Yen's Plunge Raises Specter Of New Asia Currency Crisis

12% plunge this year has traders wondering if the Group of Seven might have a currency crisis within their ranks.

The good news: not yet. The bad news, though, is that there are still seven months left in this year of dangerous living for Japan's currency. Especially when you consider the lack of urgency from Tokyo officials to put a floor under the yen.

This is unnerving Asia and injected a 1997-like vibe into the region's markets as central banks scramble to stabilize exchange rates. From the Malaysian ringgit falling to 26-year lows to Indonesia's central bank announcing a surprise rate hike last week, the battle with currency speculators is heating up.

In Manila and Bangkok, central banks are shelving rate-cuts plans. In Seoul, Governor Rhee Chang-yong says the Bank of Korea is ready to“deploy stabilizing measures” amid“excessive” won moves. In Beijing, officials are mulling their options as deflationary forces complicate China's outlook.

China, of course, is the biggest concern. Will President Xi Jinping's economy join the yen in a race to the bottom, ensuring a new currency war?

“They probably should - to boost exports, help deflation and help domestic growth,”

says Brad Bechtel, global head of foreign exchange at Jefferies Financial Group Inc.“But I don't think they will.”

Khoon Goh, head of Asia research at ANZ Bank, says“we see the possibility for further near-term weakness towards the key 7.30 level, as the authorities have been gradually allowing the onshore spot to adjust.”

The Chinese yuan is currently trading at 7.24 to the US dollar . Yet 2015-like devaluation seems out of the question as it would squander hard-earned progress in increasing global trust in the yuan. And the more the yuan falls, the harder it becomes for giant property developers to make offshore bond payments, increasing default risks.

The last thing Beijing wants, meanwhile, is making the yuan a top election flashpoint as Republicans loyal to Donald Trump and US President Joe Biden's Democrats come to blows on various fronts ahead of the November 5 election.

Will China's yuan follow the yen? Photo: Asia Times Files / Reuters / Jason Lee

Yet the longer Tokyo keeps Asia in suspense, the greater the risk of a regional meltdown ala the 1997-98 Asian financial crisis. Currency traders, for example, are convinced Japan is actively intervening to halt the yen's fall. In reality, though, officials are mostly winking at world markets.

The going-through-the-motions vibe is on clear display. Sure, it seems pretty clear the Bank of Japan acted to prop up the yen on Monday. The sudden $48.2 billion drop in its current account suggests the BOJ did indeed make its first foray into foreign exchange markets since October 2022.

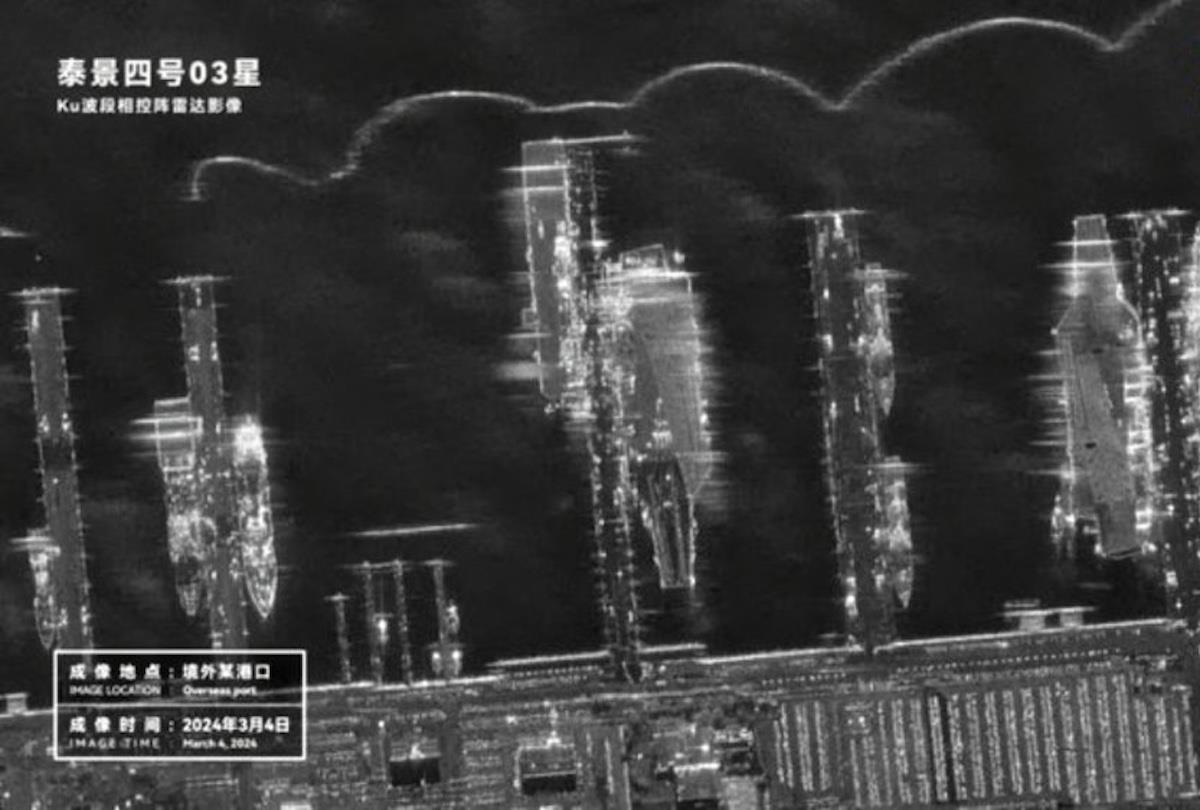

China's AI-powered satellites imperil US aircraft carriers

Feigned reluctance: New Zealand mulled joining AUKUS from the start

Japan's diplomatic blitz aims to keep US close and committed

But if this were a move to boost the yen for real, Finance Minister Shunichi Suzuki would be at the microphone early and often making the case. He would be working the phones with officials in Washington, Berlin, London, Ottawa, Paris and Rome to get the G7 on board.

From the events of late 2022, when Tokyo last acted on the yen, Suzuki's team knows full well that unilateral intervention doesn't work. It jolts the market for a few days, but then the yen's drop resumes anyway.

In some ways, this is the cost of 25 years of making an undervalued exchange rate not just your economic model but your global brand.

Since at least the late 1990s, a succession of Japanese finance ministers have come and gone. What's stayed is an Argentina-like beggar-thy-neighbor policy that's left a G7 nation addicted to an ultra-weak exchange rate.

Signs that Tokyo is intervening change little. It's more of an exercise in geopolitical virtue signaling than a line in the sand for the yen-dollar exchange rate.

Suzuki and his boss Prime Minister Fumio Kishida are merely communicating to China and the US that the yen isn't heading to 170 to the dollar - or beyond.

Yet the yen may be heading there anyway in the days and weeks ahead. Not because Suzuki or Kishida don't want it to but because, well, they kind of do.

Amid all the headlines about the yen hitting 160, the weakest since 1990, Tokyo officials are noticing the benefits. In March, overseas shipments jumped for a fourth consecutive month. The 7.3% gain in March year-on-year followed a 7.8% rise in February.

It's arguably the best thing Asia's second-biggest economy has going for it as of the second quarter of an increasingly chaotic 2024.

“The outlook for Japan looks fragile,” notes Stefan Angrick, senior economist at Moody's Analytics.

The domestic economy , Angrick adds,“has been very weak as wage gains have trailed inflation, which has kept households reluctant to spend. This, in turn, has kept businesses hesitant to invest. Japan's economy is unlikely to have grown much in the first quarter of the year, continuing a streak of disappointing gross domestic product releases.”

This greatly complicates the BOJ's way forward. All that Governor Kazuo Ueda's team thought it knew about 2024 is going awry. China's economy isn't bouncing back with great force, the Federal Reserve isn't cutting interest rates and the dollar's powerful rally isn't losing momentum.

Bank of Japan Governor Kazuo Ueda has sat by idly as the yen free falls. Image: Twitter / Screengrab

Nor is Japan's economy leaving recession fears in the rearview mirror. At the same time, inflation in the Tokyo area, a good proxy for national trends, is now rising at a

1.6% year-on-year

rate, below the BOJ's 2% target.

So, Ueda's BOJ may have missed its window for a significant rate hike or two – and currency traders know it. That's why the yen is slowly but surely gravitating back to levels it was at before officials were believed to have intervened.

That's not to say strategists aren't baffled by the yen. Gavekal Dragonomics calls the yen“the biggest anomaly in global financial markets,” estimating its value to be about 40% below purchasing-power-parity measures.

As such, Gavekal writes,“the yen's weakness is having wide-ranging global repercussions, from fueling a carry trade that boosts emerging market debt, to weighing on US exports and thus President Biden's re-election prospects. With the BOJ not yet finding the weak currency reason enough to shift its monetary policy stance, markets are on the alert for the possibility of direct foreign-exchange interventions to bolster the yen.”

Or not. As Asia's second-biggest economy loses momentum, inflation recedes and Kishida's approval numbers flatline, is the BOJ really about to slam on the monetary brakes?

Again, the lack of urgency among Tokyo policymakers speaks louder than intervention threats. As Richard Katz, author of“The Contest for Japan's Economic Future”, notes, Japan“has plenty of ammunition” to stop the yen from falling too far.

“Even though it now runs a trade deficit most years, Japan still runs a

surplus

in a broader measure, the international current account,” Katz explains.“That's because it earns so much from its investments abroad, and those earnings keep growing.”

In 2023, net income on these investments

totaled 34 trillion yen (US$215 billion), amounting to 6% of nominal GDP.

The most important thing, Katz says, is not to panic over a yen in freefall.“If it looked like capital flight was beginning,” he explains,“Japan could use its currency reserves to shore up the yen. But it's very unlikely it would need to do so.”

Katz notes that the countries that have fallen victim to currency runs – as in Asia's 1997-98 crash or the European debt crisis of 2010 – were in the opposite position from Japan.“They,” he adds,“had run year after year of current account

deficits

and, as a result, were big international

debtors.”

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

For now, though, the“yen is weak because Japan's economy is weak and its exporters are increasingly uncompetitive,” Katz says.“So, intervention can mainly delay the inevitable for a little while or prevent markets from overreaching too far.”

This weakness is bigfooting all else. The economy's underperformance is a key reason why Kishida's approval ratings are in the low-to-mid-20s. This dynamic will weigh on the BOJ's deliberations in the weeks ahead.

Though the BOJ is technically independent, its autonomy in practice is more limited than that enjoyed by the US Fed or European Central Bank.

For example, a government representative attends BOJ policy meetings. And what truly sovereign monetary entity leaves rates fixed at or near zero for 25 years?

For Ueda, the lessons from 2006 probably loom large in his own deliberations. Back in 2006 and 2007, then-governor Toshihiko Fukui managed to end quantitative easing and lobby fellow board members to raise official rates twice.

Yet Fukui's attempt to normalize rates failed. The Tokyo establishment pushed back hard, complaining Japan Inc wasn't ready for tighter credit. Soon after, the economy slid into recession. Once Masaaki Shirakawa replaced Fukui in 2008, he quickly cut rates back to zero and restored QE.

Bank of Japan doesn't want to shortcircuit the Nikkei 225's rally. Image: Twitter

Then came Haruhiko Kuroda in 2013 to ramp up BOJ stimulus efforts even further to defeat deflation once and for all. In 2013 alone, the Nikkei 225 Stock Average

surged 57% . Today, it's rallying to the point where the benchmark is now trading near its all-time 1989 high.

Ueda's balancing act is finding a way to normalize rates without ending the Nikkei's bull run. And without being the latest BOJ leader to be blamed for plunging stocks, creating a recession or both.

All of which explains why Tokyo is in less of a hurry to break the yen's fall. And why Asia has little choice but to hope Japanese officials know what they're doing as the yen edges lower and lower.

Follow William Pesek on X at @WilliamPesek

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment