403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

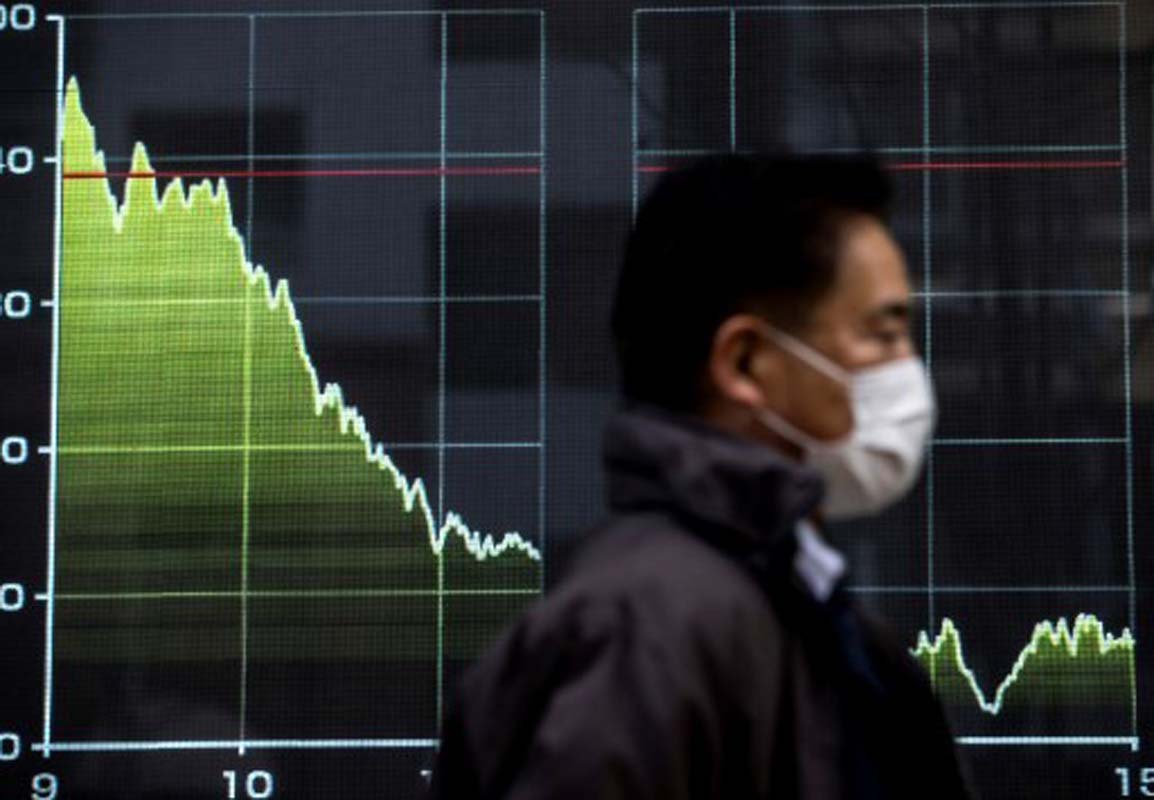

Dow Jones, Nasdaq end winning streak amid investor concerns over inflation, interest rates

(MENAFN) The Dow Jones and Nasdaq Composite indices experienced weekly losses on Friday, bringing an end to their multi-week winning streaks as investors carefully assessed the latest inflation report and speculated on the Federal Reserve's timeline for potential interest rate cuts. During Friday's trading session, the Standard & Poor's 500 index saw a rise of 0.80 percent, closing at 5,277.51 points. Meanwhile, the Nasdaq Composite index marginally decreased by 0.01 percent, finishing at 16,735.02 points, and the Dow Jones Industrial Average climbed by 1.51 percent, ending the day at 38,686.32 points.

Despite these mixed results, the indices displayed varied performance on a weekly basis. The Standard & Poor's 500 index posted a slight weekly gain of 0.18 percent. In contrast, the Nasdaq Composite Index recorded a negligible weekly loss of 0.01 percent, and the Dow Jones Industrial Average fell by 0.97 percent. This shift in market dynamics followed the release of data showing that the core personal consumption expenditures (PCE) price index in the United States had slowed to 0.2 percent on a monthly basis in April, aligning with expectations. This deceleration in the PCE price index offered a glimmer of hope to investors regarding the possibility of interest rate reductions within the year, influencing their market strategies and outlooks.

Despite these mixed results, the indices displayed varied performance on a weekly basis. The Standard & Poor's 500 index posted a slight weekly gain of 0.18 percent. In contrast, the Nasdaq Composite Index recorded a negligible weekly loss of 0.01 percent, and the Dow Jones Industrial Average fell by 0.97 percent. This shift in market dynamics followed the release of data showing that the core personal consumption expenditures (PCE) price index in the United States had slowed to 0.2 percent on a monthly basis in April, aligning with expectations. This deceleration in the PCE price index offered a glimmer of hope to investors regarding the possibility of interest rate reductions within the year, influencing their market strategies and outlooks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment