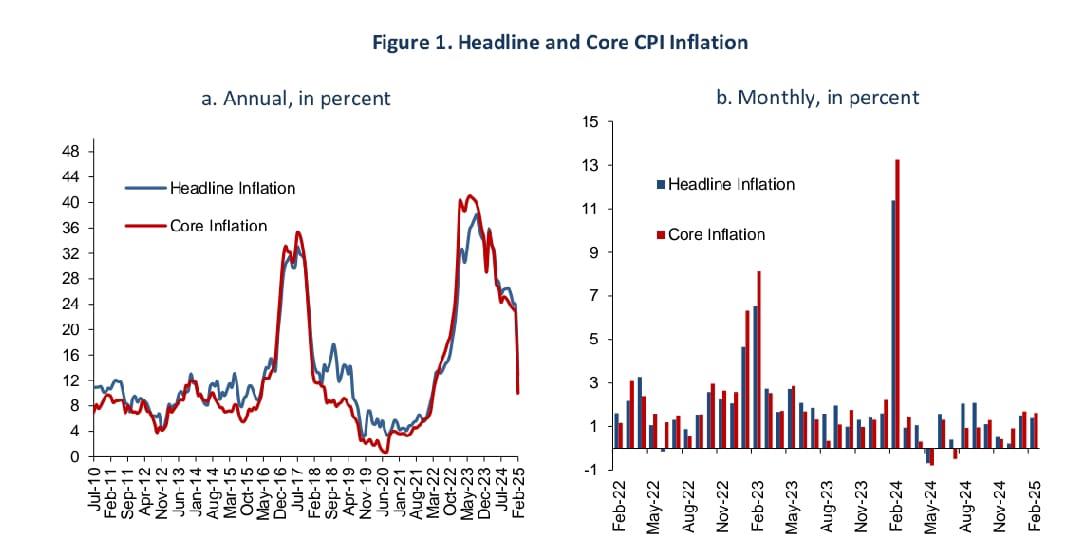

Annual Urban Inflation Drops Sharply To 12.8% In February 2025: CBE

The decline in core inflation reflects an increase in non-food inflation, mainly due to seasonal hikes in tuition fees and education-related expenses, as well as higher rents and spending on restaurants and cafés. While food inflation had a weaker impact on monthly figures, it was influenced by rising prices of core food items such as poultry, which saw increased demand ahead of Ramadan.

Monthly urban headline inflation stood at 1.4% in February 2025, compared to 1.5% in January and a significantly higher 11.4% in February 2024. This movement was shaped by rising costs in non-food items, including education-related products and services, as well as core food products. Additionally, increases in regulated prices, such as those of tobacco and public education tuition fees, contributed to inflationary pressures. However, fresh vegetable prices declined unexpectedly, defying their usual seasonal pattern.

Annual rural headline inflation also registered a sharp decline, dropping to 12.2% in February 2025 from 22.6% in January. Similarly, nationwide inflation slowed to 12.5% in February, down from 23.2% the previous month.

Within food categories, fresh fruit prices rose by 2.5%, while fresh vegetables recorded an unusual 10.8% decline. Together, they exerted a negative impact of 0.34 percentage points on monthly headline inflation. Poultry prices increased for the second consecutive month, rising by 5.8% in line with pre-Ramadan trends, contributing 0.33 percentage points. Other core food products, including pasta, market rice, and dairy products, saw slight price increases, while red meat, market sugar, pulses, confectionery, and tea also contributed modestly to overall inflation.

Inflation in services rose by 1.8%, mainly driven by seasonal tuition fee hikes, increased spending at restaurants and cafés, and higher rents, collectively adding 0.50 percentage points to monthly headline inflation. Regulated prices increased by 2.6%, reflecting higher tobacco costs and seasonal increases in public education tuition fees, which contributed 0.55 percentage points to inflation. Retail prices also saw a 1.8% increase, driven by education-related products, clothing, personal care items, and household cleaning supplies.

The overall monthly core inflation trend was shaped by rising costs in services, core food, and retail items, with services exerting the largest influence. Despite short-term fluctuations, the recent stability in core prices suggests a more favorable inflation outlook in the months ahead.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment