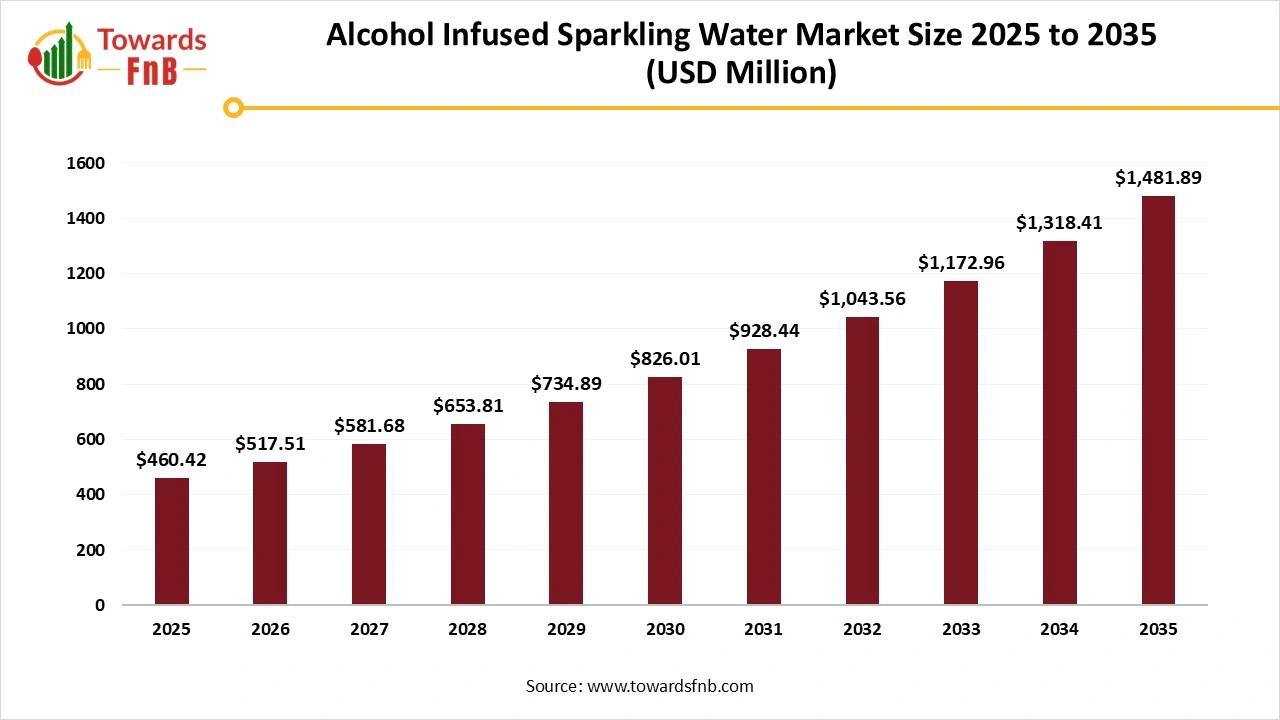

Alcohol Infused Sparkling Water Market Set To Grow At 12.4% CAGR Through 2035, Says Towards Fnb

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Alcohol Infused Sparkling Water (Malt-Based) | Carbonated water beverages containing alcohol derived from fermented malt bases | Neutral malt base, flavored variants | Ready-to-drink alcohol brands, retail beverage shelves | Malt-based hard seltzers |

| Alcohol Infused Sparkling Water (Sugar-Fermented) | Alcohol produced through fermentation of cane sugar or dextrose for a cleaner taste profile | Sugar-fermented alcohol base, low-carb variants | Premium RTD alcohol producers | Sugar-brewed hard seltzers |

| Spirit-Based Sparkling Water | Sparkling water blended with distilled spirits for controlled alcohol content | Vodka-based, gin-based sparkling waters | Craft beverage brands, on-premise offerings | Spirit-infused sparkling beverages |

| Flavored Alcohol Infused Sparkling Water | Alcoholic sparkling waters enhanced with natural or nature-identical flavors | Citrus, berry, tropical flavor variants | Mass-market and premium seltzer brands | Flavored hard seltzer lines |

| Unflavored or Neutral Seltzers | Minimalist formulations focused on low calories and clean taste | Plain or lightly carbonated variants | Health-conscious consumers, mixability use | Neutral hard seltzers |

| Low-ABV Sparkling Alcohol Waters | Reduced-alcohol formulations targeting moderation trends | Session-strength variants | Lifestyle alcohol brands | Low-ABV hard seltzers |

| Zero-Sugar Alcohol Infused Sparkling Water | Formulated without added sugars or sweeteners | Unsweetened, flavored-unsweetened variants | Low-calorie and keto-positioned brands | Zero-sugar hard seltzers |

| Functional Alcohol Infused Sparkling Water | Products incorporating functional cues alongside alcohol | Electrolyte-infused, vitamin-infused variants | Experimental and niche beverage brands | Functional hard seltzer products |

| Organic Alcohol Infused Sparkling Water | Made using certified organic alcohol bases and flavors | Organic-certified flavor lines | Organic and clean-label alcohol brands | Organic hard seltzers |

| Private Label Alcohol Infused Sparkling Water | Contract-manufactured products for retailers and distributors | Store-brand formulations | Retail chains, beverage distributors | Private-label hard seltzer products |

For Detailed Pricing and Tailored Market Report Options, Click Here:

Alcohol Infused Sparkling Water Market Dynamics

What are the Growth Drivers of the Alcohol Infused Sparkling Water Market?

The growing population of health conscious consumers is one of the major factors for the growth of the market. Hence, it leads to higher demand for options such as low-calorie, low-sugar, and other forms of healthier options. Higher demand for exotic and real-fruit flavor options also helps to enhance the growth of the market. Availability of ready-to-drink and convenient drink options, helpful for consumers with a hectic schedule, also helps to fuel the growth of the market. Rising disposable income, leading to higher demand for premium and customized options, also helps to fuel the growth of the market. Easy availability of different types of alcohol infused sparkling water on various platforms also helps to fuel the growth of the alcohol infused sparkling water market.

Regulatory Hurdles Impacting the Growth of the Alcohol Infused Sparkling Water Industry

Managing major alcohol laws, tax structures, and labeling requirements in different regions is one of the major factors disturbing the growth of the market. Keeping a tap on such rules and regulations and following them may turn out to be a costly and slow procedure, further affecting the market's growth. A few areas also have partial alcohol bans and 'dry days' to be followed, restricting the growth of the market.

Growing Health and Wellness Trends are helpful for the Growth of the Alcohol Infused Sparkling Water Market

The growing population of health and wellness-conscious consumers is one of the major opportunities for the growth of the market. Such consumers highly demand low-calorie and low-sugar options, further propelling the market's growth. Higher demand for exotic and natural fruit-flavor infused options is an ideal alternative to alcoholic drinks, further hampering the growth of the market. Higher demand for quality flavors, premium ingredients, and fortified options also helps to enhance the growth of the market. Such drinks are also an ideal option for alcohol, and are also light and refreshing for social occasions, fueling the growth of the market.

Alcohol Infused Sparkling Water Market Regional Analysis

North America led the Alcohol Infused Sparkling Water Market in 2025

North America dominated the alcohol infused sparkling water market in 2025 due to the growing population of health conscious consumers in the region, leading to higher demand for low-sugar and low-calorie options. Higher demand for convenient and ready-to-drink options also helps to enhance the growth of the market. Consumers in the region highly demand exotic and fresh fruit flavor options, which are attractive for consumers and helpful for the growth of the market.

Higher shift of consumers towards gluten-free and healthier options, such as hybrid seltzers and vodka-based seltzers, also helps to fuel the growth of the market. The US has a major contribution in the growth of the market due to higher demand for healthier, flavorful, and innovative alcohol infused sparkling water choices.

Asia Pacific is observed to be the fastest-growing region in the Foreseen Period

Asia Pacific is observed to be the fastest growing region in the foreseen period due to factors such as growing disposable income, rising health and wellness trendsEurope is observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to higher demand for healthier options that are low in calories, gluten-free, and low in sugar. Rising health and wellness trends, along with higher demand for exotic and natural fruit-flavor options, also help to fuel the growth of the market. Germany has a major contribution to the growth of the market due to the higher demand for innovative flavors that are easily available on various platforms in the region.

Trade Analysis for the Alcohol Infused Sparkling Water Market

What Is Actually Traded (Product Forms and HS Proxies)

- Alcohol-infused sparkling water beverages, typically containing fermented alcohol or distilled spirits blended with carbonated water, are commonly traded under HS 2206 (other fermented beverages) when produced via fermentation. Spirit-based ready-to-drink sparkling beverages, where alcohol is derived from distilled spirits such as vodka, are generally classified under HS 2208 when the alcoholic component defines the product. Malt-based hard seltzers, produced using fermented malt bases, are often declared under HS 2203 or HS 2206 depending on national customs interpretation. Flavor concentrates and alcohol bases supplied separately for local blending and carbonation are typically traded under HS 2106 or HS 3302 depending on composition. Bulk alcoholic bases for contract bottling, used by beverage brands to localize production, are usually cleared under HS 2207 or HS 2208.

Top Exporters (Supply Hubs)

- United States: Major exporter of branded hard seltzers and alcohol-infused sparkling waters supported by large-scale RTD beverage production and brand-led distribution. Canada: Exporter of malt- and spirit-based sparkling alcoholic beverages benefiting from established alcoholic beverage manufacturing and access to North American markets. United Kingdom: Exporter of premium alcohol-infused sparkling beverages aligned with RTD innovation and private-label production. Australia: Exporter of hard seltzers and low-alcohol sparkling beverages supported by domestic alcohol production and brand experimentation.

Top Importers (Demand Centres)

- United States: Significant importer of premium and niche alcohol-infused sparkling waters to complement domestic brand portfolios. European Union: Strong intra-EU and extra-EU imports driven by RTD category expansion and diversification of low-calorie alcoholic beverages. Japan: Imports flavored alcohol-infused sparkling beverages aligned with convenience retail and RTD consumption trends. South Korea: Growing imports linked to premiumization and rising demand for low-alcohol ready-to-drink beverages.

Typical Trade Flows and Logistics Patterns

- Finished canned or bottled beverages are shipped via containerized sea freight with attention to carbonation integrity and packaging durability. Regional contract manufacturing and co-packing are widely used to reduce freight costs and comply with local alcohol regulations. Bulk alcohol bases may be shipped separately and blended locally with carbonated water and flavors. Distribution often relies on alcohol-specific logistics networks and licensed importers.

Trade Drivers and Structural Factors

- Growth in ready-to-drink alcoholic beverages sustains cross-border trade in hard seltzers. Demand for low-calorie and low-sugar alcohol options drives product diversification. Brand-led innovation cycles encourage test launches across multiple markets. Regulatory differences influence whether finished beverages or bulk alcohol bases are traded. Packaging efficiency and shelf stability support long-distance distribution.

Regulatory, Quality, and Market-Access Considerations

- Alcohol-infused sparkling water is subject to national alcohol laws governing taxation, labeling, and permitted alcohol sources. Classification as beer, fermented beverage, or spirit-based drink affects tariffs and market access. Labeling requirements covering alcohol content, ingredients, and health warnings are mandatory. Importers must hold appropriate alcohol licenses and comply with excise control systems.

Government Initiatives and Public-Policy Influences

- Alcohol taxation structures and excise regimes strongly influence trade competitiveness. Public health alcohol policies affect product positioning and market access conditions. Trade facilitation agreements and customs harmonization impact cross-border beverage flows.

Alcohol Infused Sparkling Water Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 12.4% |

| Market Size in 2026 | USD 517.51 Million |

| Market Size in 2027 | USD 581.68 Million |

| Market Size in 2030 | USD 826.01 Million |

| Market Size by 2035 | USD 1,481.89 Million |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let's Talk-Schedule a Meeting with Our Insights Team:

Alcohol Infused Sparkling Water Market Segmental Analysis

Distribution Channel Analysis

The off-premise segment led the alcohol infused sparkling water market in 2025, due to factors such as higher demand for consumption of healthier alcoholic alternatives at home, higher disposable income, and a major shift in consumer preferences. The segment also observes growth due to the easy availability of such healthier choices at lower prices, which also helps in fueling the growth of the market. The segment also provides a variety of flavor options and products in different quantities, fueling the growth of the market.

The on-premises segment is expected to grow in the foreseen period due to the convenience provided by the online platforms, fueling the growth of the market. Online platforms also provide multiple other services such as quick home delivery, a huge product portfolio, and detailed information and reviews of different products, which are helpful for the growth of alcohol infused sparkling water market in the foreseeable period.

End Use Analysis

The offline sales segment led the alcohol infused sparkling water market in 2025, as the segment allows consumers to buy such products easily, and in case of impulse purchases. Easy availability of such products in the nearby supermarkets or liquor shops also helps to fuel the market's growth. Such stores also have a variety of other options in various flavors and in packages of different quantities, fueling the growth of the market. Huge displays depicting the availability of new products and new flavors are also a major factor fueling the growth of the market.

The online sales segment is expected to grow in the foreseeable period due to higher demand for different types of alcohol infused sparkling water in different flavor options. Higher demand for healthier options that are low in sugar, low in calories, and gluten free also helps to fuel the growth of the market. Such platforms also have ideal options for consumers searching for light and refreshing options that are perfect for after-office get-together cultures or for elite social gatherings.

Feel Free to Get in Touch with Us for Orders or Any Questions at: ...Additional Topics Worth Exploring:

- Tea Market: The global tea market Gluten Free Food Market: The global gluten free food market Organic Food Market: The global organic food market Canned Food Market: The global canned food market Dietary Supplements Market: The global dietary supplements market Canned Wines Market: The global canned wines market Plant-based Protein Market: The global plant-based protein market Frozen Food Market: The global frozen food market Beverage Packaging Market: The global beverage packaging market Vegan Food Market: The global vegan food market Food Additives Market: The global food additives market size Coconut Products Market: The global coconut products market

Top Companies of Alcohol Infused Sparkling Water Market

- Asahi Group Holdings Ltd. Brown-Forman Corp. Carlsberg A/S Coca-Cola Co. Diageo Plc E. & J. Gallo Winery Heineken NV Kirin Holdings Co. Ltd. Mark Anthony Brands Molson Coors Beverage Co. Naked Collective Ltd. PepsiCo Inc. Pernod Ricard SA Phusion Projects LLC Polar Beverages Suntory Holdings Ltd. White Claw Seltzer Works

Segments Covered in the Report

By Distribution Channel

- On-Premise Off-Premise

By End-User

- Online Sales Offline Sales

By Region

North America

- U.S. Canada

Asia Pacific

- China Japan India South Korea Thailand

Europe

- Germany UK France Italy Spain Sweden Denmark Norway

Latin America

- Brazil Mexico Argentina

Middle East and Africa (MEA)

- South Africa UAE Saudi Arabia Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific-are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: Feel Free to Get in Touch with Us for Orders or Any Questions at: ... Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It's your strategic edge in the food and beverage industry:About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we'll navigate this transformative journey.

Web:Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials | Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals AnalyticsFor Latest Update Follow Us:

LinkedIn Medium TwitterDiscover More Market Trends and Insights from Towards FnB:

➡️ Beverage Flavors Market: insights/beverage-flavors-market ➡️ Salt Market: insights/salt-market ➡️ Probiotic Food Market: insights/probiotic-food-market ➡️ Protein Bar Market: insights/protein-bar-market ➡️ Gluten-Free Bakery Market: insights/gluten-free-bakery-market ➡️ Europe Nutraceuticals Market: insights/europe-nutraceuticals-market ➡️ Canned Food Market: insights/canned-food-market ➡️ Non-Alcoholic Beverages Market: insights/non-alcoholic-beverages-market ➡️ Dry Fruit Market: insights/dry-fruit-market ➡️ Frozen Meat Market: insights/frozen-meat-market ➡️ Fish Oil Market: insights/fish-oil-market ➡️ Soft Drink Concentrates Market: insights/soft-drink-concentrates-market ➡️ Meal Kits Market: insights/meal-kits-market ➡️ Ethnic Food Market: insights/ethnic-food-market

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment