Mortgage Boycotts Rattle Chinese Banks And Regulators

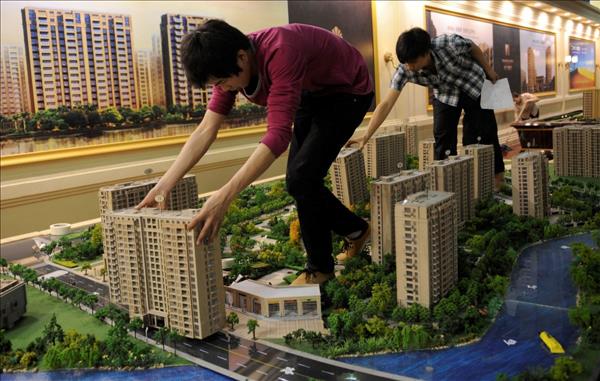

Chinese financial and housing officials reportedly have held meetings with major banks this week after homebuyers from at least 150 property projects announced plans to stop paying their mortgages.

Media reports said on Thursday that financial regulators and Ministry of Housing and Urban-Rural Development officials held emergency meetings with banks on Tuesday and Wednesday to discuss the rising risks of mortgage boycotts.

The reports came after tens of thousands of homebuyers said they would stop mortgage payments as property developers failed to deliver their apartments.

Meanwhile, Chinese legal experts warned that it was unwise for homebuyers to unilaterally stop paying their mortgages as they would become defaulters in China's credit system and lose their basic rights, including even the ability to buy train tickets.

They said homebuyers who did not receive their apartments should seek to terminate the purchase contracts with the property developers first.

Bank shares downOn Thursday, most Hong Kong-listed Chinese banks declined on the mortgage boycott news. Postal Savings Bank of China's shares dropped 5% while China Merchants Bank fell 4%. Industrial and Commercial Bank of China, the world's largest bank, declined 2.4%. The Hang Seng Index, a benchmark of the Hong Kong stock market, eased 0.22%.

Many of the unfinished property projects are in central China's Henan province but the problem extends to as many as 20 other provinces.

The affected homebuyers complained that their banks had not set aside their mortgage funds pending property developers' completion of construction work but instead had allowed the developers control over the funds.

Analysts said the incidents could make potential homebuyers even more hesitant to enter the markets.

An earlier wave of unfinished buildings emerged in the late 1990s as many Hong Kong people could not take delivery of the housing units they had bought in Zhongshan and Dongguan in southern China's Guangdong province.

At that time, property developers failed to complete their projects as the company owners fled with homebuyers' money. After 20 years, some of these unfinished buildings were demolished and rebuilt into new ones but some have remained unchanged.

In July 2020, financial regulators announced“three red lines” that barred highly-geared property developers from receiving loans for expansion.

Many property developers sold their assets at huge discounts in order to replenish their cash flows and repay debts. From mid-2021, some developers including the heavily-indebted Evergrande Group, which is now restricting its assets, have faced shortages of funds to continue their construction projects.

Residential buildings developed by Evergrande in Yuanyang County, Henan. Photo: Wikimedia Commons

A total of 396 Chinese property developers went bankrupt last year, compared with 270 in 2020, Liu Guangyu, a property market analyst, wrote in an article earlier this year. He predicted that more property developers with high gearings would collapse while the high-quality ones would be able to expand their market shares and raise funds more easily.

Some analysts said the bankrupted property developers only accounted for a very small proportion of the estimated 100,000 property developers in China but nevertheless they saw a rising trend that mid-sized and large property developers were facing financial difficulties.

On December 20 last year, the People's Bank of China and China Banking and Insurance Regulatory Commission jointly issued a document to urge local banks to support high-quality property developers' acquisition of weaker players' high-quality assets – referring to unfinished property projects.

Early this year, the Guangdong provincial government held meetings with key state-owned and private property developers, including China Overseas Property, Yuexiu Property, China Aoyuan Group and R&F Properties, to discuss the matter.

Despite the central and local governments' efforts, high-quality property developers remained hesitant to acquire other players' assets due to rising risks in the property sector, said Pan Ho, a senior property analyst at Beike Research Institute, a Chinese property data service provider.

Cheaper land prices also reduced property developers' incentives to purchase unfinished projects, he said.

Over the past one week, a social media post saying that homebuyers from at least 150 unfinished property projects stopped mortgage payments had gone viral on the Internet, Yicai.com reported on Thursday.

The projects' developers included Evergrande, Sunshine City Group, Sunac China and Kaisa Group, many of which had failed to repay their debts, according to the report. Some unfinished projects are located in top cities including Shenzhen, Shanghai and Suzhou but most of them are in lower-tier cities.

Customers of Mingmen Real Estate in Zhengzhou in Henan province said in a statement that they had borrowed mortgage loans from banks including state-owned banks to buy housing units. But instead of requiring the developers to use the money only for construction work, banks had allowed the property developers to abuse their funds. They accused the banks of failing to monitor the property developers' use of funds.

Warnings to irate mortgage debtorsWang Yuchen, a lawyer at Beijing Jinsu Law Firm and one of those urging caution, warned that homebuyers who have been unable to receive their apartments need to reach agreement with their banks before they stop paying their mortgages.

According to the legal procedures, aggrieved homebuyers should first file a civil case to terminate the home purchase contact with the property developer and then cancel the mortgage, Wang said.

Stop and think before you rip up your mortgage contract. Photo: Denver Real Estate Attorney

However, if property developers have started their liquidation process, homebuyers need to queue up with other creditors to get back their money from the developers, he said. If homebuyers unilaterally stop paying mortgages, they can become defaulters and lose credit or be sued, Wang said.

However, some Chinese media and commentators said it was reasonable for the affected homebuyers to stop mortgage payments if they could not see any hope that they would receive their apartments.

On Tuesday, a netizen in a video described the new campaigns of the homebuyers as“high-quality rights protection.” He said homebuyers already realize that their previous protests at property developers' sales offices were useless.

In China, activists and lawyers who participate in rights protection campaigns can face legal cases or be accused of disrupting social stability, depending on the nature of the rights they are fighting for.

On social media, articles and videos mentioning“rights protection” can be heavily censored and removed, but as of Thursday, the netizen's video remained up and had been viewed 242,000 times.

Read: China banking scandal may involve US$6 billion

Follow Jeff Pao on Twitter at @jeffpao3

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment