Hammer Candlestick Patterns: A Trader's Guide

The hammer candlestick pattern is frequently observed in theforexmarket and provides important insight into trendreversals . It's crucial that traders understand that there is more to the hammer candle than simply spotting it on a chart.Price actionand the location of the hammer candle, when viewed within the existingtrend , are both crucial validating factors for this candle.

This article will cover:

What is a hammer candle pattern? Advantages and limitations of the hammer chart pattern Using a hammer candlestick pattern in trading Further reading on trading withcandlestickpatterns What is a Hammer Candlestick?The hammer candlestick is found at the bottom of a downtrend and signals a potential (bullish) reversal in the market.The most common hammer candle is the bullish hammer which has a small candle body and an extended lower wick – showing rejection of lower prices.The other pattern traders look out for is the inverted hammer, which is an upside-down bullish hammer.

Bullish HammerCandlestick

The hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. The hammer candle has a small body, little to no upper wick, and a long lower wick - resembling a 'hammer'.

The pattern indicates that the price dropped to new lows, but subsequent buying pressure forced the price to close higher, hinting at a potential reversal. The extended lower wick is indicative of the rejection of lower prices.

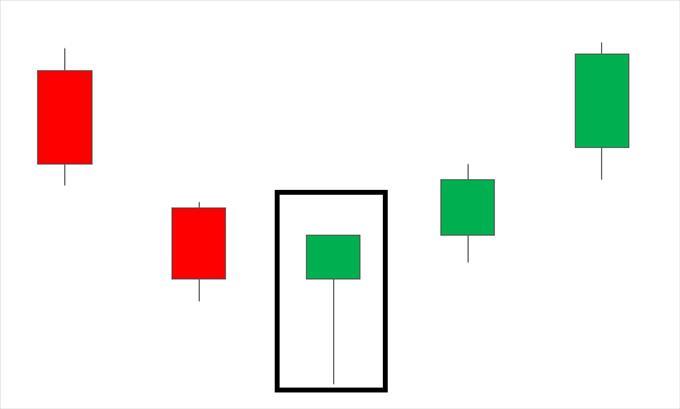

Inverted Hammer Candlestick

The inverted hammer candlestick, like the bullish hammer, also provides a signal for a bullish reversal. The candle is, as the name suggests, an inverted hammer. The candle has a long extended upper wick, a small real body with little or no lower wick.

The candle opens at the bottom of a downtrend before the bulls push price upwards – reflected in the extended upper wick. Price does eventually return down towards the opening level but closes above the open, to provide the bullish signal. Should the buying momentum continue, this will be seen in the subsequent price action moving higher.

Advantages and Limitations of the Hammer Candlestick

Advantages and Limitations of the Hammer CandlestickHammer candles have their advantages and their limitations; therefore, traders should never rush into placing a trade as soon as the hammer candle has been identified.

Advantages

Reversal signal: The pattern indicates the rejection of lower prices. When found in a downtrend it could signal the end of selling pressure and begin to trade sideways or reverse to the upside. Exit signal: Traders that have an existingshortposition, can viw the hammer candle as an indication that selling pressure is subsiding - presenting the ideal time to close out of the short position.Limitations

No indication of trend: The hammer candle does not take the trend into consideration and therefore, when considered in isolation, can provide a false signal. Supporting evidence: In order to enter into high probability trades, it is important for traders to look for additional information on the chart that supports the case for a reversal. Such confluence can be found by assessing whether the hammer appears near a major level ofsupport ,pivot point , significantFibonaccilevel; or whether an overbought signal is produced on theCCI ,RSIorstachastic indicator . Using Hammer Candles in Technical AnalysisThe following example of how to trade the hammer candlestick highlights the hammer candle on the weeklyEUR/USDchart.

Traders can make use of hammer technical analysis when deciding on entries into the market. Looking at a zoomed-out view of the above example, the chart shows how price bounced from newly created lows before reversing higher. The zone connecting the lows acts as support and provides greater conviction to the reversal signal produced by the hammer candlestick.

Stopscan be placed below the zone of support while targets can coincide with recent levels of resistance – provided a positiverisk to reward ratiois maintained.

Learn more about Trading with Hammer CandlesIf you are just starting out on your trading journey it is essential to understand the basics of forex trading in ourNew to Forextrading guide. The hammer candlestick is just one of many candlestick patterns that all traders should know. Improve your knowledge by learning theTop 10 Candlestick Patterns . For more information on reversal patterns, read our article onTrading the Bullish Hammer Candle .

Learn more about Trading with Hammer CandlesIf you are just starting out on your trading journey it is essential to understand the basics of forex trading in ourNew to Forextrading guide. The hammer candlestick is just one of many candlestick patterns that all traders should know. Improve your knowledge by learning theTop 10 Candlestick Patterns . For more information on reversal patterns, read our article onTrading the Bullish Hammer Candle .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment