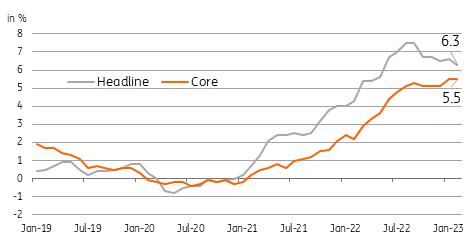

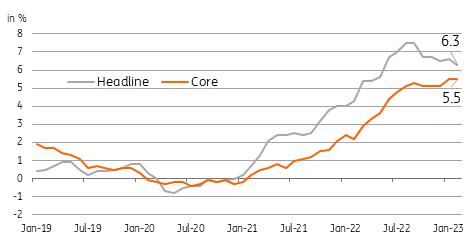

(MENAFN- ING) February inflation at 6.3%

Price pressures in Singapore remained potent with headline and core inflation still well above the Monetary Authority of Singapore's (MAS) inflation target.

The pace of growth, however, appears to have moderated with headline inflation slowing more than expected to 6.3%YoY (6.4% expectation).

Food prices rose sharply by 8.1% while price gains were noted in four other sectors possibly due to still robust demand, and after the latest round of goods and services tax kicked in at the start of the year.

Meanwhile, core inflation was steady at 5.5% YoY, unchanged from the previous month and much slower than market expectations for a 5.8% rise.

Finance Minister

Lawrence Wong indicated at the start of the year that inflation would likely be elevated for at least the first half of the year and current data trends point to this playing out in 2023.

Has core inflation peaked?

Singapore Department of Statistics

MAS on notice but slowing growth an additional concern

Still elevated inflation should have the MAS on notice ahead of the

April meeting.

With price pressures still potent, the MAS will likely need to retain its

hawkish stance until inflation slows considerably and approaches target.

Complicating any potential MAS moves however is the fact that real sector economic data has been soft with retail sales unexpectedly stalling in january while non-oil domestic exports remain in contraction for five

months and counting.

Elevated inflation coupled with slowing growth should prod the MAS to achieve some form of balancing act to sustain its hawkish bias while still finding ways to support growth given the current challenging environment.

MENAFN23032023000222011065ID1105843157

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment