Wealthy Americans Seeking Financial Privacy Abroad

Americans increasing concerned about rising taxes and financial privacy

A citizenship from Saint Kitts is the golden parachute to have for every wealth American” — Chirag GiriCHARLOTTE, NORTH CAROLINA, UNITED STATES, November 25, 2021 /EINPresswire.com / -- An increasing number of Americans are looking for financial emancipation by seeking solutions outside of US borders. As the American government tightens the noose around wealth through the new proposed tax reform, those who worked their entire lives amassing their assets are left to ponder whether holding on to the American passport is actually worth it.

In many cases, the answer is that it isn't. Record numbers of Americans are renouncing their citizenship, but they need to obtain a second one so they aren't left stateless. Some are already dual citizens, but those who don't have a second home are steering towards the Caribbean nation of St. Kitts & Nevis, a small Commonwealth country that offers its citizenship in exchange for an affordable investment in its economy.

Why are US citizens renouncing their citizenship?

The US, long labelled as the holy grail of immigration, and home to the American Dream, is not what it used to be. The American Dream turned out to be shackled by a complex - and exhausting - tax regime, while financial privacy in the US is near extinction.

The American Foreign Account Tax Compliance Act (FATCA) has been a thorn in every American's side living outside of the US. Complex tax return filings and debilitating tax rates have left Americans abroad reeling. No one likes paying taxes, but people expect something in return when they do. Those living abroad are hardly getting the bare minimum in return for their taxes, making it no wonder why many of them, especially those living in tax-friendly nations, are looking to relieve themselves of the massive tax burden.

Why Americans are rushing towards St. Kitts & Nevis

Situated in the Caribbean, St. Kitts & Nevis is already popular among the American elite as a touristic hotspot full of luxurious resorts and unmatched natural beauty. But the most intriguing allure of St. Kitts & Nevis is its citizenship by investment program, which has seen a massive influx of American applicants in the past couple of years.

Starting at 150,000 USD investment for a single applicant, an applicant with a clean criminal background can become a citizen of St. Kitts & Nevis within a few months.

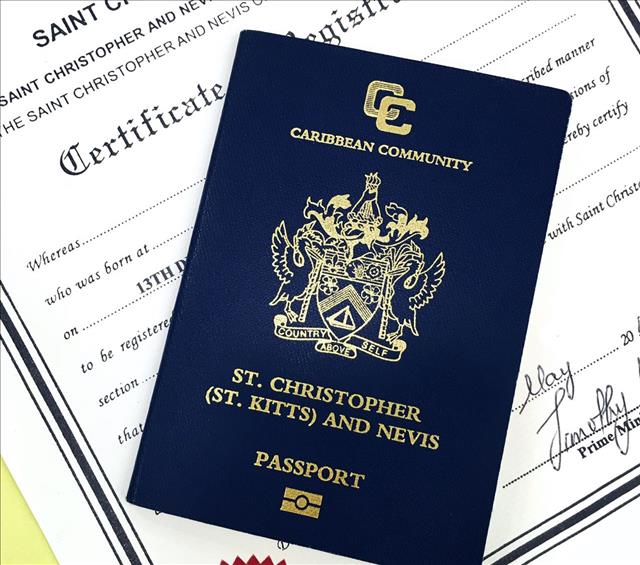

The country's passport, which provides visa-free travel to 157 destinations worldwide, including the UK, EU, and Singapore, is one of the best in the world.

For Americans looking to escape the USA's massive tax burden, the St. Kitts & Nevis passport offers a good alternative in terms of global mobility but goes beyond that in what it offers in terms of financial emancipation.

The Caribbean country does not impose wealth, capital gains, or inheritance tax. More crucially, it does not tax its citizens based on their citizenship status, rather their status as tax-residents. This means anyone who does not spend more than six months a year in St. Kitts & Nevis is not taxed on their worldwide income.

The lack of capital gains and wealth tax in St. Kitts & Nevis is extremely interesting, especially now since the US government is looking into nearly doubling capital gains tax while gifts and estate tax may rise a staggering 62%,

Hence, St. Kitts & Nevis offers a robust alternative for the American elite to safeguard their assets against ludicrous tax rates. But it isn't just about the taxes; it is about the entire financial framework in the Caribbean country.

Nevis, in particular, has a robust financial services sector that is highly exclusive and extremely private. People will still announce their assets and income to the government to maintain their legitimate standing, but the public, especially foreign creditors, will find it near impossible to gather information about a Nevisian bank account or LLC except what the owner wants to divulge. This gives the wealthy more privacy in a world dominated by social media and a lack of confidentiality.

Nevis also has a great setup for asset protection tools, such as offshore bank accounts and offshore trusts, which are legal tools one can use to protect their wealth.

A crypto haven

Another reason Americans are flocking to St. Kitts & Nevis is the crypto-friendly nature of the country.

American cryptocurrency investors are finding it harder and harder to maintain their investments, as their nationality can be a hindrance in important coin offerings or mega crypto deals.

But it isn't just the challenging investment landscape, as the IRS is trying to crack down on cryptocurrency and is taxing cryptocurrency gains as it would stocks or bonds.

St. Kitts & Nevis does not impose capital gains tax, so that is an important point. But the overall perspective of the St. Kittian government towards cryptocurrency is what draws the likes of Roger Ver, maybe the most influential Bitcoin investor, to its shores.

Roger Ver gained a St. Kitts & Nevis citizenship through investment a few years back and has been living his life worry-free on the islands. He even claimed in a recent interview that not having to file tax returns, even if he did not have to pay anything, was one of the greatest feelings in the world due to the complexity of the tedious, time-consuming process.

Crypto investors like Roger will find a country that is welcoming towards cryptocurrency in St. Kitts & Nevis, as most of its banks deal with cryptocurrency investors, Bitcoin ATMs can be found throughout the nation, and the government is even part of the first union to launch an official digital currency dubbed D-Coin.

It is no wonder, then, why American cryptocurrency investors are heading over to the sunny shores of St. Kitts & Nevis.

For more information about St. Kitts & Nevis and how you can become a citizen through investment, contact Hepta Global today to book a free, comprehensive consultation with our CEO Chirag Giri. You can reach out to us via any of these routes:

Email at

Whatsapp/Signal/Telegram or Telephone at +17046590730

Chirag Giri

Hepta Global LP

+1 704-659-0730

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment