(MENAFN- ING) Korea's weak growth is likely to continue into this quarter

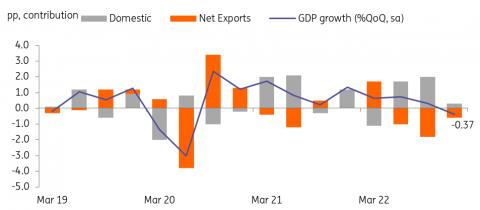

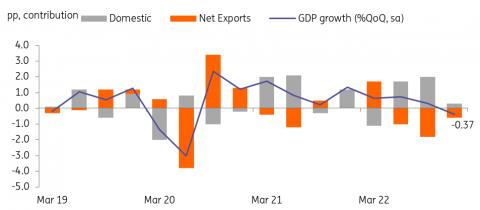

Korea's fourth quarter GDP contracted for the first time since the second quarter of 2020. We think that the impact of the cumulative interest rate hikes along with fading reopening effects have begun to slow down private consumption while weak global demand conditions are hurting Korea's exports.

Private consumption fell 0.4% with declines in both goods and service consumption. The debt service burden on households will not be relieved any time soon since Korea's households are highly leveraged and more than 70% of the outstanding household loans are based on floating rates. As such, the

rate hike by the Bank of Korea in January

will weigh on consumption this quarter. Also, we expect the unemployment rate to rise quite meaningfully in the first half of the year, thus household incomes

are likely to worsen.

Meanwhile, construction and facility investment rose 0.7% and 2.3%, respectively, mainly due to the completion of pre-ordered projects. Forward-looking construction orders and machinery orders data have declined over the last few months, and we expect investment to decline this quarter. The credit crunch has eased a bit since late December, but many investment plans have already been cancelled or trimmed down due to the high level of funding costs and uncertain global conditions.

For external components, exports and imports both fell significantly by 5.8% and 4.6% each. Weak global and Chinese

demand drove not only the decline of semiconductor and petrochemical exports but also

the sluggish imports, as more than 40% of imports are for re-exports. We do not expect these weak global demand conditions to turn around sharply during the first half of the year. China's reopening is key for Korea's exports, but the positive impact will likely materialise in the second half of the year.

Korea GDP contracted in 4Q22

CEIC

GDP forecast

With a fairly sharp contraction last quarter, we revised up the first quarter GDP forecast slightly, mainly on the back of a technical rebound.

But we still think that GDP for this quarter will contract or at best stagnate. The contribution to net exports

is expected to improve mainly due to a sharper decline in imports, but domestic demand is expected to worsen. Private consumption is likely to shrink, while investment is also expected to decline. Thus, we maintain our annual GDP growth forecast of 0.6% year-on-year

in 2023.

BoK watch

The Bank of Korea will likely stand still on monetary policy

from now on due to

the weak growth but may

also keep its hawkish stance for a while. Inflation still remains around the 5% level and upside risks are high. But

we think that if GDP continues to contract this quarter then the BoK could

consider a rate cut later this year.

Comments

No comment