Crude Oil Prices Struggle as Viral Resurgence Clouds Asia''s Demand Outlook

- struggled to hold gains amid viral concerns and weaker US data

- A new wave of Covid-19 outbreaks in the Asia-Pacific region adds uncertainty to the demand outlook

- faces a key resistance level at $ 66.5 – the 200% Fibonacci extension

Crude oil prices were muted during the Asia-Pacific mid-day session after surging 2.6% on Friday. Investors are concerned about a new wave of Covid-19 outbreaks in the Asia-Pacific region, which may overshadow a brighter energy demand outlook in the US, Europe and China. Viral resurgence may slow down the pace of economic recovery in the region as many Asian countries have made relatively slow progress on vaccination.

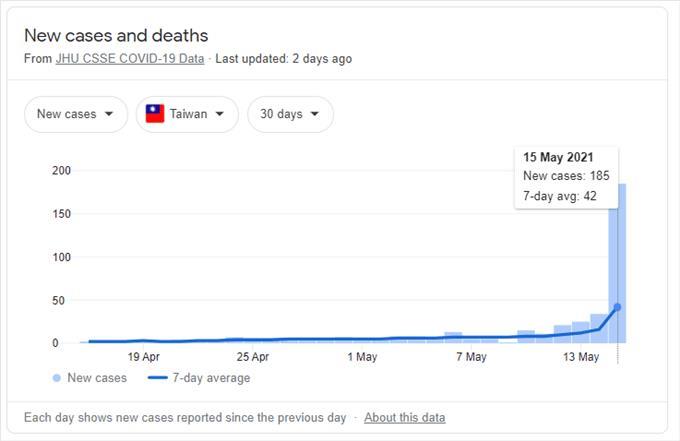

Taiwan and Singapore, which have handled the pandemic relatively well in 2020, reported surging Covid infections in the community. Both economies have entered partial lockdowns, resulting in panic selling in their stock markets. Mutant viral strains found in India appeared to be more contagious and fatal than the previous ones, rendering a fragile economic recovery vulnerable to backsliding. China has also tightened border controls and lengthened the quarantine period for inbound travelers in the wake of foreign outbreaks.

India and Japan, the world’s third- and fourth-largest oil importers respectively, are still struggling to contain the spread of the virus domestically. The complicated situation may continue to weigh on the energy demand outlook in the region.

Now the key question is whether the mutant viral strains will spread to other parts of the world and how much impact they could have. Sporadic cases showed that even people who have been fully vaccinated can still get infected by Covid-19.

On the bright side, the arrival of summer driving season in the US and Europe, alongside a strong economic recovery in China, may lend support to oil prices. US crude inventories have been falling in the past few weeks, underscoring strong demand. The restart of the Colonia Pipeline over the weekend could ease fuel shortages along the East Coast and buoy consumption.

New confirmed Covid-19 cases in Taiwan – Past 30 Days

Source: Google

Looking ahead, traders are eyeing Thursday’s meeting minutes and Friday’s US Markit Manufacturing PMI data for clues about the Fed’s take on inflation and the health of the US economy. Wednesday’s API inventory data will also be closely watched.

Technically, WTI appears to be hitting a key resistance at around 66.5 – the 200% Fibonacci extension level. WTI tried a few attempts to breach this level but didn’t succeed, suggesting that strong selling pressure may be persisting at this level. Prices remain in an ''Ascending Channel” formed since the end of March, showing that the overall trend remains bullish-biased.

The MACD indicator is flattening and may form a bearish crossover if prices drop, pointing to weakening upward momentum.

WTI Crude Oil Price – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or on Twitter

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment