Greece: What next after the V-shaped rebound?

The rebound of the Greek economy after the Covid-19 slump has been surprisingly strong. After falling 8.8% in 2020, the economy posted substantial gains in every quarter in 2021, resembling a V-shaped profile. A softer 4Q21 would still leave average 2021 growth close to 8%.

Private consumption and summer tourism the main drivers of growthSuch a strong rebound resulted from a combination of factors. Extraordinary public support was effective in propping up the labour market, with employment exceeding pre-Covid levels by the summer and unemployment falling to 13% in 3Q21, the lowest level since 2010. Labour protection allowed consumers to spend part of the savings accumulated during the pandemic, with the most obvious positive effects on durable goods. On the tourism front, the partial lifting of international travel restrictions was reflected in a strong acceleration of inbound tourist flows in 3Q21, which were at the heart of the solid contribution of the exports of services to GDP growth.

Declining unemployment rate supported consumption recovery over 2021

Refinitiv Datastream

Investments, spurred by RRF funds, to gain traction in 2022

With the phasing out of extraordinary Covid-19 support measures, 2022 should mark a transition towards more balanced growth, with a bigger role for investment. The process should be crucially helped by the inflow of grants and loans from the European Recovery and Resilience Facility (RRF), mostly channelled into the digital and green domains. These should at first propel the public investment component, which had undergone severe cuts over the fiscal adjustments of the last decade, but also activate new private investment.

As far as private investment is concerned, the pull coming from RRF funds might not necessarily be smooth though because the structure of the Greek economy, still dominated by small firms, might not represent the most fertile environment for substantial investment flows. Still, the improved financial position of non-financial corporations and resilient business confidence indicators justify some optimism.

Impact of inflation on consumption the biggest risk for 2022The biggest risk to Greek growth in 2022 is posed by the uncertain impact of rapidly-rising inflation on private consumption. In Greece, the deflationary impact of Covid-19 had kept annual inflation in negative territory through to May 2021, supporting real disposable income and, ultimately, private consumption. Since then inflation has crept up, reaching 5.1% in December 2021, driven by the energy components but also by food and beverages, and used and new cars. We expect that good labour market conditions will weather the shock, but softer consumption looks very likely at least over 1Q22.

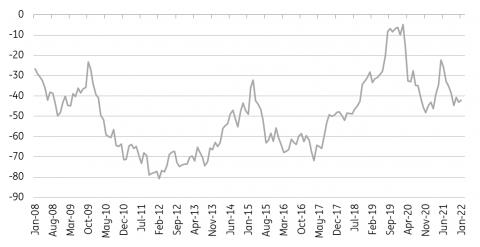

Consumer confidence might soon reflect inflation impact on household disposable income

Refinitiv Datastream

Fiscal policy is getting neutral, as temporary support measures are suspended

The strong growth performance over 2021 and the follow-up in 2022 should allow for a substantial improvement in public accounts. The Greek government has made a target in the 2022 budget of a reduction in the primary deficit to 1.2% of GDP, from an estimated 7.3% in 2021. This is expected to come from improvements in tax revenues and by the phasing out of the temporary fiscal stimulus, with a neutral fiscal stance confirmed by a stable projection for the cyclically adjusted primary deficit. This should allow a further decline in the debt/GDP ratio well below the 200% threshold.

Refinitiv Datastream, all forecasts ING estimates

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment