403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Oil Rises for 6th Straight Week as Global Supplies Tighten

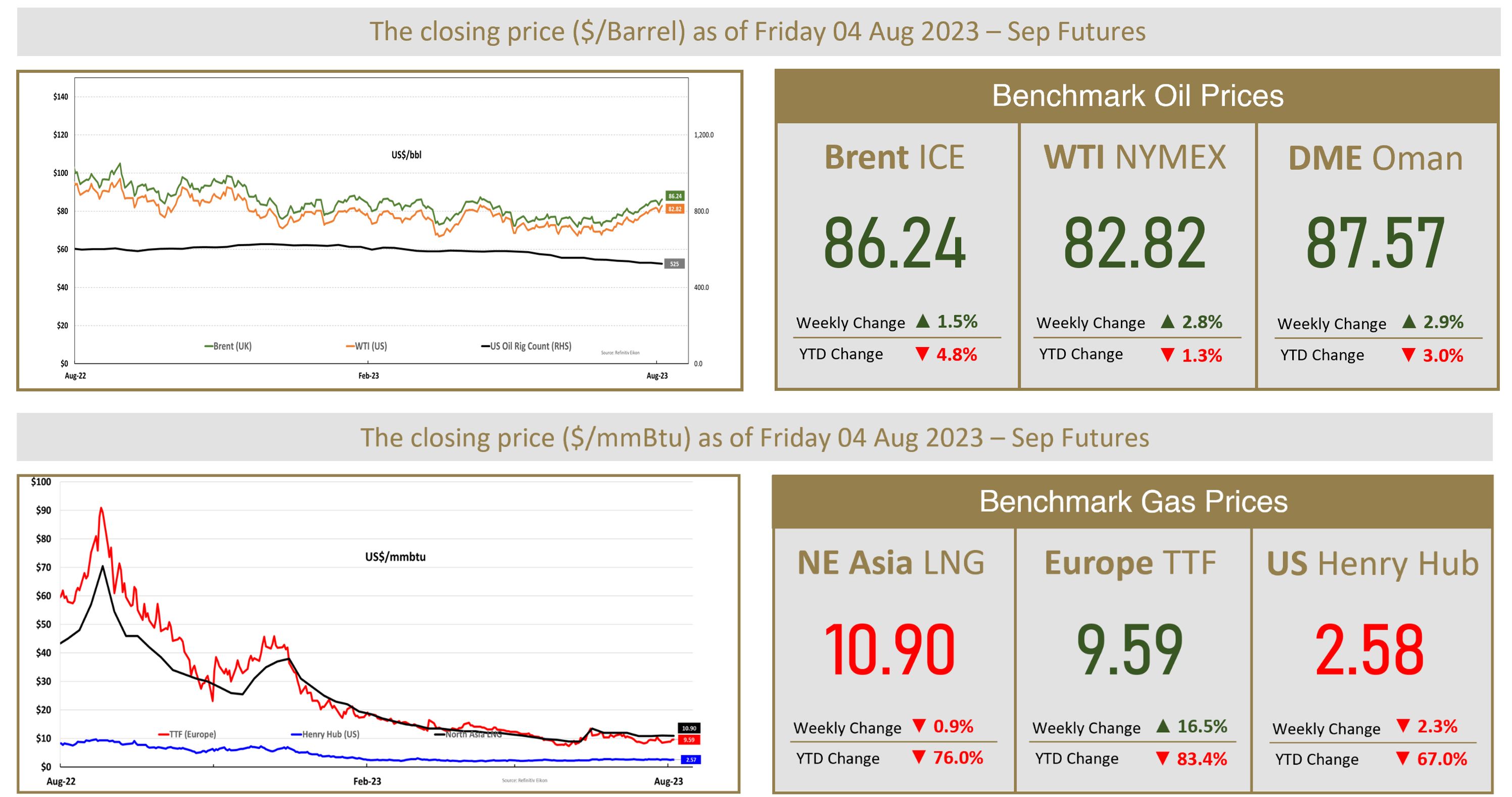

(MENAFN- The Al-Attiyah Foundation) Oil prices rose more than a dollar a barrel on Friday to record a sixth consecutive week of gains, after top producers Saudi Arabia and Russia extended supply cuts through September, adding to undersupply concerns. Brent crude futures rose $1.10, or 1.3%, to settle at $86.24 a barrel, while the U.S. West Texas Intermediate crude gained $1.27, or 1.6%, to close at $82.82 a barrel. Both benchmarks hit their highest levels since mid-April on Friday. Saudi Arabia on Thursday extended a voluntary oil production cut of 1 million barrels per day to the end of September, keeping the door open for another extension. Russia has also elected to reduce its oil exports by 300,000 barrels per day next month. On the demand front, global oil consumption could grow by 2.4 million bpd this year, Russian Deputy Prime Minister Alexander Novak said on Friday after a ministerial panel meeting of the OPEC+ group - the Organization of the Petroleum Exporting Countries and allies. The meeting yielded no changes to output policy. The U.S. Energy Information Administration reported that the country's crude oil inventory declined by 17 million barrels last week as exports and refiners' input of crude oil ramped up in the heart of summer travel season.

Asia Spot Prices Ease Slightly as Demand Remains Tepid

Asian spot liquefied natural gas (LNG) prices fell slightly this week, as demand in the region remained weak. The average LNG price for September delivery into northeast Asia was $10.90 per million British thermal units (mmBtu), industry sources estimated, edging down from $11 per mmBtu the previous week. Asian demand is currently tepid at best, fundamentally most of the bigger players are well covered. One or two utilities may run short with the ongoing heatwave and that could lead to short-term tightening, analysts said. Parts of North Asia have been grappling with heatwaves in recent weeks, with South Korea raising the hot weather warning to its highest level for the first time in four years as parts of the country see temperatures of over 38 degrees Celsius. In Europe, gas prices at the Dutch TTF hub rose last week to $9.59 per mmBtu. The focus remains on early winter demand, particularly as sellers look to floating storage and slow sailing to take advantage of the contango, where the futures price of a commodity is higher than the spot price. Meanwhile, buyers are looking to late month deliveries that can be held in tank, then regasified and sold at downstream hubs later in winter.

By: The Al-Attiyah Foundation

Asia Spot Prices Ease Slightly as Demand Remains Tepid

Asian spot liquefied natural gas (LNG) prices fell slightly this week, as demand in the region remained weak. The average LNG price for September delivery into northeast Asia was $10.90 per million British thermal units (mmBtu), industry sources estimated, edging down from $11 per mmBtu the previous week. Asian demand is currently tepid at best, fundamentally most of the bigger players are well covered. One or two utilities may run short with the ongoing heatwave and that could lead to short-term tightening, analysts said. Parts of North Asia have been grappling with heatwaves in recent weeks, with South Korea raising the hot weather warning to its highest level for the first time in four years as parts of the country see temperatures of over 38 degrees Celsius. In Europe, gas prices at the Dutch TTF hub rose last week to $9.59 per mmBtu. The focus remains on early winter demand, particularly as sellers look to floating storage and slow sailing to take advantage of the contango, where the futures price of a commodity is higher than the spot price. Meanwhile, buyers are looking to late month deliveries that can be held in tank, then regasified and sold at downstream hubs later in winter.

By: The Al-Attiyah Foundation

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment