What Is A Loan Against Property And How Does It Work?

This loan is ideal for individuals who want emergency funds but lack the assets to put as a security. It also helps people seeking financial stability and want to consolidate their debts into a single loan.

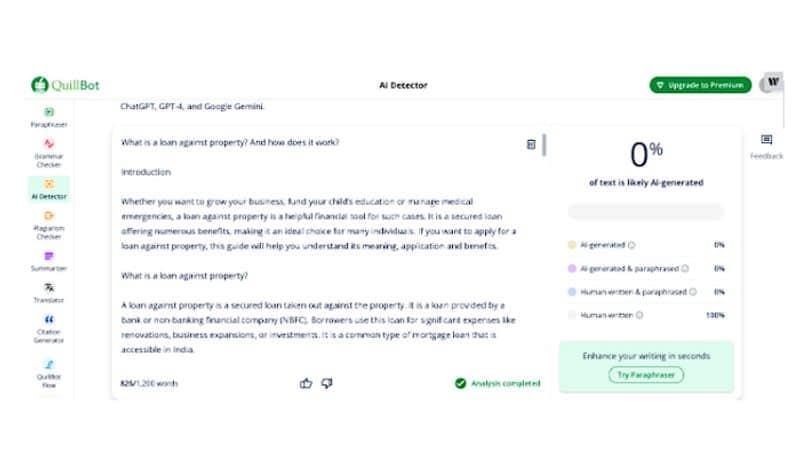

If you want to apply for a loan against property, this post will help you understand its purpose, application and benefits.

These are the following purposes of a loan against property:

- Business Expansion

Business owners use loans against property to increase their working capital,

allowing them to manage day-to-day operations more efficiently. They can use the funds to expand the business, open new branches or purchase new equipment.

- Education

Parents or students may take a loan against property to fund higher education expenses, including tuition fees, accommodation, and other related costs.

- Medical Emergencies

Loans against property can provide quick access to funds for medical emergencies, surgeries, or long-term treatments not covered under insurance.

- Home Renovation

Homeowners can use the loan to finance significant home improvements, renovations, or repairs to increase the property's value and living standards.

- Marriage Expense

These funds can cover the expenses of weddings and related ceremonies, which can be substantial in some cultures.

- Dream Vacation

Loans against property can also be utilised to finance vacations and travel expenses, allowing individuals and families to enjoy memorable trips without worrying about immediate financial constraints.

Eligibility Criteria for a Loan Against PropertyThese are the eligibility criteria for a loan against property:

- Age: 21-65 years

Employment type: Salaried or Self-employed Credit score: A minimum credit score of 700 and above is required.

Citizenship: Must be an Indian resident. Income stability: Applicant must provide proof of stable income.

Debt-to-income ratio: Applicants must maintain their debt-to-income ratio to secure a loan.

Loan Against Property (LAP) processes for major lending institutions follow a straightforward documentation procedure.

Required documents for salaried or self-employed individuals:

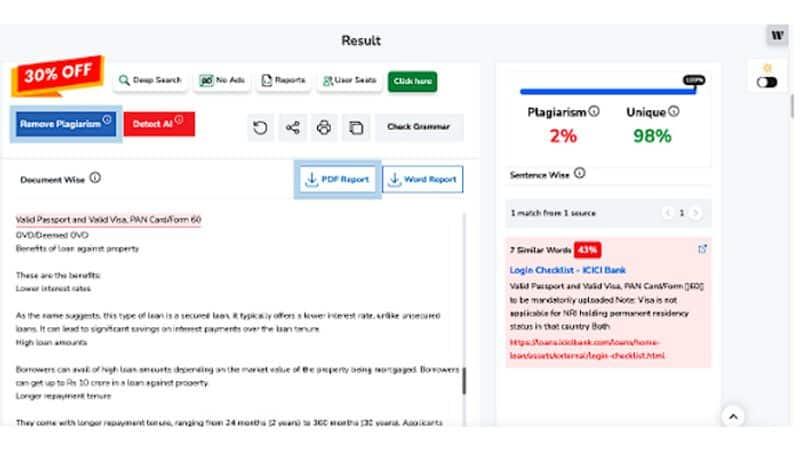

- Identification documents like Aadhaar Card, PAN Card, Passport, Voter ID, etc.

Proof of income including Salary Slips (for salaried individuals), Bank Account Statements, and Income Tax Returns. Property-related documents such as Title Deeds, a chain of documents of previous owners (if any), property approval plan, and non-encumbrance certificate.

Appointment letter, especially if associated with a company for less than a year. Bank Statements of the last 6 months to assess Loan repayment capability, if there's any ongoing Loan with the Bank.

Passport-size photographs of the applicant and co-applicant must be affixed to the application form. Business profile documents for self-employed non-professionals.

Leading banks in India offer loans against property to their new and existing users. The process is slightly different and is as follows:

Existing users- Verify your account to start the loan process.

Check offers on the bank's website and select what suits best with your needs. Make payment to proceed ahead.

Get the sanction letter and use the funds.

- Enter your basic information to start the loan process.

Check various offers offered by the bank Make the payment to process further

Get provisional approval from the bank Upload the required documents

These are the following benefits of the loans against property:

- Lower Interest Rates

As the name suggests, this type of loan is a secured loan. It offers a lower interest rate, unlike unsecured loans. It can lead to significant savings on interest payments over the loan tenure.

- High Loan Amounts

Borrowers can avail of high loan amounts depending on the market value of the mortgaged property. Borrowers can avail loan amounts up to Rs. 10 crore in a loan against property.

- Longer Repayment Tenure

They come with longer repayment tenure, and institutions like ICICI Bank offer up to 15 years. Applicants have a reduced monthly EMI burden, making it easier for them to manage their finances.

- Flexible Usage

Borrowers can use the funds for various purposes, including business expansion, education, marriage expenses, debt consolidation, and more.

- Easy Accessibility

Loans against property are easily accessible as it's a secured loan, making banks willing to offer credit. By mortgaging your property with a reputable bank, you can obtain funds for various business or personal requirements.

- Tax Benefits

When borrowers use the loan amount for business purposes, the interest paid on the loan may be eligible for tax deductions as a business expense.

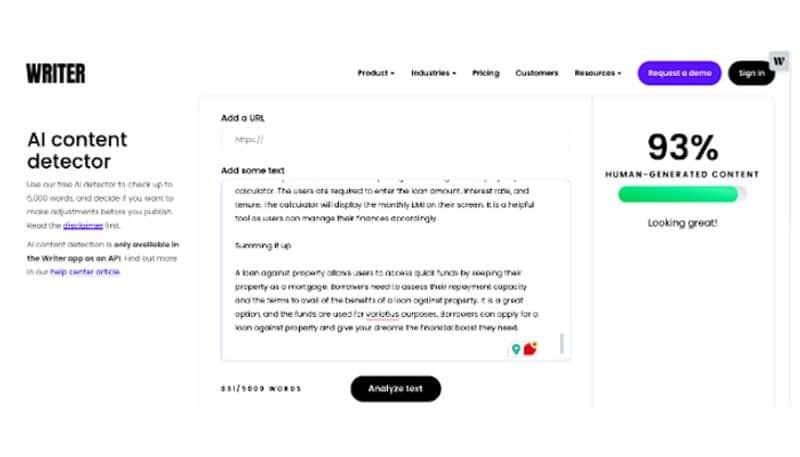

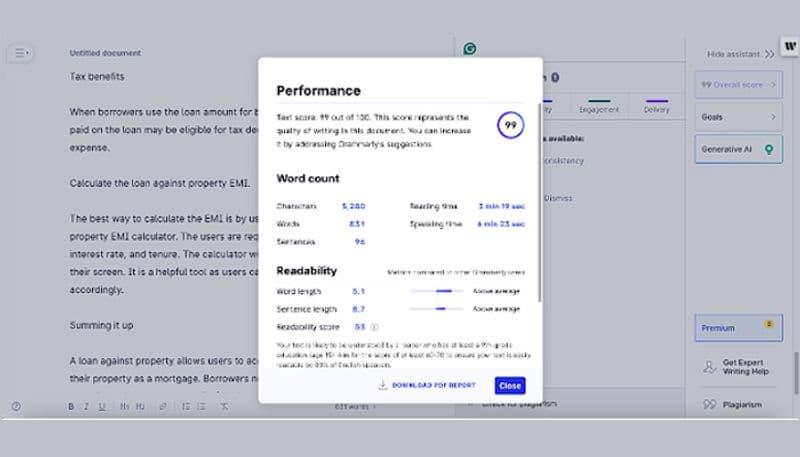

The best way to calculate the EMI is by using the loan against property EMI calculator . The users are required to enter the loan amount, interest rate, and tenure. The calculator will display the monthly EMI on their screen. It is a helpful tool as users can manage their finances accordingly.

A loan against property allows users to access quick funds by keeping their property as a mortgage. Borrowers need to assess their repayment capacity and the terms to avail of the benefits of a loan against property. It is a great option, and the funds can be used for various purposes. Borrowers can apply for a loan against property and give their dreams the financial assistance they need.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment