403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

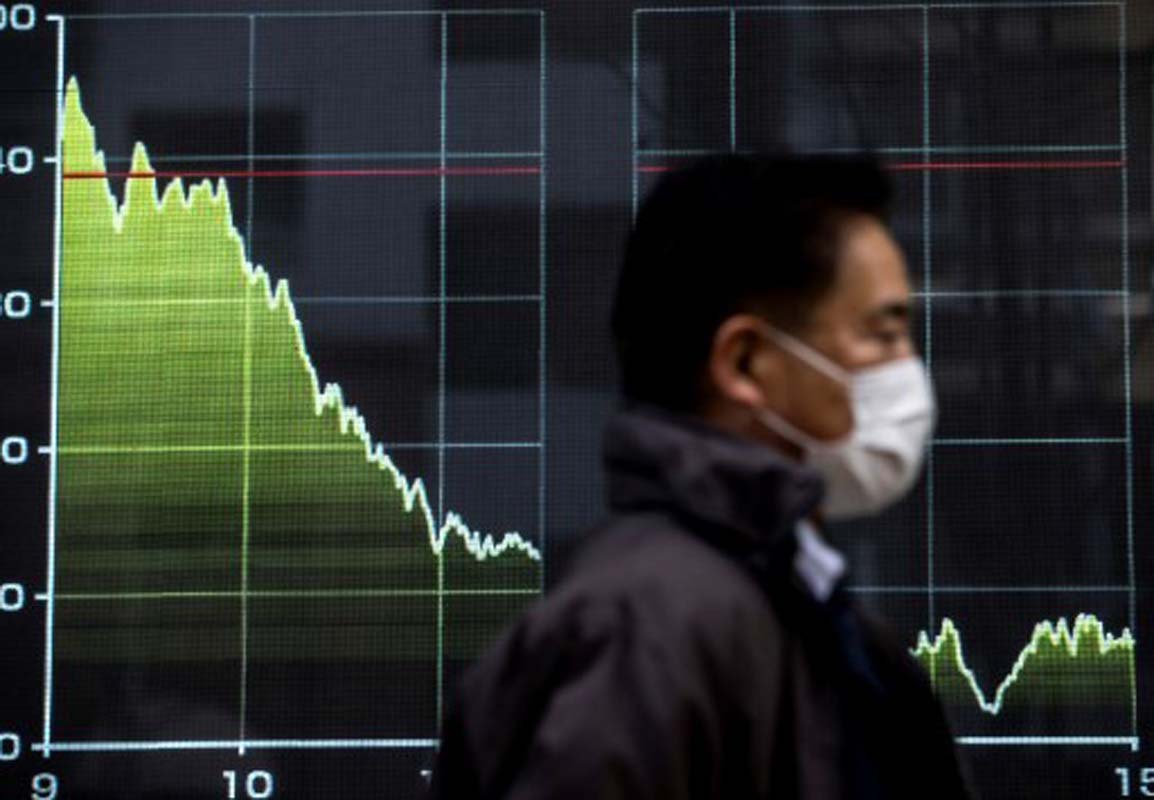

Nikkei hits record high amid robust U.S. stocks performance, technology sector gains

(MENAFN) Japan's Nikkei index soared to an all-time high at the close of Thursday's session, surpassing the 42,000-point milestone for the first time. This surge was fueled by the positive performance of US stocks overnight, which bolstered investor sentiment. The Nikkei ended the day up 0.94 percent, closing at 42,224.02, marking its third consecutive record close for the week. Earlier in the session, the benchmark index peaked at 42,426.77. Since the beginning of the year, the Nikkei has climbed an impressive 25 percent.

The broader Topix index also experienced a notable rise, closing the session up 0.69 percent at a record level of 2,929.17 points. The strong performance of Wall Street's three main indexes on Wednesday, ahead of anticipated inflation data and quarterly corporate earnings reports, contributed to the upward momentum of most Japanese stocks. Out of the 225 companies listed on the Nikkei index, 180 saw their stock prices advance. Fast Retailing, the owner of the clothing brand Uniqlo, rose 2.3 percent, providing the biggest boost to the index.

Semiconductor-related stocks mirrored the gains of their US counterparts, following robust quarterly earnings from Taiwan Semiconductor Manufacturing Co., the world's leading chipmaker. As a result, Tokyo Electron increased by 0.6 percent, Disco Corp surged by 3.4 percent, and Sumco soared by 5.9 percent, becoming the top percentage gainer on the Nikkei index. SoftBank Group, known for its investments in artificial intelligence, rose 0.8 percent. Additionally, other technology stocks, including Sony and Fanuc, saw significant gains of 3.6 percent and 1.4 percent, respectively.

Japanese stocks have reached unprecedented highs over the past two weeks, a trend that analysts attribute to the continued decline in the value of the yen. This depreciation of the yen has further enhanced the attractiveness of Japanese equities to investors.

The broader Topix index also experienced a notable rise, closing the session up 0.69 percent at a record level of 2,929.17 points. The strong performance of Wall Street's three main indexes on Wednesday, ahead of anticipated inflation data and quarterly corporate earnings reports, contributed to the upward momentum of most Japanese stocks. Out of the 225 companies listed on the Nikkei index, 180 saw their stock prices advance. Fast Retailing, the owner of the clothing brand Uniqlo, rose 2.3 percent, providing the biggest boost to the index.

Semiconductor-related stocks mirrored the gains of their US counterparts, following robust quarterly earnings from Taiwan Semiconductor Manufacturing Co., the world's leading chipmaker. As a result, Tokyo Electron increased by 0.6 percent, Disco Corp surged by 3.4 percent, and Sumco soared by 5.9 percent, becoming the top percentage gainer on the Nikkei index. SoftBank Group, known for its investments in artificial intelligence, rose 0.8 percent. Additionally, other technology stocks, including Sony and Fanuc, saw significant gains of 3.6 percent and 1.4 percent, respectively.

Japanese stocks have reached unprecedented highs over the past two weeks, a trend that analysts attribute to the continued decline in the value of the yen. This depreciation of the yen has further enhanced the attractiveness of Japanese equities to investors.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment