China's Trade Resilience Shows That US Tariffs Aren't Everything

| 8.3% YoY | China's September export growth |

| Higher than expected |

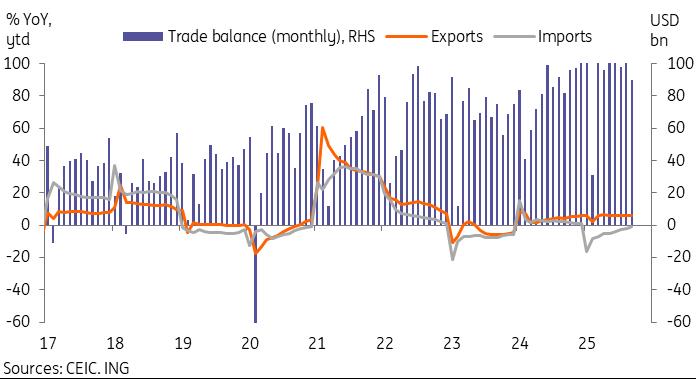

China's exports grew by 8.3% year on year in September, up from 4.4% in August, once again beating market expectations. Through the first three quarters of the year, China's exports grew by 6.1% YoY, year-to-date, to $2.78tn, faster than 2024's 5.9% YoY growth. It's a solid performance that few economists expected amid the trade war.

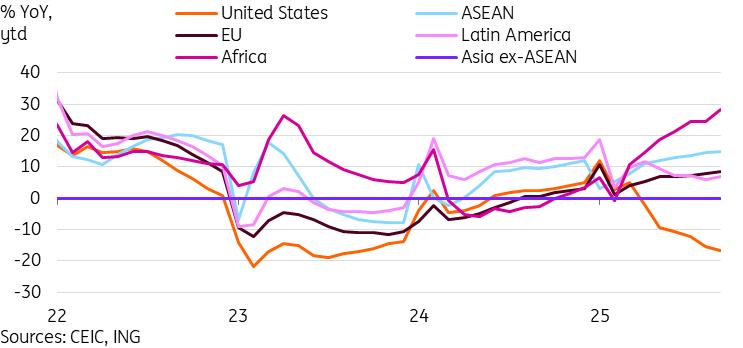

By export destination, we continued to see a sharp slump in exports to the US (-27.0%), offset by robust growth to many other economies. Exports to the EU (14.2%), ASEAN (15.6%), as well as Africa (56.6%) and Latin America (15.2%), all saw strong growth in September. Trade volume generally outpacing trade value growth, indicating that export prices have generally fallen due to heavy competition. Anti-involution measures aimed at reducing excessive price competition may help address price trends, but the process will likely be gradual.

Exports are holding up better than expected, but the tariff impact has been quite clear in select industries. China's main growth categories continued to fare well in September. Ships (42.7%), semiconductors (32.7%), and autos (10.9%) all continued to outpace headline growth. Categories more exposed to the US market, such as apparel and accessories (-8.0%), footwear (-13.3%), furniture (0.4%), and toys (-27.9%), all heavily underperformed.

Exports to the US have fallen sharply but have been offset by global demand

Imports unexpectedly surged to 17-month high

More surprisingly, we also saw China's import demand accelerate to 7.4% YoY, up from 1.3% in August. This growth represented a 17-month high, and came as a surprise given the recent signs of softness in domestic demand. Through the first three quarters of the year, imports contracted -1.1% YoY ytd to $1.90tn.

Commodities imports may have contributed to the import growth surprise in September. In YoY terms, iron (13.4%) and copper (24.4%) both saw strong growth. Agricultural imports as a whole grew 5.7% YoY, a little slower than headline growth. Within this category, though, imports of meat (24.7%), fruits (10.9%), and edible oils (9.6%) all displayed strength.

Commodities aside, the import categories which have performed well in previous months continued to see strong growth in September as well. Hi-tech imports (14.1%), semiconductors (14.1%), and aircraft (201.3%) all outperformed the headline growth in September. The continued outperformance of these categories is unsurprising given the policy focus.

The impact of the US-China trade spat can be seen in China's import profile as well. Imports from the US slumped to -16.1% YoY in September amid reports of halting soybean purchases. Instead, imports from the EU (9.4%), Japan (20.9%), South Korea (13.1%), Africa (22.4%), and Latin America (17.9%) all saw strong growth in September.

The September data was encouraging, but the overall trend remains uncertain. Moving forward, the fourth quarter should benefit from a relatively supportive base effect for imports. But unless domestic demand recovers by more than expected, growth looks likely to moderate from September's levels.

A flip side of the stronger import data, the trade surplus actually came in below expectations at $90.5bn.

Import surprise led to lower-than-expected trade surplus

Reasons to temper pessimism amid renewed US-China trade tensions

The last several weeks have marked a re-escalation of tension after a series of largely constructive trade talks. The US Bureau of Industry and Security's Interim Final Rule expanding export controls to cover affiliated units of entities already on current restricted lists has seen an escalation. The same with the US Customs and Border Protection publishing guidance on port fees to be assessed to ships owned, operated, or built by Chinese companies, effective 14 October. This sparked a response from China, which tightened controls on rare earth controls and announced a port fee for US ships. China's retaliation was met with fresh threats from President Trump, raising the stakes for the meeting between Xi and Trump at APEC at the end of the month. Whether or not the talks will even proceed as planned has been called into question amid recent escalations.

Given the disruption seen during the peak of the trade war in April and May, and the language from policymakers in both countries, we believe that neither China nor the US wishes to return to mutually-damaging tit-for-tat escalations and retaliations. As such, finding common ground to continue the trade truce remains our base case scenario. However, the past few weeks show that the possibility of miscalculation is always present. This continues to be the tail risk for US-China relations and markets.

That said, it's worth noting that despite China already facing very high tariff rates throughout the year, export growth has managed to hold up very well in the first three quarters of the year. While a potential re-escalation of the trade spat certainly represents a risk, we see a few reasons to avoid being too downbeat on trade:

-

The US is no longer as important to China's exporters as it was in the past. In 2017, the US represented over 19% of China's total exports. Through the first three quarters of 2025, it's down to just 11.4%.

China's fastest-growing export categories, such as lithium batteries, electric vehicles, ships, and semiconductors, have a limited exposure to the US market.

Demand from other economies has been more than enough to offset the fall seen in the US. The focus on USDCNY stability and overall weaker US dollar environment this year has led to some CNY depreciation versus other currencies, helping to support exports to those regions.

Despite taking a notable hit on the aggregate level, various specific exports to the US remain sticky given limited alternatives. Global tariff uncertainty has also led to more caution when it comes to setting up alternate factory locations.

Consequently, we continue to expect that external demand should remain an important driver of growth for the rest of the year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment