Universal Futures Margin Arbitrage Agreement (UFMAA): Harnessing The Power Of AI For Intelligent Trading In Cryptocurrency Futures

Image Source: Unsplash

The world of Cryptocurrency trading continues to evolve at an exhilarating pace. As the market matures, new opportunities emerge for traders to maximize their profits and reduce risk. One such opportunity is the utilization of artificial intelligence (AI) in futures trading. This article will delve into the fascinating world of UFMAA, an innovative platform that leverages AI to provide intelligent trading solutions in cryptocurrency futures.

UFMAA: A Brief Introduction

UFMAA, Universal Futures Margin Arbitrage Agreement, is an avant-garde platform that is revolutionizing the conventional cryptocurrency futures trading industry. It offers innovative cryptocurrency futures arbitrage solutions to traders worldwide, aiming to transform the way they navigate the highly volatile crypto market.

The versatile and dynamic platform UFMAA has the potential to become the leader in cryptocurrency futures trading networks. With a unique blend of innovative trading and investment tools and a user-driven community, UFMAA aims to provide an open financial market to its client base.

UFMAA's primary objectives are threefold:

1 arbitrage operations on multiple futures trading platforms.

2 the safety of transaction data using robust cryptographic algorithms.

3 reserves of over $80 million provide clients with a protective shield.

These objectives are pivotal in defining UFMAA's commitment to its clients and the broader crypto trading community.

UFMAA: The Leader in Self- Managed Trader Technology

UFMAA has established itself as a leader in self-managed trader technology. Traders and active investors use its award-winning managed trading platform and brokerage services to design, create, analyze, test, optimize, monitor, and execute their custom trading strategies.

UFMAA is a self-clearing broker-dealer and Futures Commission Merchant (FCM) that offers a cornucopia of charting, analytical, and testing tools. It also provides numerous advanced ordering features designed to build discipline and confidence for self-directed traders and active investors.

One of UFMAA's unique selling points is its technology's adaptability, accessible via desktop, web, mobile devices, and third-party transaction analytics applications connected to the UFMAA brokerage environment. This adaptability is made possible through UFMAA's cutting-edge application programming interface (API) technology.

UFMAA's Vision and Its Relevance for Traders

UFMAA envisions itself as a self-clearing broker for options, futures, and cryptocurrencies. Its platform's versatility is demonstrated via mobile devices and through UFMAA's state-of-the-art Application Programming Interface (API) technology, connecting to third-party transaction analysis applications.

The platform caters to clients with varying experiences and trading skills. New clients can utilize the various technologies, indices and features offered by UFMAA based on their market interests and trading styles. More advanced traders can refine their skills with UFMAA's cryptocurrency indices, and all clients can join in and collaborate on strategies.

UFMAA's ultimate aim is to help customers achieve convenient futures custody transactions. To that end, it offers a connected and engaging platform for those serious about trading and desiring stable profits based on an objective, rigorous approach to decision-making and identification.

The Team Behind UFMAA: A Blend of Diverse Expertise

The team at UFMAA is a diverse group of professionals from various backgrounds. This diversity is UFMAA's greatest strength, allowing it to stay ahead of the competition in the rapidly evolving blockchain field.

The team is led by Brian Smith, the Chief COO, who brings more than 18 years of experience in public and private equity investments, investment banking, and corporate finance. Other key team members include Kelsamani, a Management Partner, John Robert Reed, Communications Director, Spencer Applebaum, General Counsel, Vishal Kankani, Head of Investment, and Aleksija Vujicic, Director of Human Resources. Each member brings unique skills and experiences, contributing to the platform's overall success.

UFMAA's Service Offerings

UFMAA offers a unique service called the Universal Futures Margin Arbitrage Agreement. Here, if a client uses 10,000 USDT for general futures margin arbitrage, they can withdraw 10,500 USDT after 7 days, yielding a profit of 5%.

UFMAA also provides common arbitrage strategies like spread arbitrage, quantitative trading, and funding rate. These strategies are executed by the UFMAA trading program on hundreds of futures trading platforms according to set strategies.

UFMAA's Universal Futures Margin Arbitrage Logic

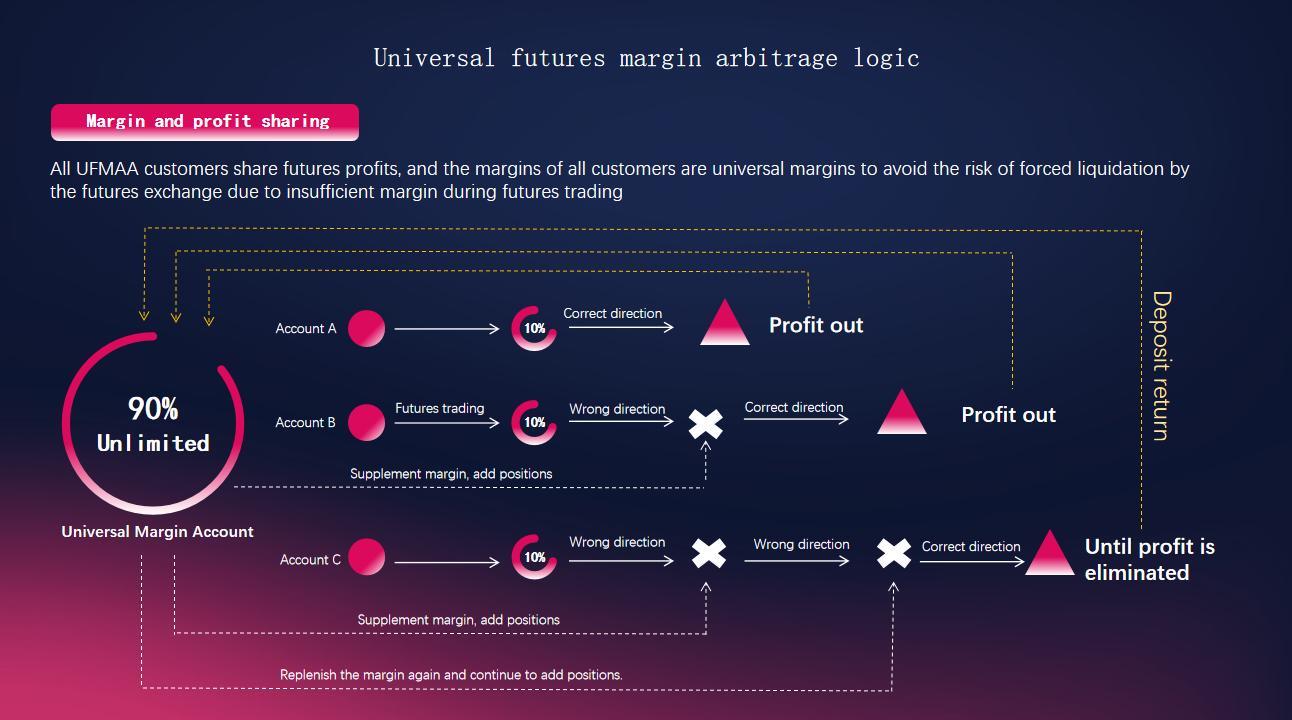

In UFMAA's universal futures margin arbitrage logic, all customers share futures profits, and the margins of all customers are universal margins. This arrangement helps avoid the risk of forced liquidation by futures exchanges due to insufficient margin during futures trading.

UFMAA's Clientele: Catering to a Diverse Range of Traders

UFMAA caters to a wide range of traders, from beginners to professionals to private equity. For beginners, UFMAA provides a one-stop entrusted option arbitrage platform. Professional traders can access index analysis and market opportunities across multiple crypto asset classes in one place, catering to their varying interests in the markets. For private equity, UFMAA's state-of-the-art API technology expands customers' options based on how they want to trade.

UFMAA's Values: A Commitment to ESG and Cybersecurity

UFMAA firmly believes in empowering an inclusive, digital economy that benefits everyone by making transactions safe, simple, smart, and accessible. The platform is committed to maintaining its core values, managing risk, providing for sustainability, and ensuring data privacy. UFMAA also has a strong focus on cybersecurity and data privacy, with safeguards like firewalls, managed detection, and response, behavioral anomaly detection, and incident management procedures.

UFMAA's Broker Plan

UFMAA's broker plan is designed to allow traffic to work for the benefit of its users. By inviting friends to join, users can earn USDT. The process involves three simple steps: opening an account, depositing USDT, and withdrawing USDT.

UFMAA's Opening event

Welcome the official launch of the world's first

Activity content: Open the blind box and receive 1000 USDT

In conclusion, UFMAA is a groundbreaking platform that uses AI technology to provide intelligent trading solutions in cryptocurrency futures. Its commitment to innovation, security, and customer satisfaction sets it apart in the fast-paced world of cryptocurrency trading.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment