403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Best 7 Data Center Stocks In December 2025 (Chart)

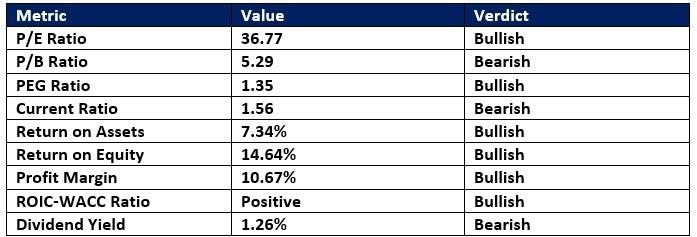

(MENAFN- Daily Forex) The emergence of AI has driven demand for data center stocks, ushering in a new technological revolution are Data Center Stocks?Data center stocks refer to publicly listed companies that are actively involved in building and operating data centers. These companies are active in construction, power generation, thermal management, and data center operations. There are power-hungry, massive, warehouse-like buildings that house servers and related technology powering AI, the internet, and everything in the cloud Should You Consider Investing in Data Center Stocks?Data centers are not a new investment phenomenon, as the internet requires them to operate. The breakthrough in AI adoption in 2022 created a demand boost, as hyperscalers require massive data centers for AI-related operations. The data center market is on track to exceed $600 billion by the end of 2030, as part of the multi-trillion AI sector, with annualized double-digit growth rates.Here are a few things to consider when evaluating data center stocks:

- Research data center stocks with revenue growth over the past three years. Diversify your data center portfolio with companies that construct data centers, provide thermal management, and server components. Mix your data center stock portfolio with companies involved in electricity generation. Analyze the balance sheet and avoid high-debt data center stocks. Check the Power Utilization Effectiveness (PUE), a core indicator of how efficiently the data center operates, together with occupancy rates

- Super Micro Computer (SMCI) Modine Manufacturing (MOD) TE Connectivity (TEL) Corning (GLW) Vertiv Holdings (VRT) Flex (FLEX) Equinix (EQIX)

- The TEL D1 chart shows price action breaking out above its ascending 61.8% Fibonacci Retracement Fan level. It also shows TE Connectivity breaking out above a horizontal support zone. The Bull Bear Power Indicator is bearish with an ascending trendline, nearing a bullish crossover.

- TEL Entry Level: Between $224.18 and $227.64 TEL Take Profit: Between $270.47 and $278.58 TEL Stop Loss: Between $205.30 and $210.80 Risk/Reward Ratio: 2.45

- The GLW D1 chart shows price action breaking out above its ascending 50.0% Fibonacci Retracement Fan level. It also shows Corning breaking out above a horizontal support zone. The Bull Bear Power Indicator turned bullish with an ascending trendline.

- GLW Entry Level: Between $82.82 and $84.59 GLW Take Profit: Between $97.98 and $102.87 GLW Stop Loss: Between $75.77 and $76.15 Risk/Reward Ratio: 2.15

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment