403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

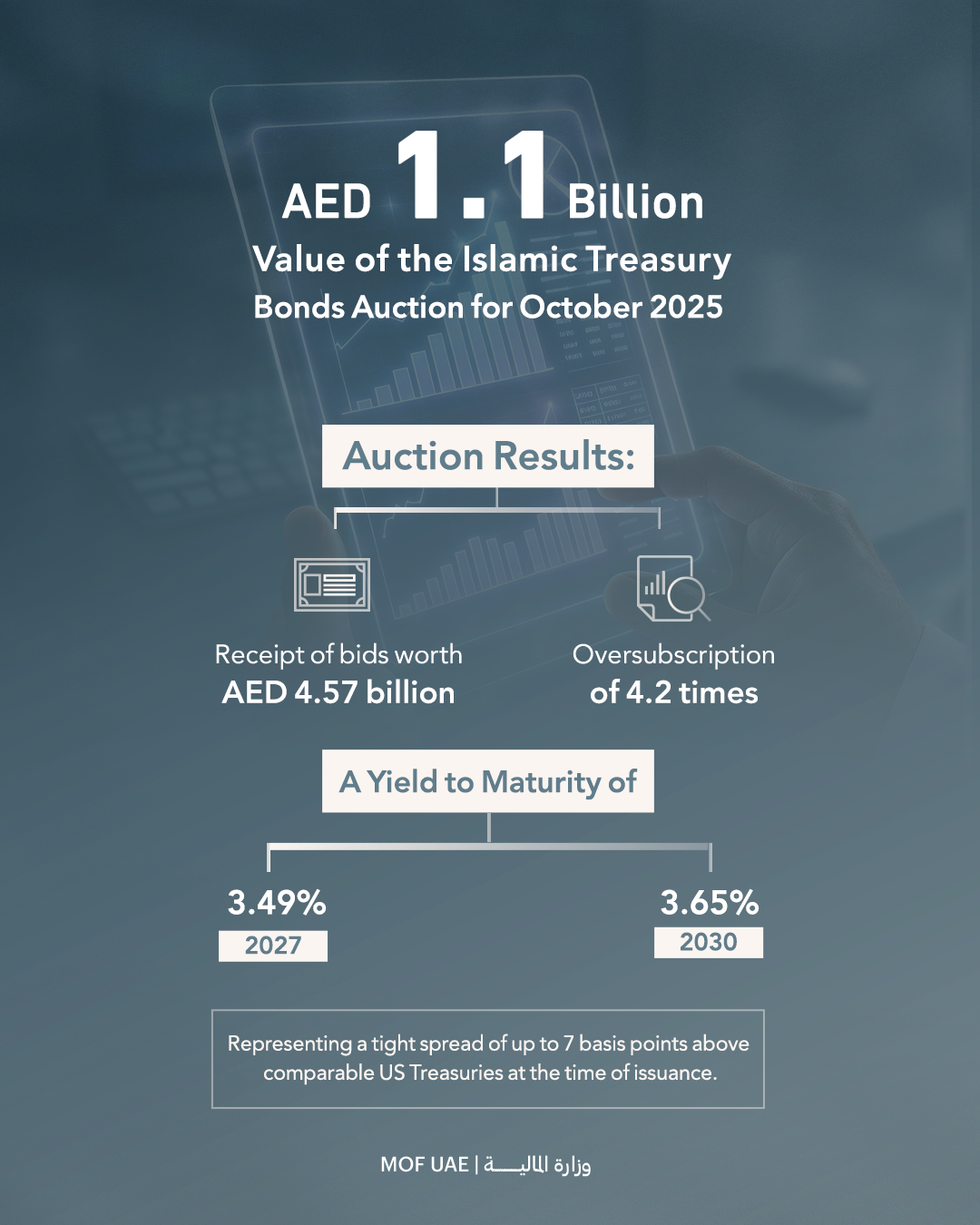

Islamic Treasury Sukuk Auction For October 2025 Attracts Bids Worth AED 4.57 Billion

(MENAFN- Mid-East Info)

The auction witnessed strong participation from all eight primary dealers for both the new 2-year tranche maturing in October 2027 and the tranche maturing in May 2030. Total bids amounted to AED 4.57 billion, representing an oversubscription of 4.2 times. This robust demand reflects investors' confidence in the UAE's creditworthiness and Islamic finance framework. The auction results highlighted competitive, market-driven pricing with a YTM of 3.49% for the new 2-year tranche maturing in October 2027 and 3.65% for the tranche maturing in May 2030. These yields represent a tight spread of up to 7 basis points above comparable U.S. Treasuries at the time of issuance. Additionally, these Sukuk are listed under the UAE Treasury Islamic Sukuk Programme with Nasdaq Dubai, enhancing investor access in the secondary market. The Islamic T-Sukuk program plays a vital role in supporting the development of the UAE's dirham-denominated yield curve, offering secure investment instruments for a wide range of investors. Furthermore, it reinforces the local debt capital market, contributes to the development of the broader investment landscape, and supports the UAE's long-term economic sustainability and growth objectives.

-

Marking an oversubscription of 4.2 times.

Yields of 3.49% for the new 2-year tranche maturing in October 2027 and 3.65% for the tranche maturing in May 2030.

The auction witnessed strong participation from all eight primary dealers for both the new 2-year tranche maturing in October 2027 and the tranche maturing in May 2030. Total bids amounted to AED 4.57 billion, representing an oversubscription of 4.2 times. This robust demand reflects investors' confidence in the UAE's creditworthiness and Islamic finance framework. The auction results highlighted competitive, market-driven pricing with a YTM of 3.49% for the new 2-year tranche maturing in October 2027 and 3.65% for the tranche maturing in May 2030. These yields represent a tight spread of up to 7 basis points above comparable U.S. Treasuries at the time of issuance. Additionally, these Sukuk are listed under the UAE Treasury Islamic Sukuk Programme with Nasdaq Dubai, enhancing investor access in the secondary market. The Islamic T-Sukuk program plays a vital role in supporting the development of the UAE's dirham-denominated yield curve, offering secure investment instruments for a wide range of investors. Furthermore, it reinforces the local debt capital market, contributes to the development of the broader investment landscape, and supports the UAE's long-term economic sustainability and growth objectives.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment