CME Futures Surge Past Binance In Open Interest After Flash Crash

- Aggregate futures open interest across the top four cryptocurrencies on CME reached $28.3 billion, overtaking Binance 's $23 billion and Bybit 's $12.2 billion. Despite CME's rising influence, unregulated crypto exchanges still hold significant trading market share, especially in altcoin and perpetual futures markets. The recent crypto market crash saw record liquidations of over $19.2 billion, highlighting risks in leveraged trading, particularly on unregulated platforms.

The aftermath of Friday's cryptocurrency market crash revealed the fragility of traders' positions across the industry. Nearly $75 billion was wiped out in moments, causing many exchanges to face massive liquidations and auto-deleveraging. Although prices rebounded more than fifty percent within hours, the ripple effects sent shockwaves through the futures markets. This event has been described by some analysts as potentially marking the“end of an era” for unregulated derivatives trading, as institutional interest appears to be consolidating around regulated venues.

Aggregate cryptocurrency futures open interest, USD. Source: CoinGlassData shows that CME's aggregate futures open interest for Bitcoin , Ethereum , Solana , and XRP hit $28.3 billion on Wednesday. This comfortably exceeds Binance 's $23 billion and Bybit 's $12.2 billion, marking a notable shift toward institutional-driven price discovery. Nonetheless, trading activity remains heavily concentrated on less-regulated exchanges, which continue to facilitate the bulk of crypto derivatives trading, particularly through perpetual swaps versus time-limited contracts.

CME leads open interest, but trading activity persists on unregulated platformsBinance retains dominance over smaller altcoin futures, with around $7 billion spread across assets such as BNB , Dogecoin , and others. Meanwhile, Bybit commands an additional $4.4 billion. The combined daily trading volume of the top three exchanges-Binance, OKX , and Bybit-exceeds $100 billion, outpacing CME's $14 billion daily average for futures in key cryptocurrencies. This indicates that despite CME's growth in open interest, retail and speculative trading largely stay on lesser-regulated platforms.

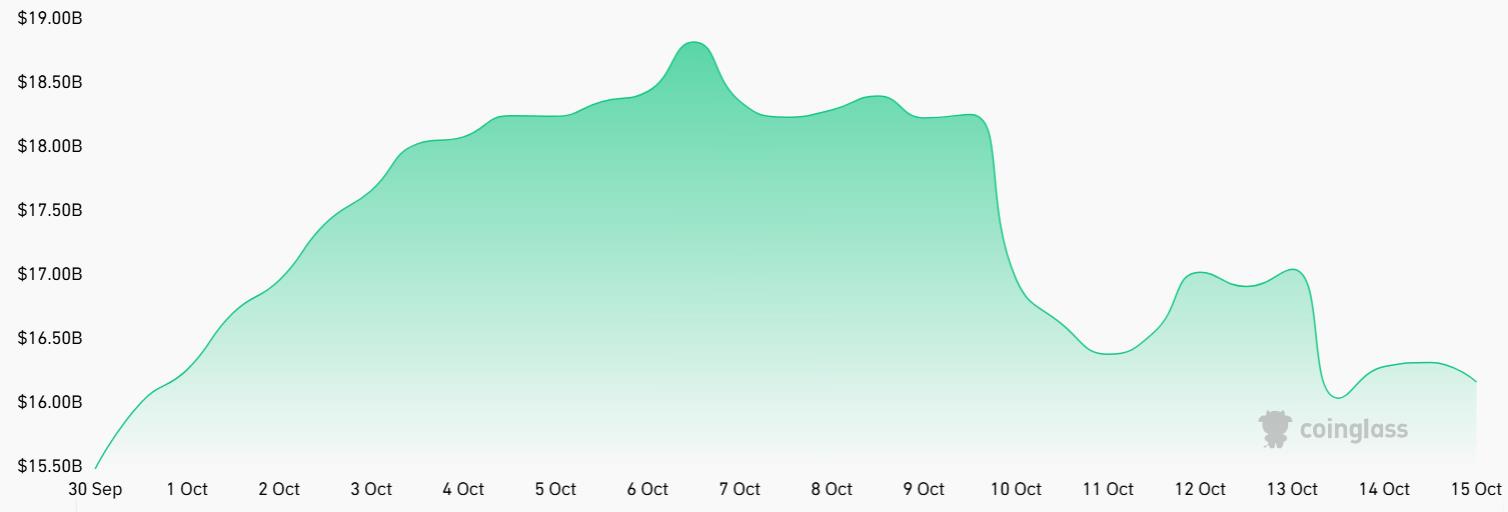

CME Bitcoin futures open interest, USD. Source: CoinGlass

Bitcoin futures open interest at CME declined 11% from $18.3 billion to $16.2 billion since the crash; a sharper decline of 22% occurred on Binance, influenced by higher leverage use and broader retail participation. The market turmoil triggered auto-deleverage mechanisms on Binance and other platforms, causing cascading liquidations and disrupting pricing oracles used by decentralized exchanges. However, CME remained unaffected during the trading halt from Friday afternoon through Sunday.

Unlike unregulated exchanges, CME futures are cash-settled and typically require a maintenance margin of roughly 40%, limiting leverage to around 2.5x. Conversely, unregulated derivatives platforms often offer leverage of up to 100x and accept various collateral, including altcoins and synthetic stablecoins, amplifying risk exposure. Looking ahead, CME plans to introduce 24-hour futures and options trading in early 2026, subject to regulatory approval, potentially attracting more institutional traders and shifting trading volumes.

While CME's recent rise in open interest signifies an important trend toward regulated derivatives, the current landscape suggests that unregulated venues continue to hold sway over much of the trading volume. Nonetheless, this evolving environment underscores an ongoing transition towards greater oversight and transparency in crypto derivatives markets, which could reshape the industry in the coming years.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment