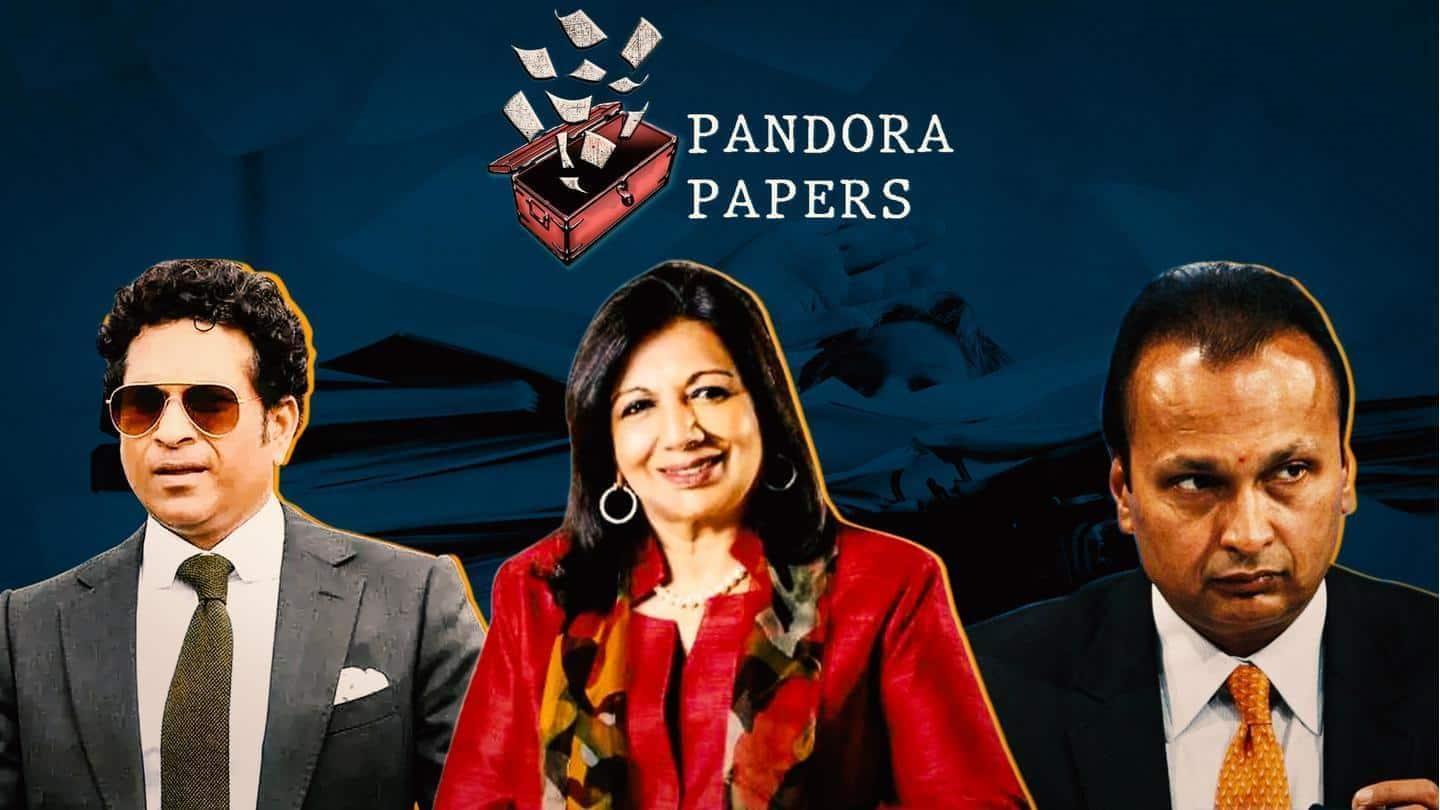

Pandora Papers probe begins I-T notices sent to Indians, NRIs

(MENAFN- NewsBytes) The Centre's investigation into the Pandora Papers revelations is gathering pace with the Income Tax Department sending notices to most Indians named in the exposé. Last month, an investigation by media organizations had revealed the hidden wealth of prominent individuals worldwide, including 300-plus Indians. The Multi-Agency Group (MAG) set up by the Centre to probe the case reportedly supervised the dispatch of notices.

Takeaways Why does this story matter?

The Centre had ordered a multi-agency probe into the Pandora Papers revelations on October 4. The Pandora leak reportedly revealed the offshore assets of over 100 billionaires, 30 world leaders, 300 public officials, among others; which includes as many as 380 Indians. It exposed a loophole that is tax evaders, fraudsters, and money launderers often exploit.

Details Notices sent under IT Act Section 131

The notices were sent under Income Tax Act Section 131, which deals with alleged concealment of income, The Indian Express reported. The notices were sent to NRIs named in the leaks to specify their residence status. They questioned whether the information on offshore accounts is accurate, which service provider was instrumental in establishing it, and whether their existence was disclosed while filing IT returns.

Information What is MAG?The MAG is headed by the Chairperson of the Central Board of Direct Taxes (CBDT). It also has representatives from the CBDT, Enforcement Directorate, Reserve Bank of India (RBI), and the Financial Intelligence Unit (FIU). It has already held two meetings, a member told TIE.

MAG How MAG is probing Pandora Papers?

Officials said the MAG has "exercised all channels" to probe the offshore data leak. Two important channels include Double Taxation Avoidance Agreement (DTAA) and the FIU. Through the DTAA route, it is obtaining information from jurisdictions with whom India has an exchange arrangement. Responses are also coming to the queries sent by the FIU to offshore jurisdictions figured in the Pandora Papers .

Investigation Probe ongoing against many named in Pandora leaksOfficials said many Indians named in Pandora Papers have previous charges of suspected tax evasion or concealment of foreign assets. An investigation against them is already underway. Several cases of individuals who also figured in previous offshore leaks—Panama Papers and the Paradise Papers—have been traced. The MAG has also asked CBDT and ED to pool their existing intelligence and action on those named.

Reason Why do people use offshore accounts?Many individuals park their money in offshore accounts or trusts in tax havens like Samoa, Belize, Cook Island, British Virgin Island, and Panama. Offshore accounts also help many promoters shield themselves from personal guarantees to loans that are defaulted by their businesses. Moreover, the fear of the return of estate duty (abolished in 1985) also led Indian industrialists to set up trusts.

Past 'Rs. 20,352 crore undisclosed credits detected'

Last month, the Centre had said that following previous leaks, such as HSBC, Panama Papers , and Paradise Papers, it had enacted the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. "Undisclosed credits of Rs. 20,352 crore approximately (status as on 15.09.2021) have been detected in the investigations carried out in the Panama and Paradise Papers," it had added.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment