403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

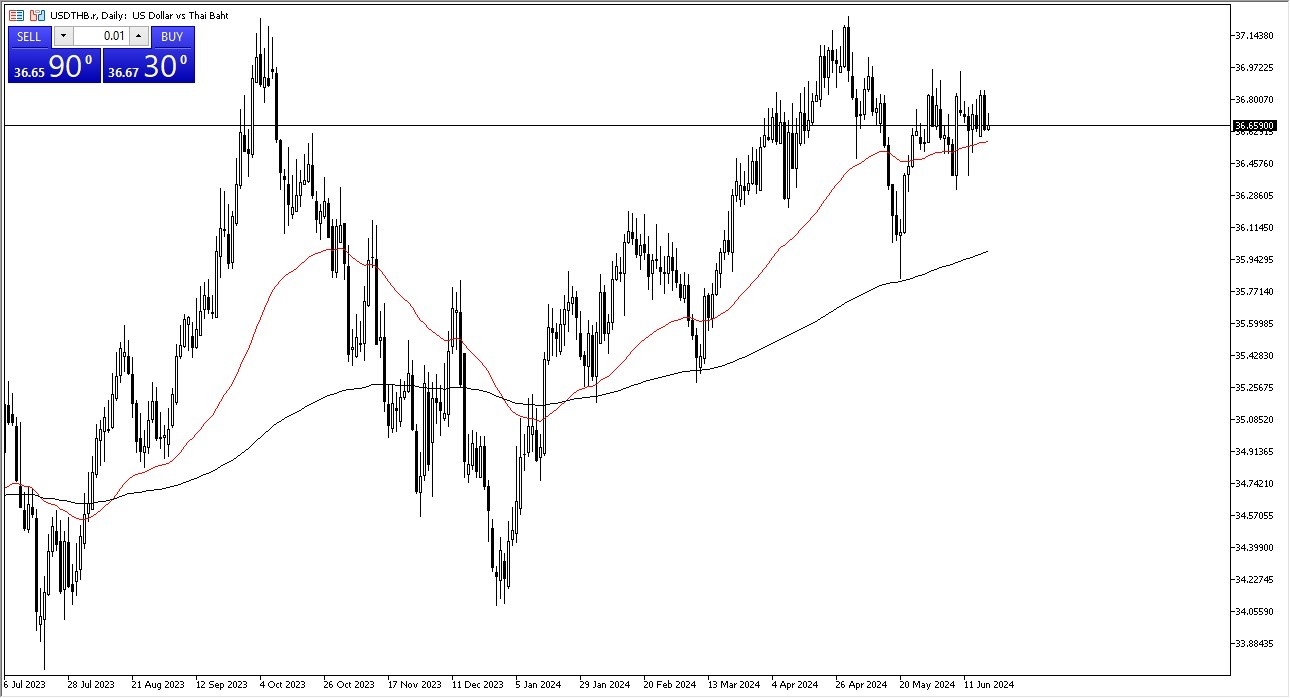

USD/THB Forecast Today - 20/06: USD Grinds Vs THB (Chart)

(MENAFN- Daily Forex)

- The US dollar has gone sideways against the Thai baht over the last several trading weeks, as we continue to hang around the 36.65 region. This is a market that obviously is going to be considered to be exotic, but it also gives us a bit of a“heads up” into what traders may think about developing Asian economies. After all, Thailand has been taking quite a bit of production away from China for a while, and of course Thailand is an area where a lot of Westerners are okay with investing in manufacturing, etc.

- 1 Get Started 74% of retail CFD accounts lose money

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment