403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Oil Gains Over 2% but Records Seventh Weekly Decline

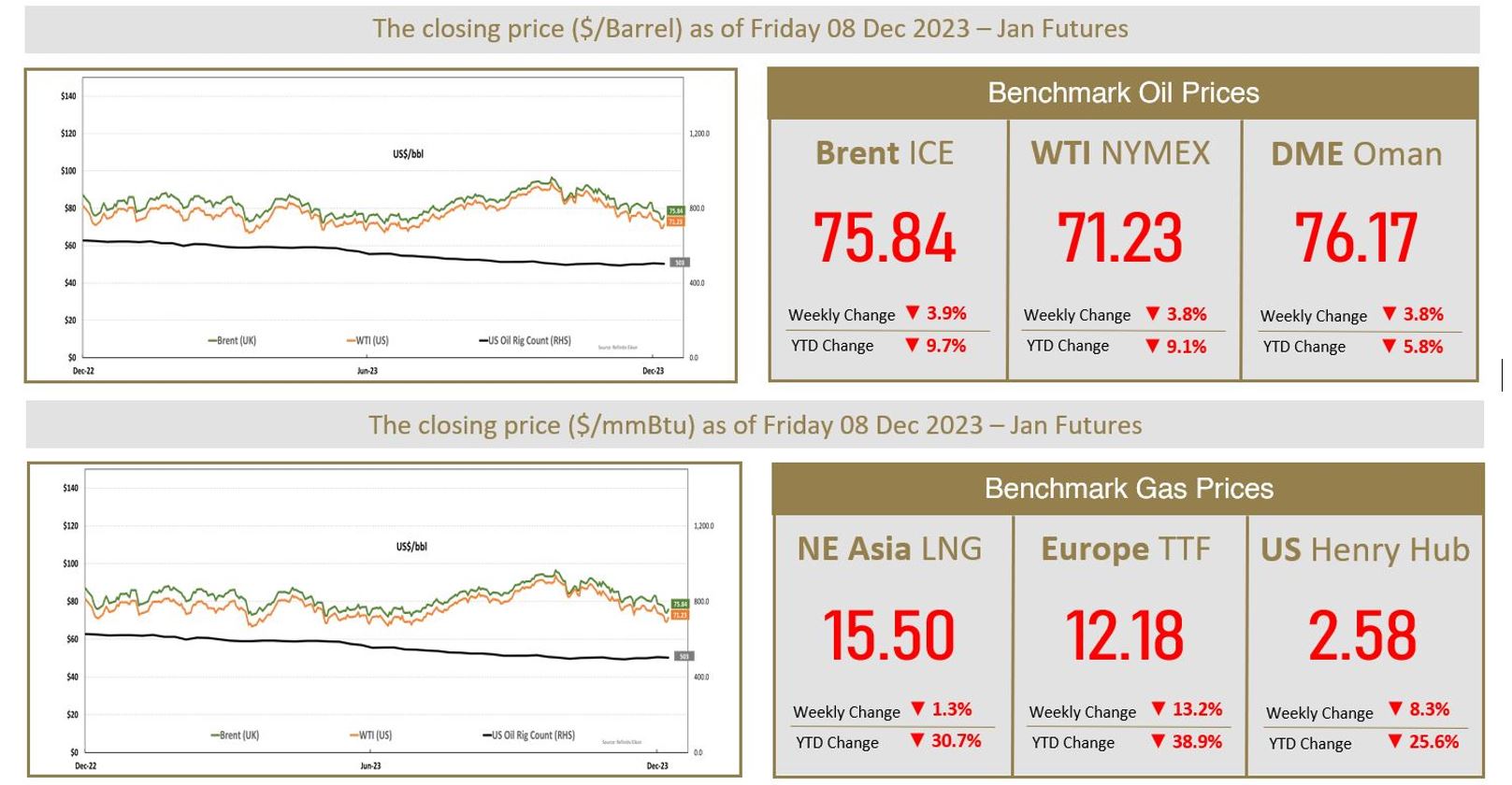

(MENAFN- The Al-Attiyah Foundation) Oil prices rose more than 2% on Friday after U.S. data supported expectations of demand growth, but both benchmarks fell for a seventh straight week, their longest streak of weekly declines in half a decade, on lingering oversupply concerns. Brent crude futures settled at $75.84 a barrel, up $1.79, or 2.4%, while U.S. West Texas Intermediate crude futures closed at $71.23, up $1.89, or 2.7%. For the week, both benchmarks lost 3.8%, after hitting their lowest since late June on Thursday, a sign that many traders believe the market is oversupplied. Also fuelling the market's downturn, Chinese customs data showed its crude oil imports in November fell 9% from a year earlier as high inventory levels, weak economic indicators and slowing orders from independent refiners weakened demand. In the U.S., Labor Department data released showed stronger-than-expected job growth, signs of underlying labor market strength that should support fuel demand in the biggest oil market. That followed government data on Wednesday showing U.S. gasoline demand last week lagged the 10-year seasonal average by 2.5% and gasoline stocks rose by 5.4 million barrels, more than quintuple forecasts, leading gasoline prices to fall.

Asia Spot LNG Prices Fall on Continued Muted Demand

Asian spot liquefied natural gas (LNG) prices slightly fell last week on continued lack of interest for spot supply from Northeast Asia players and forecast of weaker prompt gas demand in Europe. The average LNG price for January delivery into Northeast Asia slightly fell to $15.5 per million British thermal units (mmBtu), from $15.7 last week. A potential for a very cold turn of the year in Northeast China, with forecasts for overnight temperatures to be at least several degrees Celsius below historical norms, could weigh on LNG inventories and widen the scope for the additional spot purchases. Prices for LNG in Asia rose to their steepest premium over European prices for two years this week as congestion at the Panama Canal drove up the price of shipping U.S. LNG to Asia. In Europe, temperatures are returning to seasonal norms following a cold snap and the continent continues to see a healthy supply of LNG, no unplanned outages, and comfortable gas stock levels forecast to remain at all-time highs. In the U.S., natural gas futures held steady on Friday as record LNG exports offset forecasts for milder weather and lower heating demand through late December.

By: The Al-Attiyah Foundation.

Asia Spot LNG Prices Fall on Continued Muted Demand

Asian spot liquefied natural gas (LNG) prices slightly fell last week on continued lack of interest for spot supply from Northeast Asia players and forecast of weaker prompt gas demand in Europe. The average LNG price for January delivery into Northeast Asia slightly fell to $15.5 per million British thermal units (mmBtu), from $15.7 last week. A potential for a very cold turn of the year in Northeast China, with forecasts for overnight temperatures to be at least several degrees Celsius below historical norms, could weigh on LNG inventories and widen the scope for the additional spot purchases. Prices for LNG in Asia rose to their steepest premium over European prices for two years this week as congestion at the Panama Canal drove up the price of shipping U.S. LNG to Asia. In Europe, temperatures are returning to seasonal norms following a cold snap and the continent continues to see a healthy supply of LNG, no unplanned outages, and comfortable gas stock levels forecast to remain at all-time highs. In the U.S., natural gas futures held steady on Friday as record LNG exports offset forecasts for milder weather and lower heating demand through late December.

By: The Al-Attiyah Foundation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment