Hungary's Inflation Rollercoaster Ride Has Begun

| 3.8% |

Headline inflation (YoY)

ING estimate 3.7% / Previous 4.3% |

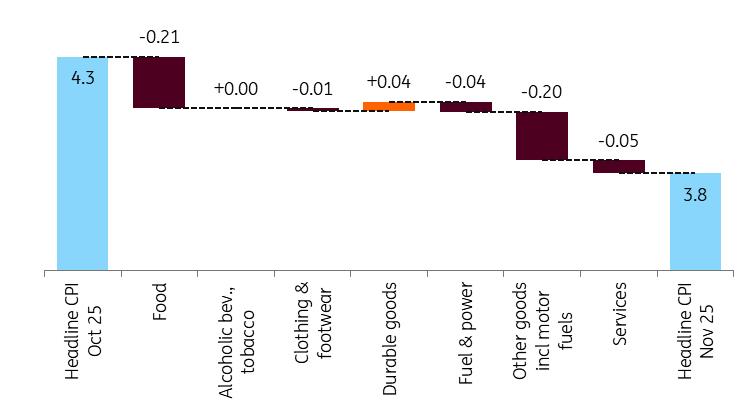

The average price level changed only minimally in November following three months of stagnation, according to recent data released by the Hungarian Central Statistical Office (HCSO). This is broadly in line with expectations. Due to a 0.1% increase in prices in November and a high base last year, the year-on-year index decreased significantly to 3.8%.

So, despite the Hungarian economy having stagnated for three years and the government having introduced measures to curb inflation, Hungary is still facing issues with price stability.

Main drivers of the change in headline CPI (%)

Source: HCSO, ING The details

-

In the case of food items, the HCSO recorded a 0.2% increase in November, indicating that the downward monthly trend in prices had stopped. Significant monthly price increases were observed in both unprocessed (e.g., vegetables) and processed food (e.g., preserved foods).

Tobacco products continued to become more expensive due to changes in excise duty. The strength of the forint is keeping price increases in check for durable consumer goods, where prices rose by only 0.2% month-on-month.

While clothing prices rose, this was counterbalanced in the general price level by the moderation of household energy prices. Monthly inflation was also held back by a 0.6% fall in fuel prices.

Perhaps the biggest surprise came in the services sector, where average prices fell by 0.1%, rather than rising slightly as usual. Prices for domestic holiday packages and transport services (mainly airline tickets) fell more than usual. It was essentially tourism-related services that pulled down the price index.

Source: HCSO, ING Core inflation is still inconsistent with the target

However, despite the long-standing moderate monthly inflation rate, the underlying trends are unfavourable. The slowdown in November's inflation was largely due to base effects in food and fuel prices. Another telling example is that only in the case of durable consumer goods did we see a significant year-on-year increase in the inflation rate compared to the previous month. Stores offered fewer and smaller discounts as part of Black Friday promotions this year.

This is evident in the core inflation indicator, which, despite declining slightly to 4.1% YoY, remains inconsistent with the central bank's 3% price stability target. In terms of inflationary pressures, two main items continue to account for 70% of price increases: rising service costs and food prices. It is interesting to note the extent to which lower-than-expected price reductions in November affected perceived inflation. The latest data on households' inflation expectations shows that the previous slight downward trend has stalled. Price expectations therefore remain too high to achieve price stability.

It is also important to note that, according to the National Bank of Hungary, inflation of industrial goods and market services without the price shield measures would have been 5.6% YoY, which is a clear hawkish remark in the central bank's monthly inflation data assessment.

Headline and underlying inflation measures (% YoY)

Source: HCSO, ING Many things will start in January, but not the cutting cycle

Looking ahead, the inflation rate may continue to decline in the coming months due to base effects. The extent of this decline will depend largely on the impact of the latest margin freeze expansion, which will be evident in the December inflation indicator. In contrast, the recent surge in the price of computer equipment may also have a noticeable effect. Still, it's quite possible that we will see an inflation rate of less than 2% in February, after which inflation could accelerate again.

The average rate of price increases next year will be greatly influenced by the future of price shield measures. However, another extension is likely, given that the current measures expire at the end of February. We expect the average inflation rate to be around 3.4% next year and around 4.3% in 2027. We expect inflation to peak again at the turn of 2026–2027, when it will temporarily rise to around 4.5-5.0%.

In light of all this, the tight monetary policy stance and the base rate are likely to remain unchanged in the short term. There is a significant chance that the benchmark rate will remain at 6.50% for most, if not all, of 2026. This is because the Hungarian economy may be subject to shocks over the next one to two years that carry clear inflationary risks, such as government demand stimulus, the removal of price shield measures, and double-digit minimum wage increases.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment