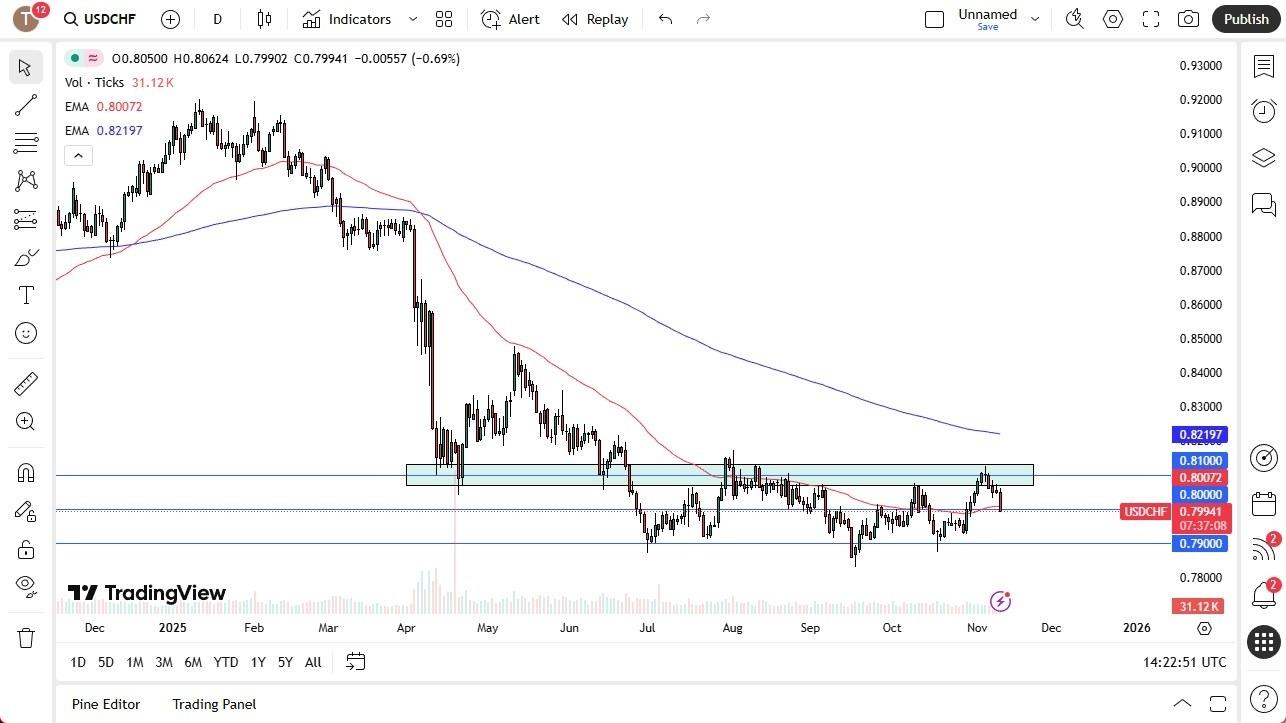

USD/CHF Forecast Today 12/11: Falls Sharply (Chart)

- The US dollar fell sharply against the Swiss franc on Tuesday but remains within a broad consolidation range. Support sits near 0.79, and a breakout above 0.8150 could spark bullish momentum, especially with potential SNB intervention looming.

That being said, even if we do fall from here, there's a very strong possibility that the 0.79 level is going to continue to offer support. The market has been in a 200-pip range for months now, and it looks as if we are going to plunge toward the bottom of that range. Quite frankly, I like the idea of buying the US dollar at the first signs of a bounce, and at one point over the last five or six sessions, it almost looked like the US dollar was ready to take off against the Swiss franc.

EURUSD Chart by TradingViewI don't think this is a move of fear, as in people running to the Swiss franc. I think this is more about the US dollar, as it's fallen against many of its other contemporaries during the session on Tuesday. Keep in mind that both of these are considered to be safety assets, so this typically tends to be a little bit of a slow-moving pair. But I also recognize that if we could break above the 0.8150 level, then the market is likely to really take off to the upside. This would bode well for the US dollar against other currencies.So, while you do get paid to hang on to the US dollar in this pair, and that's something that I've taken advantage of, I suspect that if we really take off here, we probably see the US dollar beat up on everything. Ultimately, I have no interest in shorting because the Swiss National Bank has recently stated that it is watching the FX markets and seeing whether or not the markets are getting out of control. In other words, the Swiss National Bank could be waiting on the sidelines to intervene yet again and short its own currency to keep the value of the franc down.Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment