Tejon Ranch Co. CEO Issues Letter Ahead Of Investor Engagement Event

Primary

| Secondary

|

We find that the roll-up of our operations is best measured with metrics such as Adjusted EBITDA. This measures cash flow and is a better indicator of performance of our overall portfolio than Net Income (though we remain vigilant about our earnings per share). We've also received feedback that many of our shareholders look at performance in a similar way. Going forward, we will be enhancing our earnings releases with supplemental financial information that better reflects how we evaluate and manage our investments. By focusing on improving these measures, we anticipate that our Total Shareholder Return will improve materially.

Tracking Investment Performance

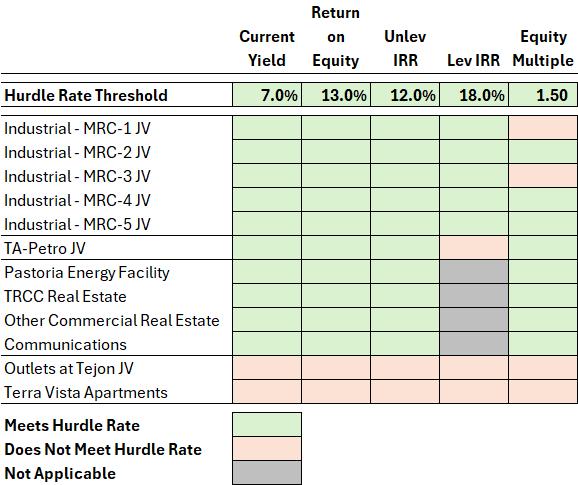

The best way to chart a path forward is to understand where we've been. At Tejon Ranch Company, that means analyzing the performance of our existing investments against our hurdles and then changing course or divesting from those investments which do not provide acceptable returns, and increasing our capital investment in those which outperform. The chart below is a summary of the investment return metrics for our existing revenue generating investments, with hurdles achieved shown in green.

When I look at the investment scorecard, the results are clear. The vast majority of the capital deployed into implemented projects has generated results which exceed our hurdle rates, validating the discipline of our approach.

There are exceptions, notably the Outlets at Tejon and the Terra Vista apartments. Both are pioneering efforts that carry strategic importance for TRCC and create demand and land value premiums elsewhere at TRCC. Today, the synergy between these assets is beginning to take hold, setting the stage for material growth in the future. The apartments drive additional retail traffic, and the outlets have been a catalyst for the growth of TRCC's restaurants, hotels and travel centers and have enhanced the value of our residential community. Collectively they make TRCC a more attractive industrial hub.

Our successful track record is a model for the future and gives me confidence that we are allocating capital to income-producing assets in a way that positions Tejon Ranch for sustained growth.

Going forward, we'll continue to use joint ventures for capital-intensive projects to avoid dilution and to leverage our partners' specialized expertise. For smaller, high-yield opportunities, our goal is to invest directly from our balance sheet. We'll continue to screen projects to ensure that they meet our investment hurdles which are designed to protect per-share value.

The Road Ahead

As we look ahead, I've heard the urgency from our shareholders that the future is now: strategic implementation, tighter costs, improved operating margins, disciplined capital, and a credible path to returns. In response, we've organized our efforts around four investor-facing priorities, our strategic pillars: Income, Growth, Governance, and Culture. These pillars are designed to guide our actions and drive earnings improvement over the next several quarters. Let me say a few words about each one.

1. Income: Demonstrate Positive Incremental Earnings

To drive incremental income growth from operations, we must focus on increasing revenues and decreasing costs. Below is a discussion of both.

Revenue Growth

Our first priority is to grow earnings from our operating businesses-TRCC, new revenue opportunities, minerals, water and farming. These platforms generate cash today, and we're optimizing them to generate more tomorrow.

Focus on TRCC

I want to reaffirm our core strategy to focus capital investment on TRCC, pursuing additional industrial development, on balance sheet if possible, plus capitalizing on opportunistic investments which become available. At TRCC, we have proven success plus a considerable runway of 11 million square feet of remaining entitled density. Moreover, as I mentioned above, there is a flywheel effect between industrial, retail and residential investment. To be absolutely clear, future investment in TRCC must be market driven. Controlling the market (as we do), maintaining high occupancy and limiting future supply are all crucial considerations for sustained long term value creation.

On the Horizon: New Revenue Opportunities

Over the past several months, management has completed an exploratory process to identify new revenue sources that take advantage of the unique attributes of the Ranch and produce recurring Adjusted EBITDA. The strongest candidates are those with the lowest capital requirement and which produce the highest yielding cash flow stream with the greatest predictability in the shortest amount of time with the least risk.

The chart below categorizes a wide range of existing and contemplated investments, weighing the revenue potential against the capital investment and resulting yield on cost for each opportunity. Scale matters, so we must prioritize those investments which move the needle the most or which can be implemented and managed with the most efficient use of resources.

The best opportunities are those which are up and to the right. These include ground leases and royalty agreements covering approved land uses and requiring minimal capital. Indeed, there is rarely a free lunch, and most promising ideas are also the most difficult to source and typically come with strings attached – approval challenges, restrictions under existing agreements, not enough revenue for considerable effort, or significant capital requirements. We must cast a wide enough net to catch some fish while differentiating the signal from the noise so that we avoid going down too many rabbit holes. We are optimistic about our investigations into several categories of revenue growth including utilities, energy, recreation, land monetization and commercial real estate. We look forward to reporting on these as they progress.

Existing Land Monetization Efforts

Our oil and gas rights provide royalty income tied to production volumes and commodity prices, while aggregate and other minerals generate cash through easements and extraction royalties from third-party operators. We remain hopeful that recent State permitting reforms will lead to an increase in oil and gas extraction on Tejon's properties.

Water is one of our most critical resources for future development. Our long-term water rights and contracts provide the foundation for future growth, while strategic water sales help offset the costs of carrying those rights and contracts. There are also several opportunities in the early stages of development where we are looking to leverage our existing water infrastructure to generate additional cash flow.

A Word about Farming

Several shareholders have questioned our farming operations given the reported losses. When measured by cash flow (Adjusted EBITDA) rather than GAAP income (which includes significant non-cash depreciation and yielded farming operating income of $8.1M since 2013 with a 4% margin), farming has generated Adjusted EBITDA before fixed water obligations of $61.3M over 12 years with a 21% margin. These returns exceed our hurdle rates. We will continue evaluating each crop's economics, but farming remains a portfolio diversifier and supports the water contracts that will ultimately support our residential communities.

Reducing Overhead Costs

As CEO, I must ensure that we spend wisely and foster a culture that remains cost-conscious. Since coming on board in April 2025, I've led our team through tough but necessary decisions to improve operating margins and sharpen execution. Most notably, in September we completed a workforce reduction that resulted in more than $2M in annual payroll savings. This reduction, which impacted approximately 20% of our team, affected all levels of the organization. The cuts were difficult but necessary.

I have been challenged by some investors to make deeper reductions. Keep in mind that nearly half of our team works in farming, landscaping and Ranch operations. These are jobs necessary to maintain the 270,000 acre Ranch, and while the positions could potentially be performed by contractors, we are unlikely to save money and would almost assuredly lose control over this essential function.

Additionally, I have been told that we have too many real estate executives. I've scrutinized this carefully. In my past, I have personally asset managed sizable portfolios with a concentrated staff. This isn't that. We're actively and principally developing and operating several complex projects simultaneously: industrial, retail, residential and other commercial assets in TRCC, three MPCs in different regulatory jurisdictions, dozens of long-term participating contractual relationships, farming and ranch operations plus pursuing new opportunities. After benchmarking against comparable companies and analyzing workload, I'm confident we're appropriately staffed at present. I am constantly evaluating our efficiency against our needs as our business continues to evolve.

We have also worked hard to reduce overhead costs. For example, we have comprehensively evaluated our legal resources and have made several key changes. After an extensive interviewing process, we are convinced that moving forward we are well represented by firms whose billing rates are a fraction of what we were previously paying. We have similarly brought down our audit costs and are in the process of addressing our insurance costs. In total, in addition to our payroll savings, we are targeting a savings of $1.5M next year in recurring overhead between our segments and corporate expenses.

2. Growth: Honor the Land and Invest for Long-Term Value Creation

I know some of you believe we should sell our Mountain Village and Centennial land, return capital to shareholders and/or repurchase shares, and focus exclusively on building out TRCC. I've considered this idea carefully, and here's why I believe a more nuanced approach creates greater value.

Below are the concerns that I have heard from shareholders about our MPC strategy, as well as our response:

Shareholder Concerns with MPC's

| Company Response

|

We have a specific strategy for each community:

- Grapevine: This year, we have been advancing a business plan for the initial phase of the fully entitled 12,000 unit Grapevine project in planning area 6A, leveraging existing TRCC infrastructure and critical mass to initiate the flywheel on our existing industrial, retail, outlet and multifamily assets. We are confident our concept will resonate in the Kern County market. Grapevine's entitlement includes an additional 5.1 million square feet of commercial and industrial uses as well. Following Board evaluation and a mapping and permitting process which we estimate will take approximately 24 months, we intend to capitalize the first phase of Grapevine with a JV partner who would fund the new equity without dilution. The JV would implement construction of a master planned community with homes serving residents primarily of Kern County. Anticipated distributions to the Company during the sellout of the initial phase of Grapevine are expected to be orders of magnitude higher than the Company's current earnings, showing the power of the residential development. We look forward to sharing more details about Grapevine as the project progresses. Mountain Village: We intend to raise capital for the 3,450 unit fully entitled Mountain Village project, seeking a joint venture equity partner who would fund the go-forward equity without dilution. For an approximate timeline and subject to a variety of factors and market conditions, we estimate that the JV would complete construction documents over a projected 18 to 24 month period, then break ground on the initial phase of horizontal infrastructure which would take approximately 24 months, and then initiate homesite sales to builders and custom lot buyers. A finite amount of capital would be spent prior to closing the JV (under $1M) and only what is necessary to advance permitting or compliance and present the project to prospective investors. While the Company has been unsuccessful in its capital raising to date, I am confident that with my 25-year background in conceptualizing, capitalizing and developing luxury master planned resort communities, we will achieve a positive outcome. Centennial: Following the appellate court rescission of our project approvals, we considered several alternatives for Centennial, including a strategic disposition. The best available option which preserves our investment in Centennial is to file amended project entitlements addressing the court's specific concerns. The number of contested topics has been substantially reduced, and we have responsive plans addressing each issue. Moreover, following our anticipated submittal of updated supplemental environmental documentation within the next several months, we are optimistic that Los Angeles County will again support and approve our effort next year, and we remain optimistic that ongoing CEQA reform will further streamline the process for approvals. Upon approval and successful defense, we'll have a valuable asset with 19,333 units and 10.1 million square feet of commercial entitled density in Los Angeles County with considerable optionality.

I would like to emphasize that my approach to all of our investments, including our MPC's, is that there are no sacred cows and we must objectively consider any and all options for every asset in the best interests of our shareholders.

3. Governance and Communications: Respect Shareholders and Be Transparent

During my time as CEO, I've enjoyed working with our Board, individually and collectively. I've found them to be extremely thoughtful, diverse in their backgrounds and deeply caring with respect to the Company and its long-term interests. They have provided me with valuable input to make informed decisions about the Company.

Nonetheless, our governance can be improved and streamlined in the same way that we're addressing our management team. We've taken several steps already, including adding depth to our Board's Executive Committee and naming committee vice chairs to ensure seamless succession.

Looking ahead to the upcoming 2026 proxy and annual shareholder meeting, the Board has instructed the Nominating and Governing Committee to start the process to evaluate both the reduction of the number of directors elected at the May 2026 shareholder meeting as well as the elimination of the Executive Committee. I will report on this topic as the process unfolds.

We have also heard from shareholders about the desire to have a special meeting if requested by a certain percentage of shareholders. The Board has discussed this topic and will be proposing a special meeting right with a 25% threshold which would appear in the proxy statement for shareholder consideration at the 2026 annual shareholder meeting. The majority of public companies with a special meeting right have set the ownership threshold at 25%.

We're also finalizing our executive compensation plan for 2026 to better align with market expectations and shareholder priorities. This plan will be presented to the Board for approval this December and implemented next year. Additionally, I have deferred and partially reduced a portion of my sign-on incentive as part of our cost streamlining effort.

We have taken several positive steps forward as to how we report and communicate to you, our shareholders. This includes hosting our first quarterly earnings call on November 6th and our Investor Engagement Event on November 14th. As I noted above, we are enhancing our earnings releases with supplemental financial information to provide greater transparency into the Company's operations, including Adjusted EBITDA by segment and JV earnings. This effort will help shareholders gain a clearer understanding of each segment's performance. We also intend to hold an in-person/hybrid annual shareholder meeting in 2026 for those shareholders who want to participate, and will offer tours of our assets on the Ranch.

4. Culture: Foster a Cohesive Atmosphere to Drive Performance

Finally, we're building a team that's engaged, entrepreneurial, and focused on results. I recognize that workforce reductions can impact morale, which is why engagement is more important than ever. In a leaner organization, performance depends on a highly-functioning, motivated team.

I believe in experimentation, taking ownership, and doing things the right way. Together with senior management, we're cultivating a culture that reflects our shared commitment to succeed and deliver the outcomes our shareholders expect. After reviewing our organization, I'm confident that this is the team we need to win.

What to Expect and When

Accountability requires measurable milestones. Here's what you should expect over the next 18 months:

- Q1 2026: Enhanced supplemental financial information reporting Q2 2026: Board size reduction at Annual Shareholder Meeting Q3 2026: Progress update on Grapevine planning; additional TRCC investments Q4 2026: Year-over-year cost savings fully realized 1H 2027: Mountain Village capital raise process culminates

These aren't aspirations, they're commitments I'm making to you today.

In Closing: Accountability and Action

I've spent eight months exploring the literal and figurative landscape of our Company. Today we stand at a crossroads. Once as an Assistant Scoutmaster, I successfully chased down the hiking boot of a Boy Scout who attempted (unsuccessfully) to throw his only footwear across a waist deep river on Day 2 of a ten-day backpack trip. A road nearly poorly taken. My job is to learn from past mistakes, both my hiking misadventures and our Company's strategic decisions, and chart a wiser course forward.

My goal in this letter is to show you how I intend to lead Tejon Ranch Company down a path toward success. It starts with having a clear framework for capital allocation by establishing investment hurdles and analyzing our existing investment performance. Our plan focuses on prioritizing the four strategic pillars of income, growth, governance and culture. We are scouring the land in search of new revenue sources and have made the right steps to reduce our overhead so that we can implement our plan with maximum impact on the bottom line.

I know some of you want faster transformation and more change. I'm balancing two imperatives: first, moving quickly enough to be opportunistic and to enact meaningful change, and second, being deliberate enough to avoid missteps that would set us back. We're making fundamental progress today that we expect will compound over the coming quarters. I'm confident you'll see material results within the timeframe I've outlined.

You've watched this company for years, sometimes decades, and you have reason to be skeptical. This year's contested election has made clear that the status quo is unacceptable. I've heard that message. If we haven't delivered improved Adjusted EBITDA, new revenue streams, and momentum on our MPC partnerships by this time next year, I'll be the first to acknowledge it and adjust course. That's my commitment to you.

Sincerely,

Matthew H. Walker

President and Chief Executive Officer

Tejon Ranch Company

Forward-Looking Statements

This letter contains forward-looking statements within the meaning of the federal securities laws. Generally speaking, any statement not based upon historical fact is a forward-looking statement. In particular, statements regarding the Company's business plans, strategies, prospects, objectives, milestones, future operating results, financial condition, expectations regarding capital allocation, cost savings, share repurchases, entitlement and development timelines, partnerships, regulatory reforms, and other future events or circumstances are forward-looking statements. These statements reflect the Company's current expectations and beliefs about future developments and their potential effects on the Company. Forward-looking statements are not guarantees of performance and speak only as of the date of this letter.

Words such as“anticipate,”“believe,”“estimate,”“expect,”“intend,”“plan,”“project,”“target,”“can,”“could,”“may,”“will,”“should,”“would,”“likely,”“improve,”“commit,” and similar expressions, as well as discussions of strategy, objectives, and intentions, are intended to identify forward-looking statements. These statements are based on current assumptions and involve known and unknown risks, uncertainties, and other factors-many of which are beyond the Company's control-that could cause actual results to differ materially from those expressed or implied. Such factors include, but are not limited to, market, economic, geopolitical and weather conditions; the availability and cost of financing for land development and other activities; competition; commodity prices and agricultural yields; success in obtaining and maintaining governmental entitlements and permits; the timing and outcome of regulatory or litigation processes; demand for commercial, industrial, residential, and retail real estate; and other risks inherent in real estate and agricultural operations.

No assurance can be given that actual results will not differ materially from those expressed or implied by these forward-looking statements. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events, or otherwise. Investors are cautioned not to place undue reliance on these forward-looking statements. For a discussion of risks and uncertainties that could cause actual results to differ, please refer to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and subsequent filings with the U.S. Securities and Exchange Commission.

Non-GAAP Financial Measures

EBITDA represents earnings before interest, taxes, depreciation, and amortization, a non-GAAP financial measure, and is used by us and others as a supplemental measure of performance. We use Adjusted EBITDA to assess the performance of our core operations, for financial and operational decision making, and as a supplemental or additional means of evaluating period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as EBITDA, excluding stock compensation expense. We believe Adjusted EBITDA provides investors relevant and useful information because it permits investors to view income from our operations on an unleveraged basis, before the effects of taxes, depreciation and amortization, and stock compensation expense and other items impacting comparability. By excluding interest expense and income, EBITDA and Adjusted EBITDA allow investors to measure our performance independent of our capital structure and indebtedness and, therefore, allow for a more meaningful comparison of our performance to that of other companies, both in the real estate industry and in other industries. We believe that excluding charges related to share-based compensation facilitates a comparison of our operations across periods and among other companies without the variances caused by different valuation methodologies, the volatility of the expense (which depends on market forces outside our control), and the assumptions and the variety of award types that a company can use. In addition, the Company excludes other items impacting comparability to provide a clearer understanding of its core operating performance. EBITDA and Adjusted EBITDA have limitations as measures of our performance. EBITDA and Adjusted EBITDA do not reflect our historical cash expenditures or future cash requirements for capital expenditures or contractual commitments. While EBITDA and Adjusted EBITDA are relevant and widely used measures of performance, they do not represent net (loss) income or cash flows from operations as defined by GAAP. Further, our computation of EBITDA and Adjusted EBITDA may not be comparable to similar measures reported by other companies.

Reconciliation of Adjusted Farming EBITDA before Fixed Water Obligations

The Company evaluates the performance of its farming operations using Adjusted Farming EBITDA before fixed water obligations, a non-GAAP financial measure. Management believes this measure provides a meaningful representation of the underlying profitability and cash flow potential of its agricultural operations by excluding both non-operating items and the fixed water obligation, which represents a non-controllable infrastructure cost incurred regardless of the level of farming activity in this segment.

The fixed water obligations reflect the Company's allocated share of infrastructure and financing costs associated with the transmission and delivery of water to the Company's property. These obligations primarily consist of annual assessments levied to repay bonds issued by the State of California to finance the construction and on-going maintenance of the state water project system and local water districts water systems. The landowners who hold water rights, including the Company, are responsible for repaying these bonds through fixed annual payments.

Unlike variable water costs which are included in farming expenses, management views the fixed water obligation as an infrastructure cost that supports long-term access to water resources, rather than an essential operating cost of farming. Accordingly, Adjusted Farming EBITDA before fixed water obligations allows management and investors to evaluate the operating performance of the Company's farming segment independent of the fixed costs associated with water infrastructure.

| FY2013 – FY2024 Cumulative Total | |||

| Farming revenues | $208,084 | ||

| Farming expense | 199,928 | ||

| Farming operating income | 8,156 | ||

| Add: Depreciation and amortization | 23,300 | ||

| Add: Stock compensation expense | 2,365 | ||

| Adjusted EBITDA | 33,821 | ||

| Add: Fixed water obligation | 27,474 | ||

| Adjusted EBITDA before fixed water obligation | $61,295 | ||

| (thousands of dollars) | |||

About Tejon Ranch Co.

Tejon Ranch Co. (NYSE: TRC) is a diversified real estate development and agribusiness company, whose principal asset is its 270,000-acre land holding located approximately 60 miles north of Los Angeles and 15 miles south of Bakersfield.

More information about Tejon Ranch Co. can be found on the Company's website at .

Contact:

Nicholas Ortiz

Senior Vice President, Corporate Communications & Public Affairs

...

(661) 331-0313

Photos accompanying this announcement are available at:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment