road under the MoU on technical and financial investment collaboration. The MoU has been signed between Intraco Refueling Station PLC and Shijiazhuang Enric Gas Equipment Co Ltd.

Zibo Jinhuateng Paper Machinery Co Ltd will invest in the paper machinery sector in Bangladesh jointly with Nitol Niloy Group. Both the parties signed an MoU on it.

Zhengzhou Dongfeng Mid-South Enterprise Company will invest in TBR Tyre Projects in Bangladesh in collaboration with Nitol Niloy Group. The Shandong Sunite Machinery and Nitol Niloy Group signed an MoU to invest in Bangladesh's Aerated Autoclave Concrete (AAC) Block.

Daliam Huahan Rubber & Plastic Machinery will invest in Bangladesh's rubber machinery with Nitol Niloy group.

Ballooning Chinese Influence

Chinese influence in Bangladesh has been ballooning. China dislodged India as Bangladesh's top trading partner in 2015, a position India had enjoyed for four decades previously. Bangladesh still imports more goods from China than from India.

The Bangladesh's economy has also become addicted to Chinese money, says Ahmede Hussain in The Diplomat of October 16, 2023.

Bangladesh had a total debt obligation of US$ 17.5 billion to China, which was mainly invested in white elephant infrastructure projects that, along with the decline in the remittance inflow, could lead to an economic crisis in the country, Hussain warned.

“To extricate itself from this situation, Bangladesh entered into an IMF loan program worth US$4.7 billion. But the country failed to meet two of the six targets set by the IMF, one of which was mandatory for the bailout. If Bangladesh could not succeed in securing the IMF loan, how would meet the debts to China,” he asked.

According to Hussain, unlike the IMF or the World Bank, China gives its borrowers a short period to repay loans. Interest rates are also higher.

“In the last fiscal year, Bangladesh's loan repayment stood at US$

2.74 billion, a 37% increase from the year before, and in this fiscal year (2023), it will go as high as US$3.28 billion,” the article said.

Indian Investments Stalled

India has also pumped in a lot of money into Bangladesh and has supported Sheikh Hasina's government to the hilt to keep her in power and also to keep the Chinese out. But the Chinese are in and digging in.

Writing in Money Control in October 2023, Pratim Ranjan Bose said that Prime Minister Narendra Modi took Indian commitments to an“astronomical high”.

Between 2015 and 2017, India offered an additional US$ 7 billion in soft credit and grants ($500 million) for nearly 30 projects in energy, infrastructure, health, education etc.

An additional US$ 1.6 billion ultra-soft finance was given to 2X 660 MW Bangladesh-India Friendship Power Company (BIFPC) at Rampal and; a US$ 2 billion 2X 800 MW was given to the Adani Power facility in Jharkhand for dedicated supply to Bangladesh. Both the projects were completed.

Dhaka responded positively till 2017. But things changed. He quoted the Dhaka daily Prothom Alo to say:“Bangladesh lost interest in Indian projects”. Dhaka scrapped 12 projects worth over US$ 2 billion in the last five years. Barely one-fourth of the Indian line of credit was utilised, he adds.

Bose blames the easy money from China for the stalling of Indian projects. Bangladeshis complain about India's insistence on sourcing from India up to 75%. But the Chinese insist on 95% sourcing from China. Chinese loans come at higher interest and above all, there is no transparency.

The incentive to accept Chinese funding are easy disbursements, inflation of pricing and lack of transparency, Bose says. Bangladeshi officials make a pile in the process.

“According to the World Bank (which had once pulled out of the Padma bridge project citing irregularities) the per unit cost of infrastructure building in Bangladesh is the world's highest. From metro rail and bridges to expressways – the per km cost is often four to five times of India,” Bose points out.

Additionally, Bangladesh tried to put off India by shutting down the Rampal power plant five times between December 2022 and July 2023, citing lack of fuel. Thus, repayments due for the 'below market rate' loan suffered.

The India-financed Ashuganj (Bangladesh) river terminal and the 50 km road to Agartala in Tripura was not a reality in October

2023. At the Sabroom border in Tripura, India planned a rail and road connectivity to Chattogram port in Bangladesh. But not a brick had been laid on the Bangladesh side till Bose wrote the article.

India completed a road bridge (over river Feni) to connect Sabroom with Ramgarh in Bangladesh two years ago. But the connecting highway on the Bangladeshi side was not built.

Is India losing out to China, despite standing four square behind Sheikh Hasina in times of dire need?

END

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment