Can Bitcoin Bounce Back As Gold Retreats From Record Highs?

- Gold's rally has stalled after a substantial run, prompting a potential Bitcoin rebound, as analysts observe overbought conditions in gold. Bitcoin's price behaviors and technical indicators are hinting at a“generational bottom,” possibly setting the stage for significant gains. Historical patterns show Bitcoin often rallies strongly after shares of undervaluation relative to gold, with potential upside reaching $150,000–$165,000 by year-end.

Bitcoin (BTC ) is showing signs of stabilizing, coinciding with gold's (XAU) push towards overextended territory. As gold hits an all-time high of approximately $4,380 before retreating 2.90%, many market watchers see this as a potential catalyst for Bitcoin's next rally.

Bitcoin hints at“generational bottom” as gold dipsGold's recent surge has cooled, yet the metal remains up over 62.25% year-to-date. Its daily RSI has persistently exceeded 70, signaling overbought conditions and risk of profit-taking. Meanwhile, Bitcoin rebounded by nearly 4% during this period, recovering from a four-month low near $103,535. Its RSI is at levels typical of a bottom formation, reflecting similar patterns seen prior to substantial upward moves.

XAU/USD daily chart. Source: TradingViewMarket analysts interpret this inverse relationship-gold overextended and Bitcoin gaining-as a possible signal that Bitcoin is nearing a“generational bottom.” Pat, a prominent analyst, pointed out that Bitcoin's relative performance to gold over the past four years supports the idea that this could be a long-term buying opportunity.

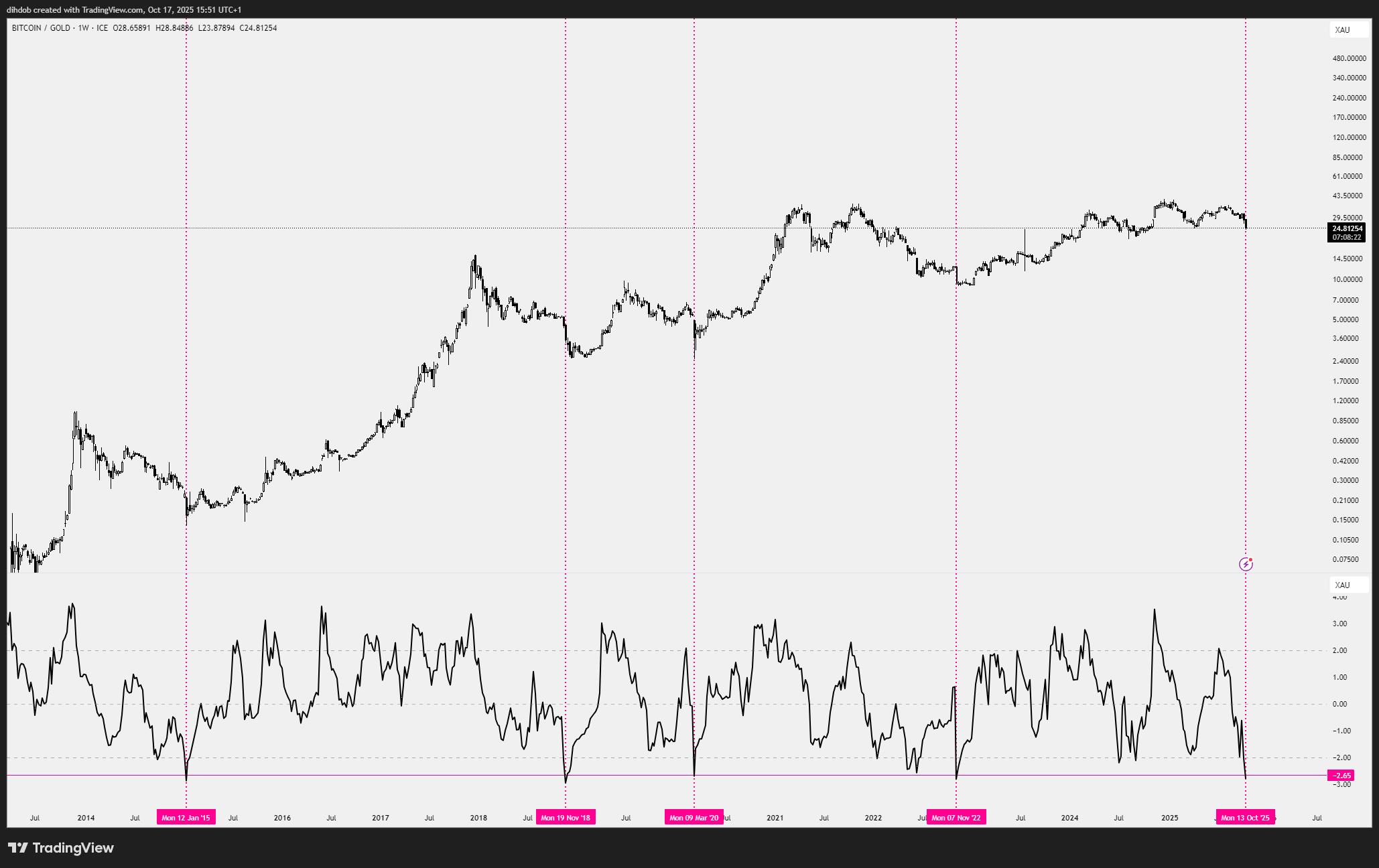

The Bitcoin-to-gold ratio has fallen to levels reminiscent of previous market bottoms in 2015, 2018, 2020, and 2022, each followed by rallies exceeding 100%. Currently dipping below -2.5, the ratio suggests Bitcoin might be undervalued, setting up a potential bullish run.

BTC /XAU 1-week chart. Source: Pat/TradingView

Echoing these sentiments, analyst Alex Wacy drew parallels between gold's 2020 peak and its current correction, questioning whether gold might again signal the start of a Bitcoin bull run.

HSBC forecasts gold's continued riseDespite some market speculation about gold's rally cooling, HSBC remains bullish, predicting the metal could reach as high as $5,000 per ounce by 2026. The bank cites geopolitical tensions, economic uncertainty, and a weakening U.S. dollar as primary drivers for sustained demand.

Source: X

This outlook suggests that investors see gold as a safe haven amidst escalating geopolitical risks and currency devaluation concerns, supporting the broader crypto markets' bullish narrative.

Meanwhile, Bitcoin remains a focal point for institutional analysts. JPMorgan predicts Bitcoin could reach $165,000 in 2025, emphasizing its undervaluation relative to gold. Similarly, Charles Edwards highlighted that a decisive move above $120,000 could spark an rapid ascent towards $150,000.

This article provides informational insights and should not be considered investment advice. Cryptocurrency trading involves significant risks; readers are encouraged to conduct their own research.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment