Asia: Accommodation To Decline As Inflation Rises

It is always difficult to generalise about non-China Asia. But in recent months, the basic message has been that the region has not suffered as much as Europe or the US from inflation driven by economic reopening and is also less exposed to the inflation consequences of the Russia-Ukraine war.

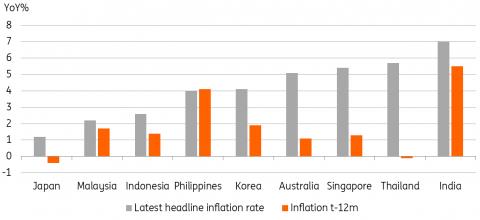

While that generalisation is still supportable, the last month has seen it taking a hit, with Asian inflation pushing higher, and pressure growing on central banks in the region to lean against this with higher rates.

Asian inflation vs a year ago

CEIC, ING

Australia - rates to rise sooner and probably faster

Nowhere is this more apparent than in Australia, where a 5.1% 1Q22 inflation reading has dramatically changed the outlook for rates. We have just seen the Reserve Bank of Australia (RBA) hiking rates by a larger than expected 25bp taking the cash rate target to 0.4%. One feature of the Australian example which generalises to the rest of the region is that the RBA had until fairly recently suggested that policy was likely to remain extremely accommodative for a protracted period.

India trying to have its cake and eat it?The same basic accommodative and patient stance was true for many central banks in the region. Another good example is the Reserve Bank of India (RBI), which left rates unchanged at its scheduled April meeting, even though headline inflation had risen to within a whisker of 7%. The April RBI statement stated that the central bank wanted policy“to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth”. That's quite a mouthful, and equally hard to interpret. In the end, it looks like the RBI decided that trying to have it both ways was not a credible position, and they hiked rates by 40bp at an unscheduled meeting on 4 May.

Rest of Asia and some exceptions to the trendBangko sentral ng Pilipinas (BSP) governor, Benjamin Diokno, has suggested that the Philippines will join this tightening group next month too, though the exact timing will be determined by inflation, with the April inflation figures likely to show a strong pick up from the March rate of 4.0%.

Korea and Singapore started their policy normalisation earlier than other Asian economies and remain on this path. New Bank of Korea governor Rhee Chang-yong recently said that he was more worried about inflation than about growth and that the BoK should stay on the path toward policy normalisation. The Monetary Authority of Singapore (MAS) is more tight-lipped about its intentions, but the continued rise in 3m SIBOR (up more than 60bp since February) indicates the efforts having to be made to keep the Singapore dollar on the announced path of modest nominal appreciation – harder of course in an environment of generalised US dollar strength.

There are, of course, some deviations from this general trend away from policy normalisation. The Bank of Japan, for example, has a rather different inflation backdrop to most other economies in the region. And rather than dilute its accommodation, the BoJ has just launched unlimited daily fixed-rate buying of longer-dated government bonds to support their ongoing yield curve control policy. Likewise, Bank Indonesia Governor, Perry Warjiyo, has commented that rate increases are the last option and that required reserve rate (RRR) increases were likely to do the brunt of the adjustment while liquidity remained ample. But these two are the exceptions that prove the general rule.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment