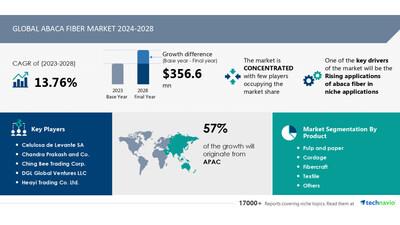

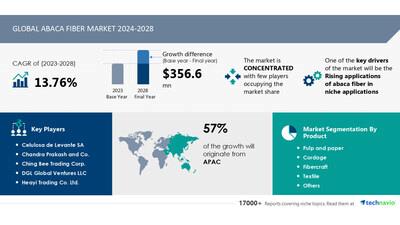

Abaca Fiber Market Size Is Set To Grow By USD 356.6 Million From 2024-2028, Rising Applications Of Abaca Fiber In Niche Applications Boost The Market, Technavio

| Abaca Fiber Market Scope |

|

| Report Coverage |

Details |

| Base year |

2023 |

| Historic period |

2018 - 2022 |

| Forecast period |

2024-2028 |

| Growth momentum & CAGR |

Accelerate at a CAGR of 13.76% |

| Market growth 2024-2028 |

USD 356.6 million |

| Market structure |

Concentrated |

| YoY growth 2022-2023 (%) |

12.6 |

| Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

| Performing market contribution |

APAC at 57% |

| Key countries |

US, The Philippines, Japan, China, and UK |

| Key companies profiled |

Celulosa de Levante SA, Chandra Prakash and Co., Ching Bee Trading Corp., DGL Global Ventures LLC, Heayi Trading Co. Ltd., PALTEX COMPANY LTD, SAMATOA, Simor Abaca Products, Specialty Pulp |

Market Driver

The abaca fiber market is experiencing significant growth due to advancements in processing techniques, leading to improved fiber quality and consistency. Sustainable cultivation practices and fair-trade initiatives are also gaining importance to promote ethical sourcing and support local communities. Notable developments include PhilFIDA's partnership with MANGYAN MANACO for livelihood and technical training, and Glatfelter and Ekman's collaboration to distribute superior abaca pulp worldwide. These collaborations will increase the demand for abaca fibers, benefiting various industries due to its durability and high performance.

The Abaca fiber market has seen significant demand in recent years due to its unique properties. Key players in the market include manufacturers and suppliers of this natural fiber. Abaca fibers are used in various industries such as textiles, paper, and automotive. The trend towards sustainable and eco-friendly materials has boosted the market.

Clothing and accessory brands are incorporating Abaca fibers into their product lines. Additionally, the paper industry uses Abaca fibers for their strength and durability. The cost-effective production process and increasing availability of Abaca fibers are also contributing factors to the market's growth. The future looks bright for the Abaca fiber market with continued innovation and demand.

Research report provides comprehensive data on impact of trend. For more details-

Download a Sample Report

Market

Challenges

-

Abaca fibers, primarily produced in the Philippines, are essential for ropes, papers, textiles, and various industries. However, extreme weather events and climate change pose significant challenges. Typhoons, hurricanes, and droughts damage crops and hinder new plantings, reducing yields and causing supply shortages. Rising temperatures and altered precipitation patterns create unfavorable growing conditions, affecting fiber quality.

The Philippines, identified as one of the most climate-risk countries, faces frequent El Nino events, which threaten crop output. Adaptive measures, such as breeding resilient abaca varieties and investing in climate-resilient infrastructure, are crucial to mitigate these challenges and ensure market growth.

The Abaca fiber market faces several challenges in the industry. Labor intensive production processes and high costs are major hurdles. Harvesting, processing, and production require skilled labor, making it a significant expense. Procurement of raw materials is also a challenge due to the climate-sensitive nature of the Abaca plant. Clothings and accessories made from Abaca fiber are in demand, especially in tropical regions.

However, the high production costs limit its widespread use. Cost reduction through automation and efficient production methods is essential to increase competitiveness in the market. Additionally, sustainability and eco-friendliness are becoming crucial factors for consumers, making it necessary for producers to adopt sustainable farming practices and ethical labor conditions.

For more insights on driver and challenges

-

Request a

sample report!

Segment Overview

-

1.1 Pulp and paper

1.2 Cordage

1.3 Fibercraft

1.4 Textile

1.5 Others

-

2.1 Raw

2.2 Refined or Blended

-

3.1 APAC

3.2 Europe

3.3 North America

3.4 South America

3.5 Middle East and Africa

1.1

Pulp and paper- Abaca fiber, also known as Manila hemp, is a strong natural fiber widely used in the pulp and paper industry. Its long staple length, strength, and high cellulose content make it ideal for producing specialized papers like tea and coffee bags, sausage casing paper, and currency paper. Abaca fiber boasts three times the strength of sisal fiber and is more resistant to saltwater degradation than other vegetable fibers. In both wet and dry states, it has stronger tensile strength and lower elongation than synthetic fibers like rayon and nylon. These properties increase demand for abaca fiber in the pulp and paper segment, fueling the growth of the global abaca fiber market.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) - Download a Sample Report

Research Analysis

The Abaca Fiber Market encompasses various natural fibers, including Manila hemp and Sisal fibers, which are vegetable fibers derived from the Musa textilis plant. Abaca fiber, a key component, is renowned for its eco-friendly properties and is often used in interior designing practices due to its sustainability and versatility. Abaca cultivation requires extensive land and resources, making it a labor-intensive process.

Harvesting and processing demand skilled labor, leading to higher production costs. Abaca fiber exhibits remarkable tensile strength and resistance to saltwater, making it ideal for heavy loads and applications in fishing nets and ship rigging. The fiber craft industry utilizes these fibers for creating handicrafts, further emphasizing their value as renewable resources.

Market Research Overview

The Abaca Fiber Market encompasses the global trade of abaca fiber and its derived products. Abaca, also known as Manila hemp, is a type of banana plant that yields strong and versatile fibers. These fibers are utilized in various industries, including textiles, paper, and rope production. The market for abaca fiber is significant due to its unique properties, such as high tensile strength and resistance to water. Abaca fibers are sourced primarily from countries like the Philippines, Ecuador, and Indonesia.

The demand for abaca fiber is driven by its applications in industries like automotive, construction, and marine. The market is expected to grow due to increasing awareness of sustainable and eco-friendly alternatives to synthetic fibers. The production process involves harvesting the abaca plant, decorticating the fibers, and then processing them for specific applications. The market for abaca fiber is subject to various factors, including supply and demand dynamics, government regulations, and market trends.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

-

Product

-

Pulp And Paper

Cordage

Fibercraft

Textile

Others

-

Raw

Refined Or Blended

-

APAC

Europe

North America

South America

Middle East And Africa

7

Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:

[email protected]

Website:

SOURCE Technavio

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment