Can Bitcoin Bounce Back As Gold Pulls Back From Record Highs?

- Bitcoin appears to be at a bottom as gold's rally stalls, hinting at a possible near-term rebound for BTC.

Technical analysis suggests Bitcoin could rally to $150,000–$165,000 by the end of 2023. The Bitcoin-to-gold ratio is approaching levels historically associated with market bottoms, indicating potential undervaluation.

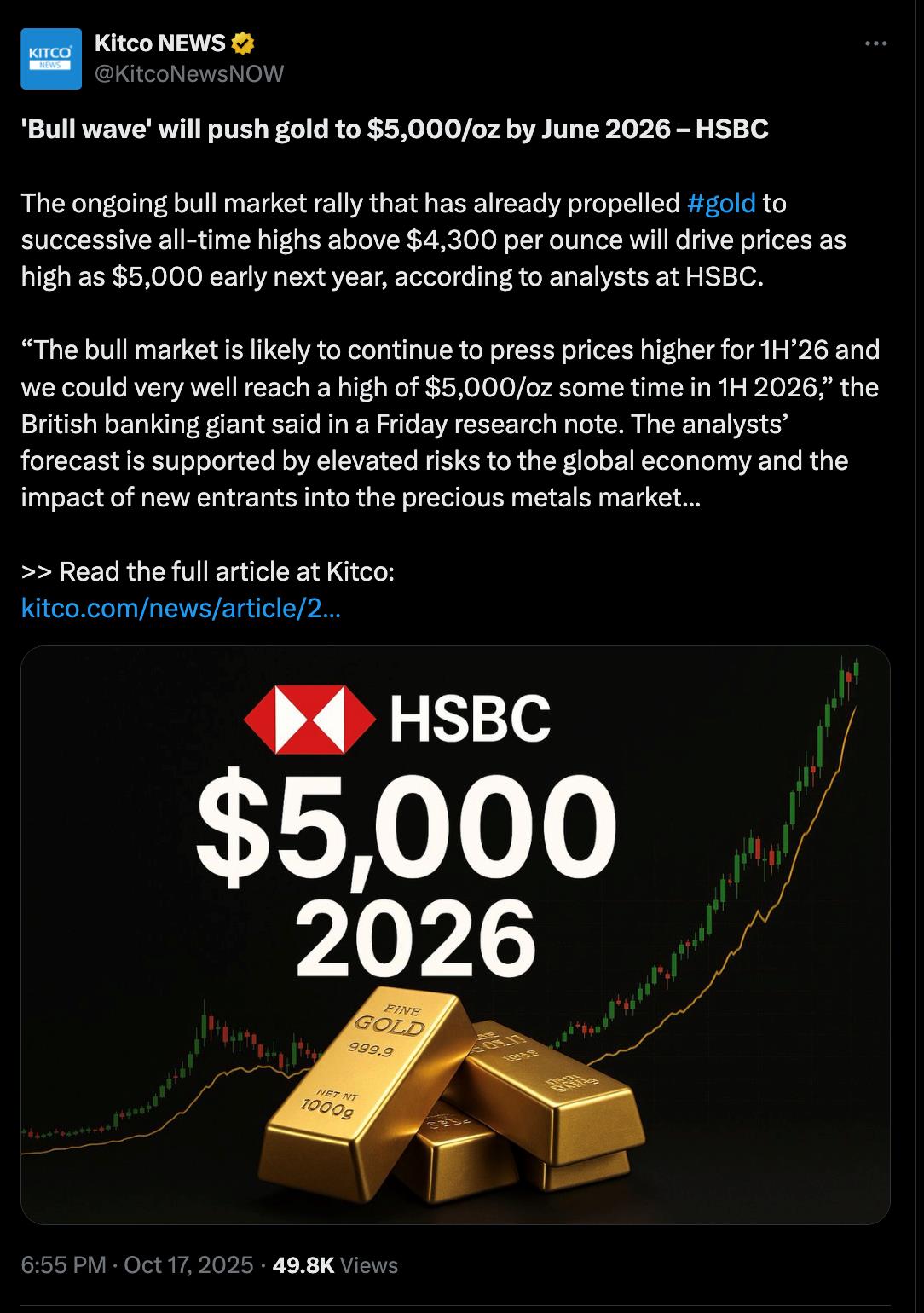

Despite gold's recent correction, HSBC maintains a bullish forecast, projecting prices could reach $5,000 per ounce by 2026. Market analysts highlight macroeconomic factors like geopolitical tensions and a weakening US dollar as catalysts for continued gold and crypto demand.

Bitcoin (BTC ) is showing early signs of recovery as gold (XAU) fluctuations suggest a potential reversal. After peaking at around $4,380 per ounce last Friday, gold has retraced nearly 3%, despite a year-to-date gain of over 62%. The metal's daily relative strength index (RSI ) readings have remained above 70, indicating overbought conditions and potential profit-taking, which has coincided with a nearly 4% rise in Bitcoin from its four-month low near $103,535.

XAU/USD daily chart. Source: TradingViewThis inverse pattern - with Bitcoin recovering while gold phases with a correction - has led some analysts to believe Bitcoin may be near a“generational bottom.” Notably, analyst Pat points to the Bitcoin-to-gold ratio, which has dropped to levels last seen in 2015, 2018, 2020, and 2022. Historically, these periods preceded rallies of 100% to 600%, suggesting strong bullish potential ahead.

BTC /XAU 1-week chart. Source: Pat/TradingView

As of mid-October, the ratio's dip below –2.5 indicates Bitcoin may be undervalued relative to gold after the precious metal's record push to $4,380. This divergence has the potential to ignite a bullish run for Bitcoin, mirroring patterns seen in previous cycles.

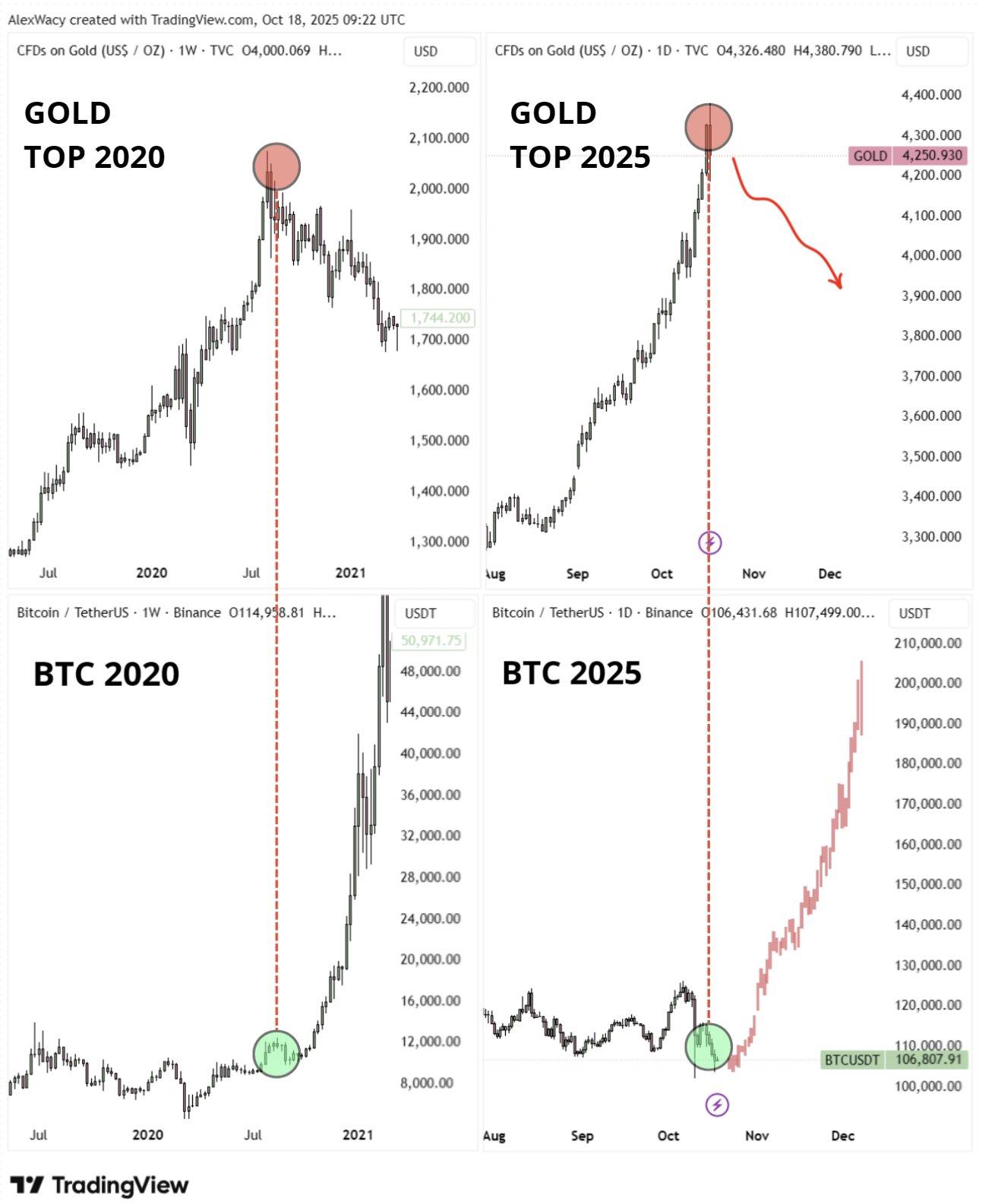

Similarly, analyst Alex Wacy draws parallels between gold's recent pullback and its 2020 peak, which coincided with a Bitcoin bottom. He raises the question of whether gold will serve once again as a reversal indicator for Bitcoin's upward trajectory.

Bitcoin and gold's price performance in 2020 vs. 2025. Source: Alex/TradingViewHSBC Is Bullish on Gold's Prospects

Contradicting some market fears of a peak, HSBC remains optimistic about gold's long-term prospects, projecting prices could reach as high as $5,000 per ounce by 2026. The bank underscores ongoing geopolitical tensions, economic uncertainties, and a weakening US dollar as key drivers supporting this outlook.

Source: X

This upward trajectory is expected to be driven increasingly by long-term investors seeking safer assets amid market volatility, rather than short-term speculators. Historically, gold's overbought corrections have been followed by even higher prices, reinforcing confidence in its sustained rally into the next year.

XAU/USD daily chart. Source: TradingView

The pattern of investor confidence amid geopolitical strains aligns with HSBC's bullish forecast, suggesting that gold could serve as a hedge for crypto investors during turbulent times. Meanwhile, Bitcoin's outlook remains highly optimistic, with institutions like JPMorgan forecasting Bitcoin prices could soar to $165,000 in 2025.

Analyst Charles Edwards adds that a decisive movement above $120,000 could rapidly push Bitcoin toward $150,000, further cementing its bullish trend in the coming months.

This analysis is not investment advice. Cryptocurrency trading carries risks, and investors should conduct their own research before making decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment