Crypto Funds Lose $360M Amid Rising Solana ETF Investments

- Last week, crypto investment funds saw $360 million in withdrawals amid Federal Reserve cautiousness. Most outflows originated from the US, with Bitcoin ETFs experiencing $946 million in redemptions. Solana attracted a record $421 million in inflows driven by new ETF launches, highlighting investor interest in staking assets. Ethereum saw $57.6 million in inflows, but overall sentiment remained mixed. New Solana staking ETF (BSOL) launched with $222.8 million in seed assets, indicating institutional demand for Solana-focused products.

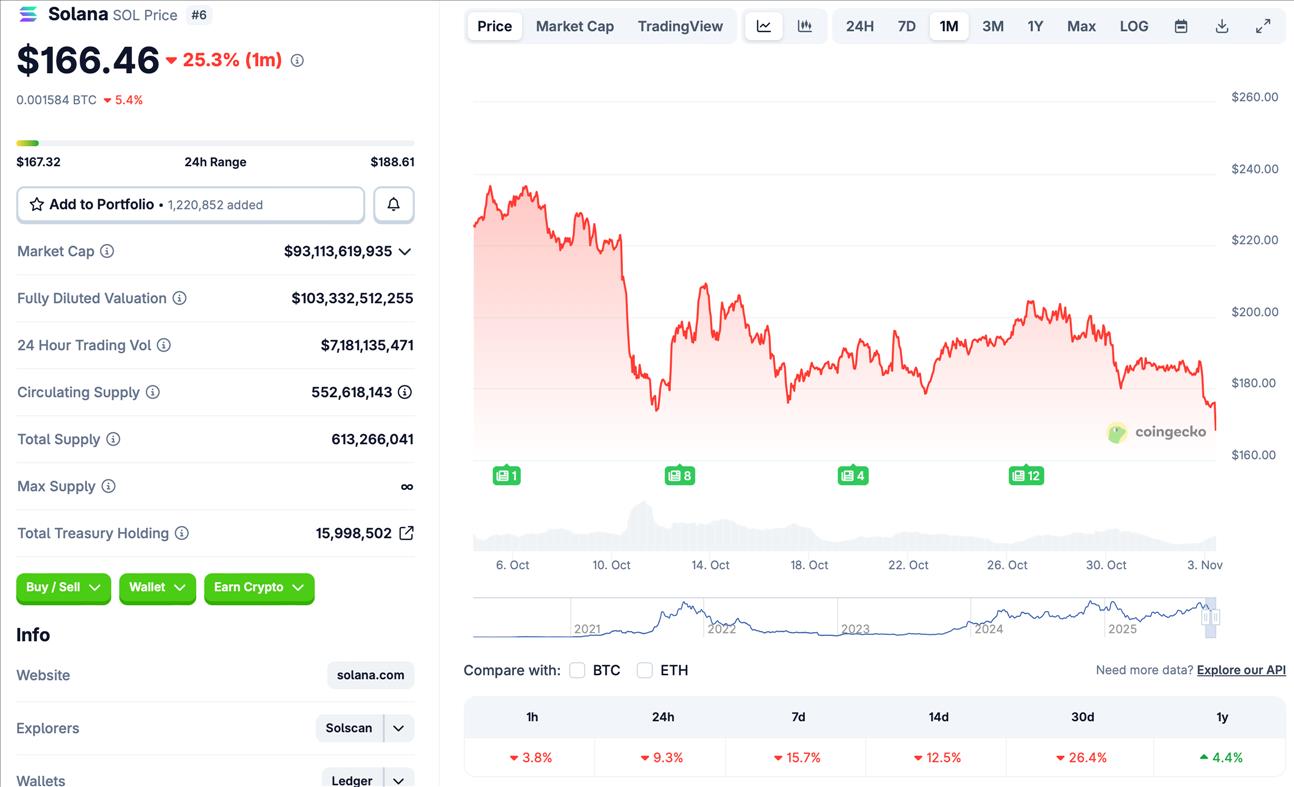

Crypto investment products recorded $360 million in outflows last week as sentiment shifted following remarks from Federal Reserve Chair Jerome Powell. While a rate cut was implemented on Wednesday, Powell's remark that further cuts are“not a foregone conclusion” unsettled markets. The lack of recent economic data due to the government shutdown further amplified uncertainty, contributing to the widespread sell-off, according to CoinShares' report.

US markets bore the brunt, with nearly half a billion dollars-$439 million-flown out of digital asset funds. Bitcoin-focused ETFs were particularly hard-hit, accounting for $946 million in redemptions. Despite this, some assets defied the trend; Solana experienced a notable $421 million influx, its second largest ever, driven by strong demand for newly launched US ETFs and a rising appetite for staking products, which lifted year-to-date inflows to $3.3 billion.

Weekly crypto asset flows. Source: CoinShares

Ethereum, another focal point of recent flows, saw $57.6 million in inflows. However, traders showed mixed signals, reflecting ongoing uncertainty about its near-term prospects. Meanwhile, the previous week saw substantial inflows totaling $921 million, primarily fueled by optimism following lower-than-expected CPI data released late October, which suggested a possibly less aggressive monetary tightening path.

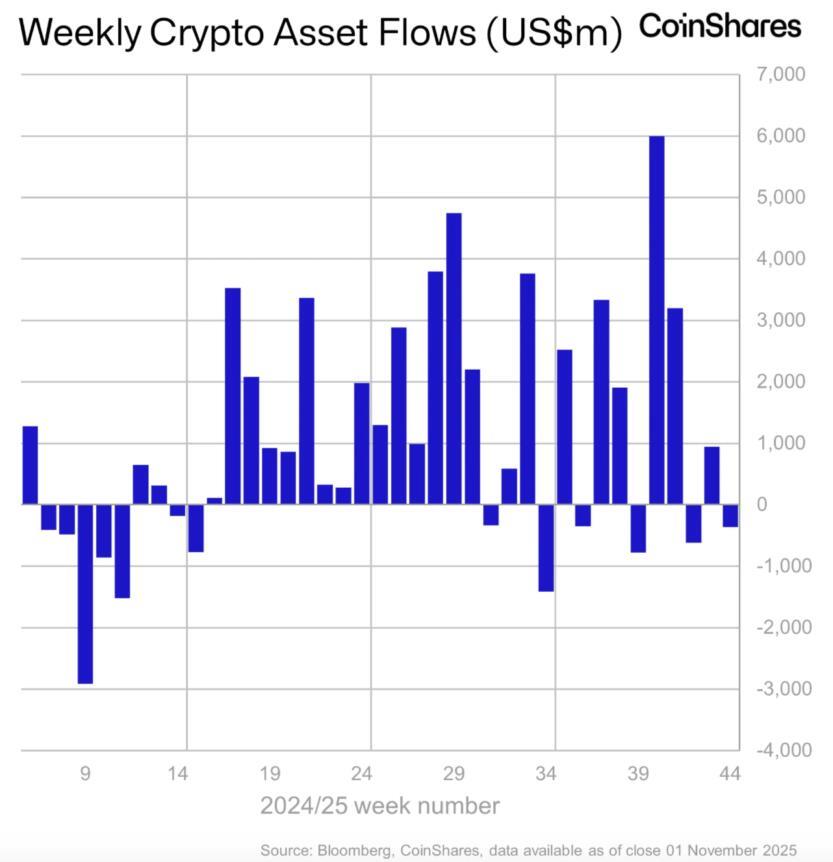

New Solana Staking ETFLast Tuesday, Bitwise announced the launch of its Solana Staking ETF (BSOL), which quickly amassed $222.8 million in seed assets, signaling strong institutional interest in Solana investment vehicles. The ETF provides direct exposure to Solana (SOL ) with an estimated annual yield of around 7% from on-chain staking rewards.

By week's end, spot Solana ETFs had recorded four consecutive days of inflows, adding $44.48 million, a reflection of growing investor appetite for staking yields and a broader“capital rotation” away from traditional assets into blockchain-based yield opportunities, according to Vincent Liu, CIO at Kronos Research. Despite the inflows, SOL's price has recently declined over 9% in the past 24 hours and around 26% over the past month, trading near $166 as per CoinGecko data.

Solana price chart. Source: CoinGecko

Overall, the latest market movements underscore continuing investor shifts toward staking assets and DeFi products, amid broader uncertainties in the macroeconomic environment. As crypto markets remain sensitive to Federal Reserve policy signals, institutional developments like the launch of Solana ETFs indicate a growing appetite for blockchain-based yields, even as prices fluctuate.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment