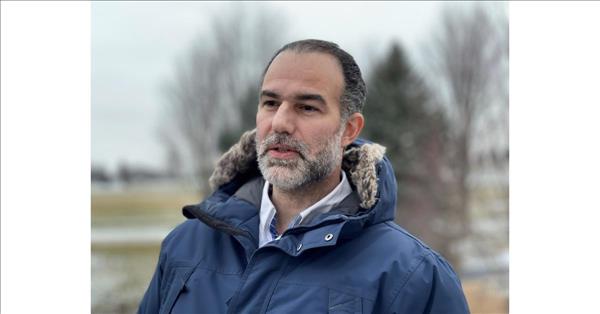

(MENAFN- EIN Presswire) Founders Trust's strategy is very different from that of other buyers, Williamson explains

Founders Trust has won the year's top M&A industry award from Acquisition International,“Best U.S. Small & Medium Business Buyer 2022.”

The fate that awaits most businesses, is a fate that eventually destroys their life's work, their families, and it seriously affects the fiber of the nation. We believe owners need a better solution.” - Matt WilliamsonCHICAGO, IL, USA, December 21, 2022 /einpresswire.com / -- Founders Trust has won the year's top M&A industry award from Acquisition International,“Best U.S. Small & Medium Business Buyer 2022.” In a landscape where most industries were marked by increasing consolidation, Founders Trust also stands out as a unique acquiror in its core strategy, which involves growing and supporting its companies instead of consolidating them.

The criteria for the award included type of deals, selection of industry, and the performance of companies one year and several years post-acquisition.

Matt Williamson, CEO of Founders Trust, says,“Our thanks goes to the team here at Founders Trust, from individuals in each of our focus areas, to the founders we work with, to the teams at each company. We truly believe that they are the best in the industry, and we are grateful. The team lives and breathes the shared mission that drives the core of what we do.”

The strategy of Founders Trust is very different from the strategy of other buyers in the US. Williamson explains,“The fate that awaits most businesses, is a fate that eventually destroys their life's work, their families, and it seriously affects the fiber of the nation. So much is lost. I don't want these business owners to have a fate like my grandfather had. We need to change that. Owners should have a successful exit, so they can set up a 'family office' with their family if they want, and focus on different goals, live the life they choose, and see their company, their life's work, flourishing in good hands. It is our mission in life.”

The article in Acquisition International can be found at:

Best U.S. Small & Medium Business Buyer 2022

Founders Trust works with founders and owners who are looking to sell their small- and medium-sized privately held companies. These individuals have spent decades building their companies; developed them, grown them, and now it is time to exit. Some are ready to retire, others enjoy what they do and would like to continue doing some of the work – but they don't want ownership weighing on them anymore. We take a closer look at how Founders Trust ensures the long-term success of each of the companies it buys, while also preserving their values, teams, and independence.

Founders Trust is a big admirer of founders. People that start from scratch, people who essentially begin their business journey with nothing. Most of the time, they don't even know the business that they are getting into, and they don't have any connections from the start. But over time, they build a great business, often with a lot of personal sacrifices. They bring jobs to many employees who are able to grow personally and professionally and support their families. They help numerous clients, whose lives are enhanced by receiving great products or services. The time comes that the founder has worked all these years, and it's time for him to exit and to pass the baton. To do that successfully, he has to do it early enough that he has time for a successful transition. Some founders want to exit and retire; others want to exit and continue working in the company without the weight of ownership.

This is where Founders Trust comes in. CEO of Founders Trust, Matt Williamson says,“We believe that businesses have intrinsic value, and they should continue to grow and succeed.”

Mr. Williamson says,“Business owners build their companies from nothing. We have respect for these people. And we're here to help them achieve their exit. They deserve to see their work and what they believe in, to continue on. And the employees deserve to grow and be successful. We give a part of the ownership to all of the employees, and we incentivize them. We support companies for success and growth, and give companies what they need to do that.”

Usually, buyers belong to two categories, the 'strategic' and the 'financial' buyers. 'Strategic' buyers typically lay off employees, cut costs, or absorb, merge, or conglomerate the company into their existing operations, and the company soon disappears, and it is like it never existed. 'Financial' buyers focus on time-framed returns and short term investment horizons. They also typically lay off employees, cut costs, do a few quick fixes, over-leverage the company, and exit the company to hit their IRR target. This puts the company into an endless cycle of acquisition and disposition to financial buyers in order to achieve IRRs. This puts a lot of pressure on the employees, the company, and often the quality of the product or service that the company offers. Both types of buyers use other people's money, so they don't have the same sense of stewardship. They are the faceless organizations that conglomerate investors and companies. Companies disappear into the Borg.

To be a different type of buyer is why Founders Trust exists. Mr. Williamson explains,“We are for sellers that care about their legacy, employees, clients, brand name, history, vendors, and local community. All of these are preserved. We are for sellers that care about the continuation of their company and its culture, and the company achieving its potential. We are for sellers that care about their employees and want to see them succeed, and see them given part of the equity, and incentivized. They want to see their employees do well, too, because they helped the business owner to reach where he is today. With Founders Trust shared ownership, the employees do very well.”

Mr. Williamson also explains,“The companies grow, and become stronger and stronger. It is a permanent home for the company. We are not returns driven, we are quality of company driven: if it is a good quality company, then over time, long term value will be created. We don't need our money back within a certain time frame.”

Each exiting founder has different needs, goals, and timeframes. For retiring business owners, their need is often to have a short transition period due to certain circumstances that do not allow them to spend time in the business anymore. In cases like this, Founders Trust works with the ownership to design a successful transition period around their schedule. Wherever possible, existing employees at the company are trained and prepared to step up and create a new leadership team.

Founders Trust has developed processes in how to prepare these individuals to replace the owner-manager. It is a difficult process and one which has been refined extensively over the decades. In some cases, Founders Trust will bring in talent from outside of the company, but it is preferred that it comes from within. This gives the opportunity to existing employees and executives to take on roles with more advanced responsibilities.

All of the activities during the transition period are overseen by Founders Trust, including the strategy and creating budget limits with the leadership team. It is there to help in any way possible. Founders Trust's role is to support and help and reinforce in any other area needed, whether legal, accounting, marketing, branding, online presence, or sales team development. It can provide any kind of specialized advice, appreciating that different companies need help in different areas.

Founders Trust talks transparently with founders to come up with a solution that supports founders' timelines and what they want to do. Founders may want to have a longer transition period. Other times, business owners want to be able to keep doing what they love in their own business, minus the heavy admin work that comes with ownership. They want to go back to doing what they used to love in their business. In cases like this, Founders Trust can provide this luxury: to buy their business, and let them continue being part of the organisation – either in a leadership position or not, depending on their preference.

On many occasions, previous owners of companies stay with the company in the form of a board member or an advisory role, and they keep their desks at the company, contributing as and when they want to, not in an obligatory manner.

Mr. Williamson says,“Founders Trust has very specific criteria for the businesses that we are interested in. We buy small to medium-sized privately-owned companies, with successful management in place, and a strong operating track record. That means profitable companies that have some successful history behind them. We're not interested in start-ups because start-ups do not have management in place which is already successful, with a history behind them.”

Founders Trust's process is transparent. Once it understands that a company might be the right company for it, a very short pre due diligence will take place. Mr. Williamson explains,“When we reach the point that we have decided to submit an offer, the offer will be transparent, and will be explained in detail. There won't be unclarified points that are going to be negotiated or defined or thought about later.”

He continues,“The owner can ask anything, or their advisors can ask anything they need to, and we explain it. Now, the reason that's important is because the majority of other potential buyers do not work like that. You receive an offer that is not very well defined. And it definitely doesn't explain the reasons of why, or how it is calculated. Very, very important.”

So, as an expert in M&A, we asked Mr. Williamson what advice he would give to those who are looking to succeed within the industry. He shares,“First is having a very well-defined criteria about the businesses. Second is having the courage to be upfront with the sellers and everyone you work with. Explain to them your criteria, so it's clear whether it's a company for you, so you don't waste your time and they don't waste their time. Also, let them know how you do the pricing of these companies. What are your parameters? Being up front with that; not being vague about it and then later stumbling into problems.”

Media

Founders Trust

+1 312-373-1123

Succession - The Final Challenge of Successful People

Comments

No comment