403

Sorry!!

Error! We're sorry, but the page you were

looking for doesn't exist.

Commodities under pressure with dollar strength extending – Saxo Bank MENA Market Report

(MENAFN- Matrix PR) Charu Chanana and Redmond Wong, Market Strategists, Saxo bank

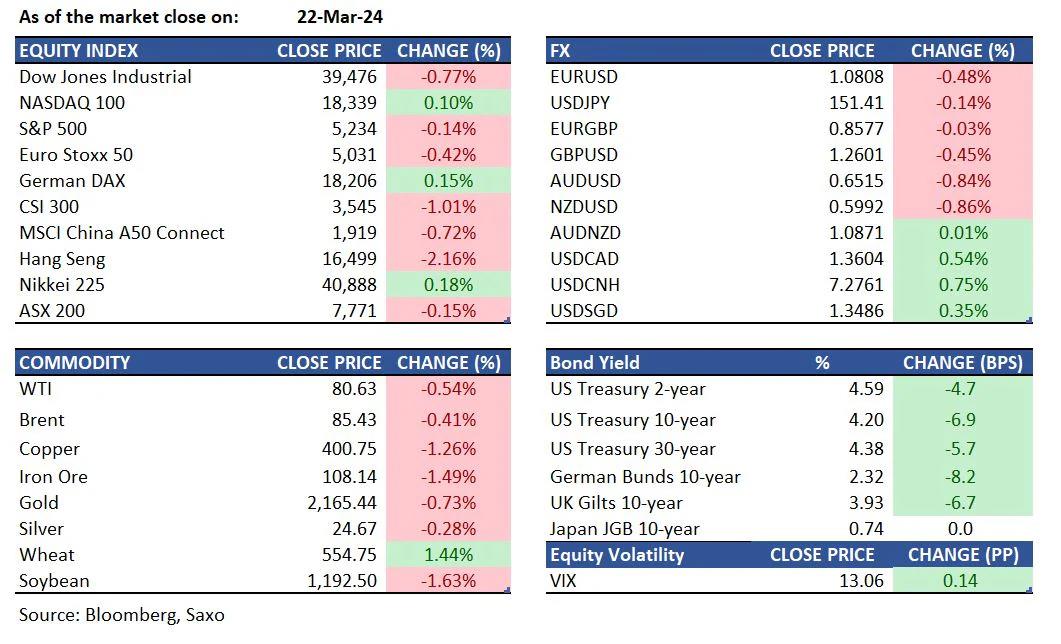

Commodities: commodities came under pressure with dollar strength extending, and China's optimism also came back under the radar. Copper was down nearly 3% for the week, although Iron ore’s Friday decline could not reverse the weekly gains completely. China’s property earnings this week will be the focus for industrial metals to extend gains. Gold also reversed from the all-time high of $2,220 to test the $2,160 support, with Fed’s Bostic moving his expectations to expect only one rate cut this year. Crude oil prices were largely unchanged last week as signs of tightness in the global crude market offset the impact of a stronger USD, but the focus remains on sanction and geopolitical risks.

Equities: Last week, the FOMC took a relatively dovish stance, maintaining the projection of three rate cuts in 2024, and Chair Powell downplayed the recent uptick in inflation data, hinting at a potential slowdown in the balance-sheet run-off. These developments were bullish for US equities, leading to a rally in the S&P500 on Wednesday. However, the momentum somewhat stalled on Thursday and Friday, with the S&P 500 modestly pulling back by 0.1% on Friday. This decline was driven by Nike's 6.9% fall and Lululemon's 15% decline, as both retailers released a downbeat outlook. In contrast, the Nasdaq 100 added 0.1%, buoyed by Nvidia's 3.1% gain and Alphabet's 2.2% increase.

In Japan, the Nikkei 225 reached another record high, closing at 40,888, after the Bank of Japan delivered expected policy shifts during the week, removing one of the key uncertainties. Investors turned their focus towards regaining corporate pricing power amid the return of inflation, corporate governance reform, and reshoring, particularly in the technology sector from China, which may benefit Japan. The Nikkei 225 index gained 0.2% on Friday and 3.7% weekly.

In China and Hong Kong, the Hang Seng Index and CSI300 dropped by 2.2% and 1.0% due to earnings downgrades and the renminbi's weakness. Li Auto's stock plunged by 10.9% on Friday and 18.3% for the week after lowering its delivery forecast. Bilibili fell by 9.4% amid Alibaba's decreased holdings. After the Hong Kong market closed on Friday, Meituan reported Q4 earnings that beat expectations, with revenue in line. Its ADS closed in New York at 4.2% higher than the closing level in Hong Kong. Investors turned cautious ahead of upcoming earnings reports from BYD, China Telecom Anta Sports on Tuesday and major state-owned banks during the week.

The renminbi's sharp depreciation added to weakness in Chinese and Hong Kong equities, with USDCNH rising by 0.8% to 7.2761. Investors expect China's tolerance for a weaker renminbi amid a slow economic recovery, potentially testing September's high of 7.3682. The possibility of a "Trump presidency 2.0" boosted medium-term prospects for USDCNH. For further discussion on the implications of the US election on Chinese equities and USDCNH

FX: The dollar strength extended further on Friday, with the DXY index back above 104.30 to its highest level in over a month. The Chinese yuan saw notable weakness, and USDCNH rose sharply above 7.27 to its highest level since November, with PBoC setting a weak fix and signalling that authorities are willing to tolerate some yuan depreciation. AUDUSD dropped 40pips as well, slipping from 0.6570 and now trades below 0.6520. EURUSD also testing the 1.08 handle with the SNB surprise rate cut, prompting wagers to increase bets for ECB, easing for June. EURCHF eased from highs of 0.9788 to settle around the 0.967 handle, although USDCHF settled just below the 0.90 handle. GBPUSD back below 1.2650 after BoE governor Bailey said rate cuts are in play at future BoE meetings amid signs that tighter policy quelled the risk of a wage-price spiral.

Commodities: commodities came under pressure with dollar strength extending, and China's optimism also came back under the radar. Copper was down nearly 3% for the week, although Iron ore’s Friday decline could not reverse the weekly gains completely. China’s property earnings this week will be the focus for industrial metals to extend gains. Gold also reversed from the all-time high of $2,220 to test the $2,160 support, with Fed’s Bostic moving his expectations to expect only one rate cut this year. Crude oil prices were largely unchanged last week as signs of tightness in the global crude market offset the impact of a stronger USD, but the focus remains on sanction and geopolitical risks.

Equities: Last week, the FOMC took a relatively dovish stance, maintaining the projection of three rate cuts in 2024, and Chair Powell downplayed the recent uptick in inflation data, hinting at a potential slowdown in the balance-sheet run-off. These developments were bullish for US equities, leading to a rally in the S&P500 on Wednesday. However, the momentum somewhat stalled on Thursday and Friday, with the S&P 500 modestly pulling back by 0.1% on Friday. This decline was driven by Nike's 6.9% fall and Lululemon's 15% decline, as both retailers released a downbeat outlook. In contrast, the Nasdaq 100 added 0.1%, buoyed by Nvidia's 3.1% gain and Alphabet's 2.2% increase.

In Japan, the Nikkei 225 reached another record high, closing at 40,888, after the Bank of Japan delivered expected policy shifts during the week, removing one of the key uncertainties. Investors turned their focus towards regaining corporate pricing power amid the return of inflation, corporate governance reform, and reshoring, particularly in the technology sector from China, which may benefit Japan. The Nikkei 225 index gained 0.2% on Friday and 3.7% weekly.

In China and Hong Kong, the Hang Seng Index and CSI300 dropped by 2.2% and 1.0% due to earnings downgrades and the renminbi's weakness. Li Auto's stock plunged by 10.9% on Friday and 18.3% for the week after lowering its delivery forecast. Bilibili fell by 9.4% amid Alibaba's decreased holdings. After the Hong Kong market closed on Friday, Meituan reported Q4 earnings that beat expectations, with revenue in line. Its ADS closed in New York at 4.2% higher than the closing level in Hong Kong. Investors turned cautious ahead of upcoming earnings reports from BYD, China Telecom Anta Sports on Tuesday and major state-owned banks during the week.

The renminbi's sharp depreciation added to weakness in Chinese and Hong Kong equities, with USDCNH rising by 0.8% to 7.2761. Investors expect China's tolerance for a weaker renminbi amid a slow economic recovery, potentially testing September's high of 7.3682. The possibility of a "Trump presidency 2.0" boosted medium-term prospects for USDCNH. For further discussion on the implications of the US election on Chinese equities and USDCNH

FX: The dollar strength extended further on Friday, with the DXY index back above 104.30 to its highest level in over a month. The Chinese yuan saw notable weakness, and USDCNH rose sharply above 7.27 to its highest level since November, with PBoC setting a weak fix and signalling that authorities are willing to tolerate some yuan depreciation. AUDUSD dropped 40pips as well, slipping from 0.6570 and now trades below 0.6520. EURUSD also testing the 1.08 handle with the SNB surprise rate cut, prompting wagers to increase bets for ECB, easing for June. EURCHF eased from highs of 0.9788 to settle around the 0.967 handle, although USDCHF settled just below the 0.90 handle. GBPUSD back below 1.2650 after BoE governor Bailey said rate cuts are in play at future BoE meetings amid signs that tighter policy quelled the risk of a wage-price spiral.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment