Asia Week Ahead: RBA Rate Decision And Key Data On China, Japan, Korea, Taiwan, And Philippines

We expect the Reserve Bank of Australia to hold rates steady on Tuesday after third-quarter CPI inflation came in above expectations -- and the 2.5% midpoint of its target range. That's likely to outweigh a surprise uptick in September's unemployment rate, even as other labour market indicators still point to underlying strength.

South Korea: Inflation expected to rise, while export momentum remains strongSouth Korean exports are expected to decline by 3.5% year-on-year in October, primarily due to an unfavourable calendar effect. Underlying momentum should appear robust, with a 6% increase in daily average exports. Semiconductors and ship exports are expected to remain strong, while auto exports are likely to decline. Although we expect the purchasing managers' index to decline slightly, as it was surveyed before the recent trade agreement, we believe the recovery in manufacturing is likely to continue. Consumer price inflation is expected to rise to 2.3% YoY in October as gasoline and manufactured food prices increase.

China: Trade growth expected to slow downLast week's much-hyped Xi-Trump meeting led to a de-escalation of bilateral tensions. Next week should be a calmer one in China. The main data point will be the trade data on Friday. We expect export growth to slow to 4.0% YoY, and imports to edge down to 3.2% YoY, leading to a rebound of the trade surplus to $101bn.

Taiwan: Inflation expected to remain below target while robust trade growth continuesTaiwan releases inflation and trade data. CPI inflation has been below target for the past 5 months. This should continue in October with only a moderate uptick to 1.4% YoY expected. Trade is expected to continue to post strong growth, with exports up 35.1% YoY and imports up 32.6% YoY for a trade surplus of $10.4bn.

Japan: Labor earnings and household spending expected to grow despite inflationJapanese labour earnings and household spending figures are projected to increase, suggesting that consumption remains stable despite elevated inflation levels. Strong wage negotiation outcomes may continue to contribute to higher wages, and the asset market rally could influence household spending.

Philippines: GDP growth expected to slow down sharplyWe expect third-quarter Philippine GDP growth to slow sharply to 5.1%, primarily due to a significant decline in government spending. This follows corruption scandals associated with flood control projects. Business sentiment also took a hit in the third quarter, with tariff uncertainties adding to the drag on growth.

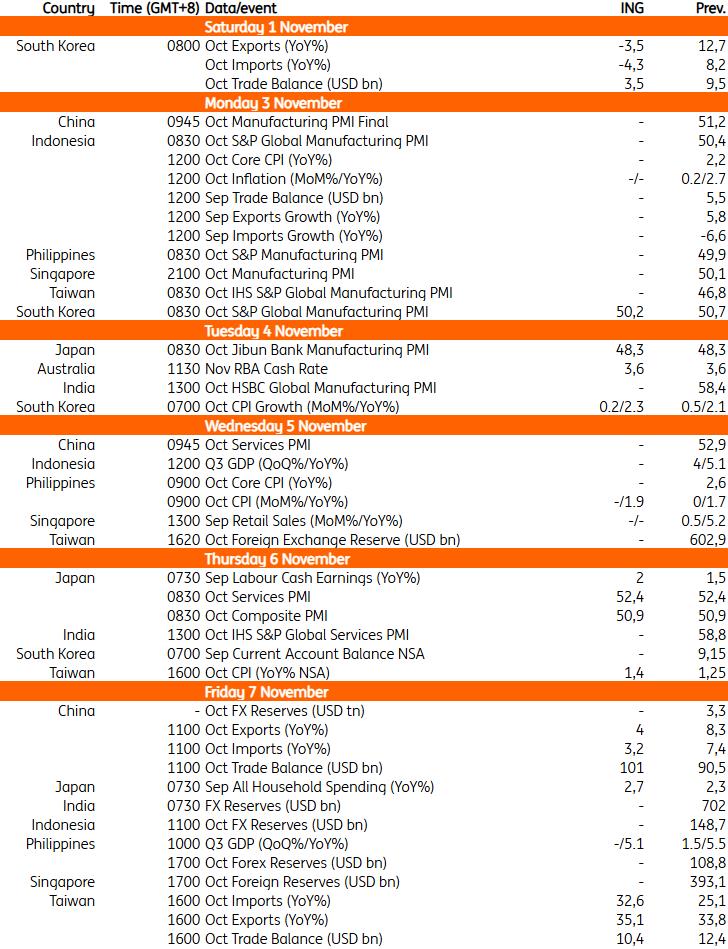

Key events in Asia next week

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment