Food Prices Drive Czech Inflation As The Economy Sings

Czech headline inflation quickened to 2.5% YoY in October, coming in above market expectations. The aggregate price level for consumers rose by 0.5% MoM, with food prices being the most prominent growth segment. In annual terms, processed food prices quickened to 4% in October, a pace that households are likely to perceive as lacking price stability.

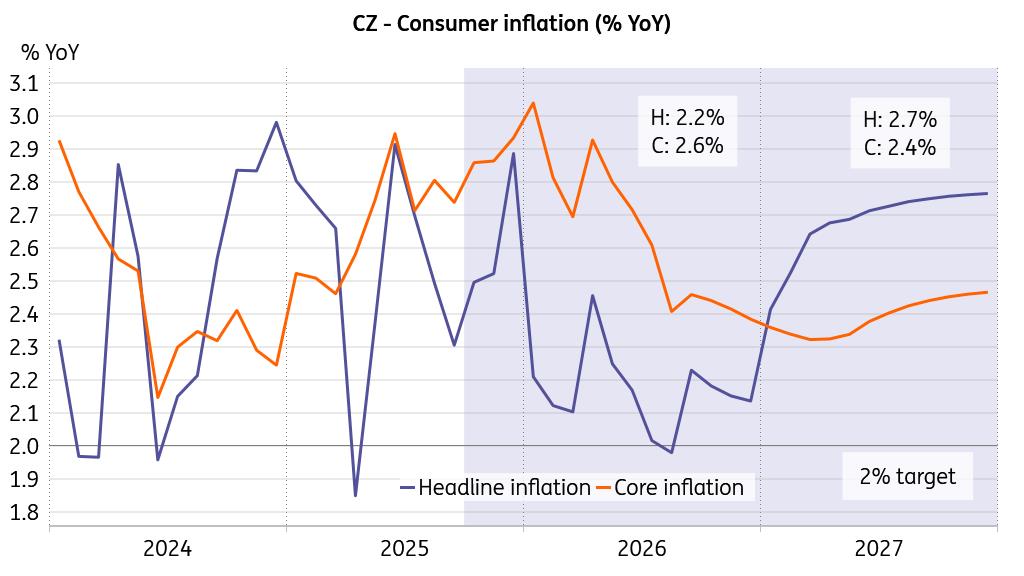

Prices of services added 4.6% YoY in October, a 0.1ppt softer dynamic than in the previous month, but still a way off from 3.5% which is consistent with having inflation on target. In contrast, prices of goods accelerated to a 1.3% annual growth in October, up from 0.8% previously. With that in mind, core inflation in October is likely to have increased to 2.9%, as per our forecast.

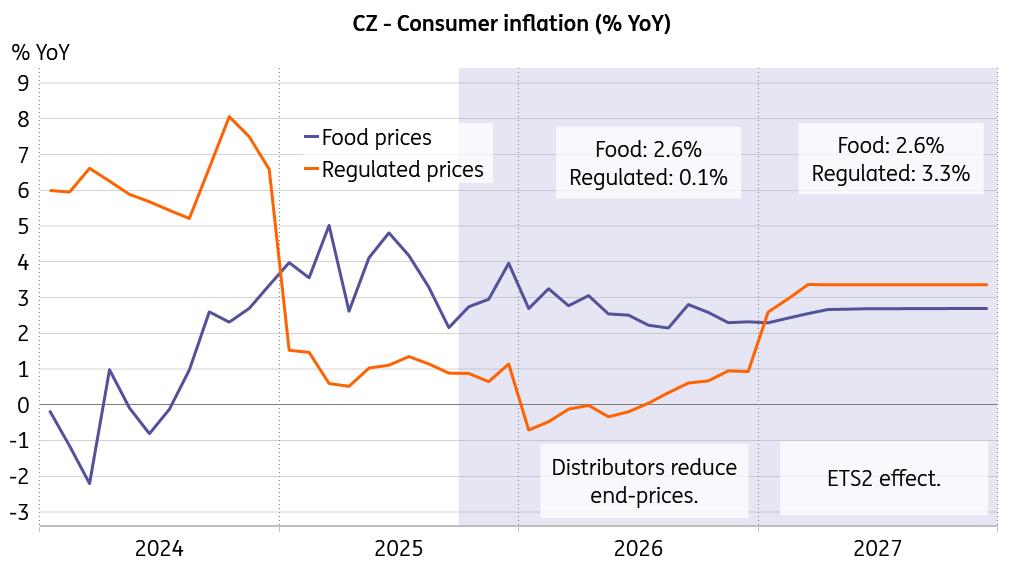

Declining energy prices set to keep food prices dynamic in checkThe inflation outlook for 2026 is somewhat tricky, as uncertainty about future price developments has amplified a pivotal concern: already high energy prices and the impact of emission allowances for households (ETS2). We currently estimate a 0.4ppt impact on headline inflation in 2027 from ETS2, including unspecified government countermeasures.

Czech households face some of the highest energy prices in Europe, which may become even pricier. It's no surprise that energy prices were a key election topic, and the new government appears to be taking action to bring them down.

Several measures are underway, although timing is difficult to predict. A reduction in the regulated share of energy prices by around 15% is being discussed and may be pushed into effect as early as January 2026 by the new government. We estimate such an adjustment to shave some 0.3-0.4ppt from the headline inflation rate, depending on whether electricity alone is affected or natural gas as well. Given the uncertain timing, we don't include this measure in our baseline forecast for now, but we are keeping an eye on it.

Energy prices to bring inflation down

Source: CNB, ING, Macrobond

Regardless of the government measure, large energy distributors began announcing plans for end-price reductions of around 10% for both electricity and natural gas in January 2026. We estimate that such a move could shed approximately 0.2 percentage points from headline inflation in the same month.

All things being equal, the electricity price reductions announced by distributors so far may bring January's annual headline inflation down to around 2.2% due to declining regulated prices. If the government proceeds with lowering the regulated share of energy prices in the same month, headline inflation may actually get even below 2% early next year. That said, news about water, waste disposal charges, and other related matters will follow, so uncertainty prevails about the traditionally pronounced January price moves.

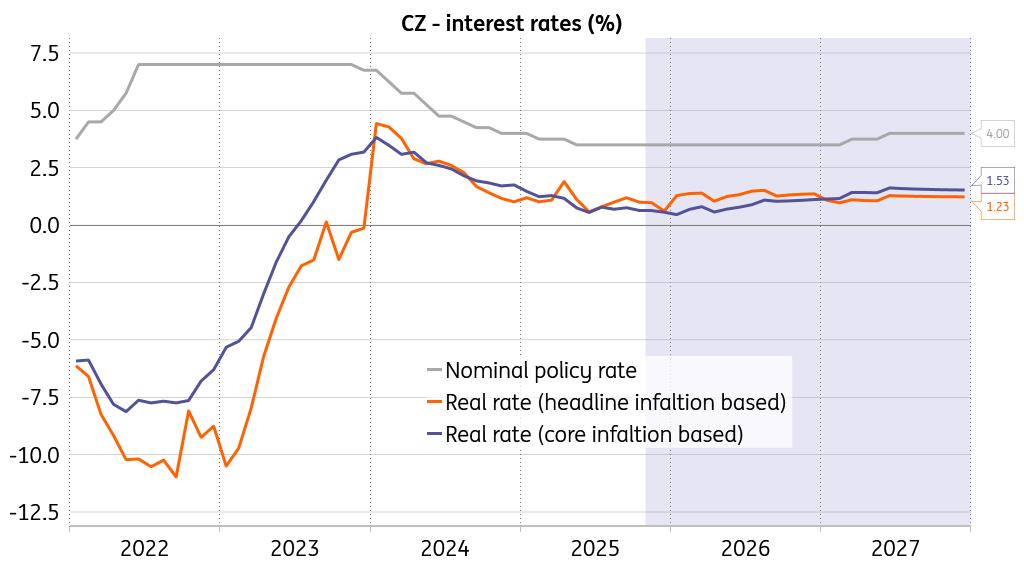

Core inflation expected to remain strongStill, core inflation is poised to exceed the target, which will contribute to base rate stability if the economy continues to expand as expected and no substantial issues arise in the struggling German economy.

We take the position that a reduction in energy prices will bring down regulated prices in January 2026 and weigh on headline inflation. Some secondary effects on other price areas are likely to follow suit, as energy flows through the entire economy.

However, more relaxed budgetary constraints for households will leave more resources available for discretionary spending, which will lend support to core inflation throughout the upcoming year.

Core inflation set to fly above the target

Source: CNB, ING, Macrobond

We see the economy expanding by 2.6% this year and 2.7% in 2026. The expected novelty for the upcoming year is that fixed investment is profoundly recovering, and we see it becoming a significant contributor to growth, comparable to consumption. Czech large and medium-sized firms appear to be in solid financial health and are actively acquiring assets in Germany's struggling economy. By investing in family-owned businesses, they are pursuing what is seen as the most direct route to reaching the conservative German consumer.

The government plans to increase public wages in 2026, with variants ranging from a low-case option of 5% for most public servants up to an upper bound of 13% top-up for some and 7% for others. The outcome will likely be some variant in between, which still is a decent nominal wage increase in conditions of tamed inflation.

Public wage increases tend to send an easy-to-read signal for the private sector, so we reiterate our hypothesis that growth is the best candidate for upward surprises over the upcoming year. Add a bit more fiscal spending should the government proceed with subsidising energy by taking the payments for regulated share on their shoulders, and you end up with a recipe for a booming economy, with a re-tightening labour market, robust nominal and real wage growth that passes through predominantly to core inflation at this phase of the economic cycle.

Indeed, that is not necessarily the right setup for a relaxing monetary policy stance, despite headline inflation being close to the target. For all these reasons, we stick to our outlook for stable rates over the next year.

Rates to remain stable as the economy hums

Source: CNB, ING, Macrobond Recovery on solid ground

A decision to postpone the implementation of ETS2 by one year was added to the draft of the climate regulation to ensure the system's compliance with the European Union's competitiveness goals. Should this become reality, then 2027 could become a sweet spot for the expansion of the Czech economy, as European economies would avoid another negative supply shock.

In such a case, more could be produced at lower prices across Europe, providing a non-negligible boost for both firms and households. We would then expect the Czech economy to expand by some 2.8% or more, with no need for extra rate hikes to mitigate the secondary effects linked to the hitherto assumed ETS2 implementation. Hey, Europe is potentially back on track with the approach it knows so well: kicking the can down the road even when it comes to troublesome ideas.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment