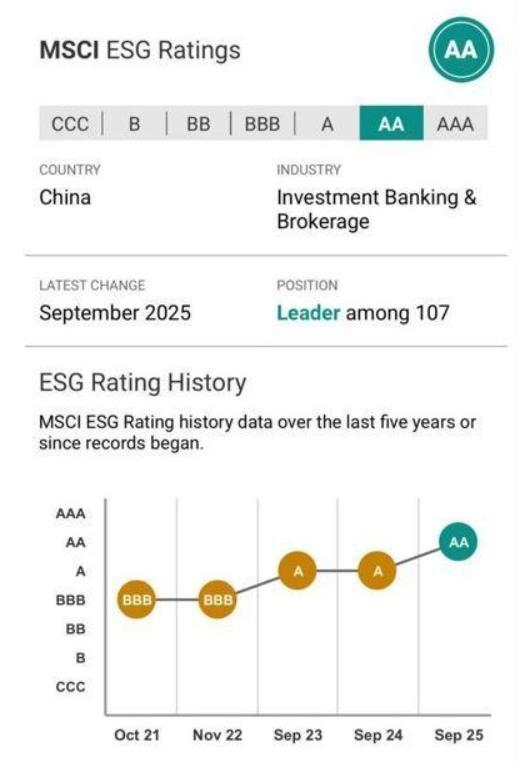

China Securities Co., Ltd. Achieves Another Upgrade In MSCI ESG Ratings, Now Rated AA

MSCI, the international index provider, recently released its 2025 ESG (Environmental, Social and Governance) rating for China Securities Co., Ltd. (601066; 6066). The Company's rating was raised from“A” to“AA”, representing another steady advancement along its ESG journey.

As one of the most widely recognized ESG assessment frameworks by global investors, the MSCI ESG Ratings is regarded as a critical benchmark of corporate sustainability. This upgrade offers a strong endorsement of China Securities Co., Ltd.'s dedicated efforts to strengthen its ESG management and signifies the international capital market's profound confidence in the Company's long-term development strategy and value-creation capabilities.

In recent years, the Company has been steadfast in integrating ESG principles into its operations, actively aligning with national strategies, and championing the high-quality development of the real economy. Its efforts have been centered on advancing the "five major areas", namely technology finance, green finance, inclusive finance, pension finance and digital finance. By harmonizing economic returns with ESG performance, the Company translates its vision for sustainability into tangible outcomes. Guided by its ambition to become a "first-class investment bank", the Company is committed to creating enduring, sustainable, and shared value for all stakeholders, including its shareholders, employees and clients.

Going forward, the Company shall remain committed to supporting national strategies and serving the public's financial needs, actively pioneering the development of new quality productive forces. Leveraging superior ESG management, the Company will drive the quality and impact of its financial services as it pursues its vision of becoming a top-tier investment bank with "five first-class" attributes. By fostering consensus, inspiring confidence, strengthening its fundamentals, rectifying weaknesses, and amplifying its competitive advantages, the Company will pave the way for its ascent as a premier investment bank and usher in a new era of high-quality growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment