India- PAN card verification: How to verify your PAN online

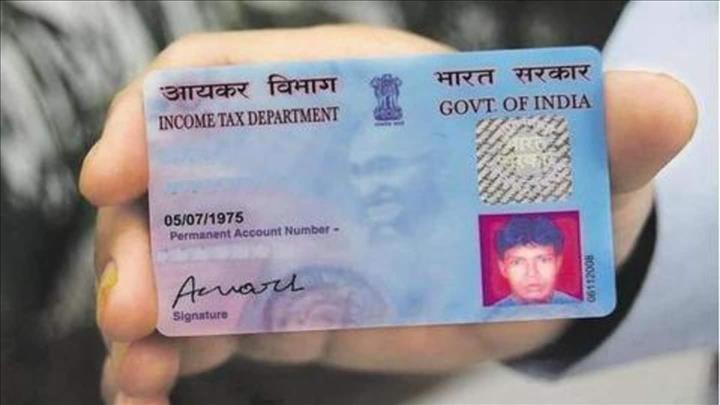

(MENAFN- NewsBytes) Permanent Account Number (PAN) is a unique, 10-digit alphanumeric identity allotted to all taxpayers in India by the Income Tax department.

It is essential for undergoing various financial transactions such as receiving taxable salaries/professional fees, sale or purchase of assets, trading of mutual funds, etc. It also serves as an important identity proof.

Here is how you can verify your PAN card online.

Online verification

Step-by-step procedure to verify your PAN card online

To verify your PAN card online, log on to the Income taxe-filing portal .

Enter details such as name, DoB, PAN number, and type of your PAN card viz., Individual, Company, Hindu Undivided Family, etc.

Once done, enter the Captcha code given in the portal and click on 'Submit' button.

Finally, your PAN card will be shown with the status of verification.

Bulk verification

This is the procedure for bulk PAN verification

For bulk PAN verification, register as a bulk PAN verification agency on the Income tax e- portal.

Then, go to the bulk PAN Query and click on 'Upload Query'.

Post the query in the specified format and click on 'Submit'.

Upon successful submission, a token number will be generated.

Finally, the status of the PAN uploaded through the query system will be displayed.

Love Business news?

Stay updated with the latest happenings.

Yes, notify Me

Interchangeability

Importantly, PAN and Aadhaar can now be used interchangeably

The Central government has now made PAN and Aadhaar cardinterchangeable .

This implies that you can now quote your Aadhaar number, instead of PAN, to file Income Tax returns.

Further, Aadhaar can also be used for other services where quoting of PAN is necessary, such as buying/selling financial instruments like MF, gold etc.

Note: August 31, 2019 is the last date to file ITR.

Linkage

Your PAN might get deactivated, if not linked with Aadhaar

Notably, the government is planning to temporarily invalidate all PAN cards that are not linked with Aadhaar latest by September 30, 2019.

The thought behind the move is that the government believes that if after so many extensions, your PAN isn't yet linked with Aadhaar, its authenticity is questionable.

Simply put, the government is skeptic that your PAN might be fake.

Procedure

Here's how you can link your PAN with Aadhaar

To link Aadhaar with PAN online, log on to the Income Tax e-portal.

Next, under the 'Quick Links' section, click on 'Link Aadhaar.'

Enter details such as Aadhaar number, PAN, name, and Captcha code.

Submit the details, click on 'Link Aadhaar', and you're done.

After successful verification from UIDAI, the linkage will be confirmed.

You can also link your PAN with Aadhaar via SMS.

You can also link your PAN with Aadhaar via SMS

Apart from the online method, users can also link their Aadhaar with PAN, using SMS service. To do so, type a text message in this format: UIDPAN (space) 12-digit Aadhaar number (space) 10-digit PAN, and send to 567678 or 56161 from your Aadhaar-registered mobile number.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment